Market Outlook for the Aerospace & Defence Industry

While the COVID-19 pandemic had a paralysing effect on the aerospace industry and travel, leaving aside quality issues at Boeing, the manufacturing and delivery rates as well as air travel have returned to pre-COVID-19 levels. The aerospace & defence industry is on a strong growth path due to substantially increased government spending as a consequence of the conflict in Ukraine and Gaza / Israel.

Commercial aircraft demand is higher than the production rates and order intake has reached record numbers to meet travel demand while at the same time rejuvenating the fleets with more fuel-efficient aircrafts. Overall, air travel, measured by revenue passenger kilometres, is projected to show a 10% growth compared to 2019 pre-COVID levels by the end of 2024.

Short-haul and regional flights are predicted to dominate the growth with long-haul being slower, both in North America and Europe; this explains the higher demand for single-isle than wide-body aircraft. Low-cost carriers will increase their market share and have a higher growth rate. According to IATA data, Asia Pacific Airlines had the highest growth rate in 2023. This will remain the case in 2024.

The global Aerospace market is expected to grow from just over USD 300 billion in 2023 to USD 370 billion in 2024.

In light of the over two years old war in Ukraine and the conflict between Israel and Hamas in Gaza, defence spending has increased substantially in Europe while North America only saw a modest increase and is not growing at the same pace. Combined defence spending increased by over 10% in 2023 from 2022, reaching a global total of over USD 2 trillion. This trend is predicted to continue until 2030 with Western countries recapitalising and improving their capabilities with a focus on fighting and winning a conventional war against the respective foes rather than focussing on counterinsurgencies.

Also, maritime surveillance and intervention have become more of a focus with detectors, combat management systems, surveillance and tracking as well as geographic information systems becoming more important, also due to the Red Sea crisis with Iran-backed Houthi attacks on shipping lanes.

2023 transaction volume in the global aerospace, defence & security sector had a 25% growth compared to 2022 while the number of deals decreased by approx. 9%.. This mixed picture is expected to continue in 2024 with a focus being on advanced materials, AI, drone and counter-drone technologies as well as cyber and space. In both aerospace and defence, supply chain readiness is the key interest of the OEMs.

Key Deal Drivers in the Aerospace & Defence Industry

TECHNOLOGY ADVANCEMENT

Innovations in artificial intelligence (AI), autonomous and unmanned systems , cybersecurity & cyber capabilities, hypersonic weapons, and space technologies are creating new market opportunities. Likewise, the move towards digitalisation is driving deal activity. Companies are looking to acquire specialised technologies as well as digital transformation capabilities for manufacturing, maintenance to enhance efficiency, reduce costs and stay competitive

GEOPOLITICS & DEFENCE MODERNISATION PROGRAMMES

Many countries have made significant increases to their defence budgets. Due to rising geopolitical tensions (Ukraine, Red Sea, Israel/Hamas) and the demand to keep pace with near-peer threats (China, Russia). This global defence outlook is driving M&A deal activity and investment interest in the sector. At the same time, foreign investments in A&D companies are placing increased regulatory scrutiny from governments resulting in M&A deals being closely reviewed and potentially blocked to protect national security.

OPPORTUNITIES IN SPACE

The space sector continues to experience growth and investment interest across both commercial and government markets. However, some new entrants from previous years seem to be struggling or have even failed in their venture. As the demand for small satellites (smallsats) and related technology as well as launch services has increased, companies are acquiring manufacturers and technology providers to expand their capabilities in this fast-growing market. Increased interest in space for national security and defense reasons has led to growing demand for all defense-related space technology. All this drives M&A as companies seek to enter this attractive market, consolidate resources, improve economies of scale, and/or enhance capabilities

SUPPLY CHAIN READINESS AND RESILIENCE

Disruptions through COVID, global conflicts or the Boeing struggles have highlighted vulnerabilities in global supply chains. Supply chain readiness continues to be a major priority to the OEMs. The bargaining power of suppliers has led to significant price increases of products that OEMs are learning to accept as the new normal; also, price escalation clauses are becoming more common. Companies in the A&D sector are targeting acquisition opportunities to secure a more robust and resilient supply chain, often through vertical integration. One example: Boeing is considering the take-over of troubled supplier Spirit AeroSystems, which could have knock-on effects on Airbus and other OEMs.

CONSOLIDATION & SCALE

Companies in the A&D space are merging or acquiring others to secure the supply chain, achieve greater scale, reducing costs and expanding market reach. This is particularly true for Tier 2 and Tier 3 suppliers, who face pressure to remain competitive. By gaining economies of scale, broadening their product portfolios, or increasing market share they secure their market position.

Sources: MCF research, market studies, PWC

Commercial Aerospace

Airbus well ahead of Boeing in Deliveries

With 735 realised deliveries in 2023, Airbus continues to dominate over its competitor Boeing, which realised 528 jet deliveries in 2023. First-quarter deliveries at Boeing were at 83 versus 142 at Airbus. Boeing’s slip in Q1 2023 deliveries was largely impacted by the ongoing safety and production issues with both the 777X and the 737 Max family, the Alaska Airline incident as well as increased quality checks and audits by regulators.

Airbus is working towards the entry into service of the A321XLR in 2024, which will have the longest range of any single-aisle aircraft. Boeing is focusing on delivering the 777x, which will be one of the most fuel-efficient long-range.

Both Airbus and Boeing plan a significant uplift in production rates with planned deliveries of over 800 by Airbus with Boeing not giving estimates any longer. In light of delayed deliveries by Boeing, Ryanair, American and Southwest (amongst others) have announced they are trimming flight plans.

Airlines continue to place orders

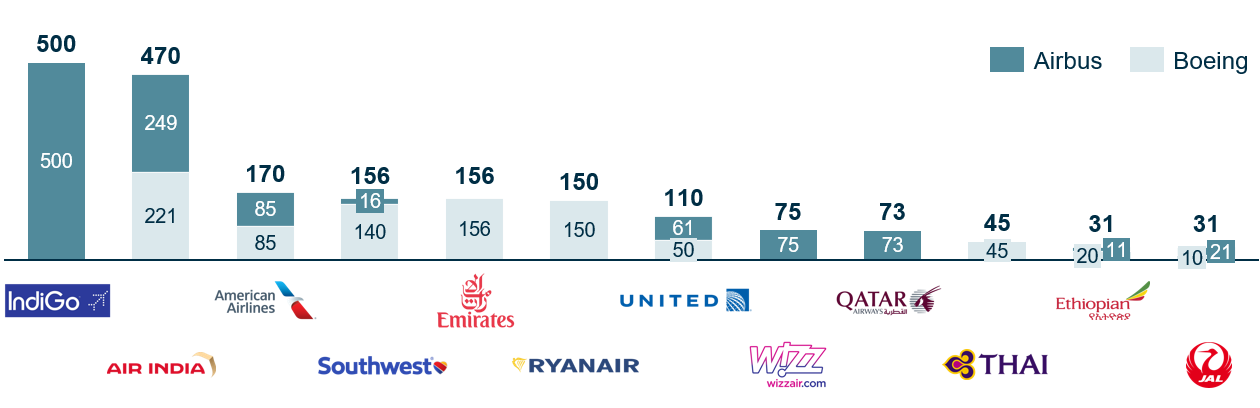

Order intake for commercial aircraft in 2023 came to 2,094 with Airbus and 1,576 with Boeing. Airbus has been able to expand its footprint with Southeast Asian airlines, amongst others with a 500 single-aisle jet order from IndiGo in summer 2023 but also with wide-body orders by JAL and Korean, 21 and 27 A350 wide-bodies respectively.

Airbus order backlog per end of February was 8,552 jets of which 90% were narrow bodies. Boeing’s backlog per year end amounted to 6,216 aircraft of which 77% were 737 narrow-bodies. This backlog translates into 9.9 years of shipment for Airbus at 2019 production levels and 7.7 years at Boeing 2017 (normal year) production levels. Chinese Comac received two orders for 100 single-aisle C919s each from Air China and China Southern Airlines. The intended build rate is 4 per month.

After COVID 19 short-haul air travel recovered first. In 2023 airlines saw the demand for long-haul travel increase and, amongst others Delta, Korean, Emirates, Ethiopian, JAL American, IndiGo and Thai, placed orders for wide-body jets like the 787 and A350 and A330neo. Also, Qatar Airways is in talks with Boeing and Airbus for the order of a total of 150 wide-bodies. Airbus will increase its A350 build rate to 12 per month by 2028.

Sources: Airbus SE, The Boeing Company

Defence

DEFENCE SPENDING HAS INCREASED SUBSTANTIALLY

As a result of the wars in Ukraine and Gaza / Israel, defence budgets have been increased in Europe and, more moderately, in North America. In 2022, the vast majority of European countries had defence spending of below 2% of their respective GDP; this changed substantially in 2023 and will also increase further in 2024. Germany is now considering an increase to 3% of GDP. While worldwide defence spending at the height of the Cold War was over 4% of GDP; it was at 2.3% in 2023. Average military expenditure as a share of government expenditure rose by 0.4 percentage points to 6.9 per cent in 2023.

Due to reduced spending and attention in prior years, a major part of the increased defence spend is now allocated to restore and maintain the functionality of equipment and ramp up of equipment. The remainder of this spending is allocated to the replacement of military equipment and stocks provided to Ukraine in 2023, with little else prioritised

MULTIPLE FRONTS

Unlike past global conflicts that were localised proxy wars (Korea, Vietnam, Afghanistan) the war in Ukraine has turned into a Russian led war for territory in Ukraine with NATO members having so far openly supported the defendant Ukraine; however, defence budgets and support of the Ukraine are being more and more scrutinised, in particular in the US. Also, countries are carefully maintaining some distance not to be directly involved with own personnel and equipment.

The October 7th attack of Hamas on Israel has triggered support from Western allies with the NATO ally Turkey taking a doubtful position. The Iranian drone and missile attack on Israel in April was thwarted with assistance from the US, UK and Jordan. The Middle East currently is a tinder box with Iran-supported Huthis opening another front in the Red Sea and disrupting shipping lanes impacting mainly trade with Europe. In addition, a potential conflict in Taiwan would overstretch resources, in particular from the US if it were to intervene. Such conflict would disrupt trade even further due to embargos that would follow as well as due to shipping lanes being impacted.

NATO nations are being drawn into these conflicts, be it through support by delivering weapons or deploying their Navies and putting troops on alert, thereby further increasing the demand for weapons and military equipment. US defence strategy is focussing on the development and manufacture of cutting-edge defence capabilities and to advance new operational concepts across domains, from advanced cyber systems and enhanced space capabilities to a modernized nuclear triad. US politics have identified three geopolitical priorities: continue to support the Ukrainian conflict against the Russian aggression / Pacific / Israel. All this will continue to put stress on defense production capacities and necessitate investment as well as M&A.

LESSONS LEARNED FROM THE UKRAINIAN BATTLEFIELD

The ongoing Russia-Ukraine conflict is generating new insights into warfare in today’s technological and weapons systems environment triggering both investments and M&A to secure technology and supply chain.as both Ukraine and Russia are adapting to the changing requirements of warfare

Artillery remains the most prominent weapon in the conflict with 80% of casualties on both sides being attributed to artillery fire. As a result of the ongoing conflict Western countries are investing in production capacities, both in systems as well as ammunition

Air defence is shaping the war in Ukraine and Gaza/Israel and has pushed manned combat aircraft to standoff distances that reduce their effectiveness and lethality. High-tech long-range surface-to-air-attacking missiles take out both aircraft as well as unmanned systems. Unmanned aerial systems have become a much cheaper and the most important equipment both for observation and intelligence as well as offensive purposes. Governments and forces are focussing on unmanned aerial systems. As a result, the US Army has cancelled the Future Attack Reconnaissance Aircraft (FARA) programme after having invested billions over the last 6+ years.

Cheap DIY „kamikaze“ drones have proven to be highly effective inflicting substantial damage on the enemy like the Ukrainian naval drones in attacks on the Russian Black Sea fleet. This trend can be seen also in Uncrewed Ground Vehicles (UGVs) with Ukraine, using commercial components like video-game controllers to manufacture UGVs at low cost. These, partially amateur designed, UGVs are used in support roles (mine-laying, de-mining) and as attack models with automatic grenade launchers, weapon turrets or explosive laden for kamikaze missions. The Ukranian government has allocated funding for mass-producing different models in hundreds of units.

Source: NATO

M&A Activity in Aerospace & Defence

A&D ATTRACTING MORE ATTENTION

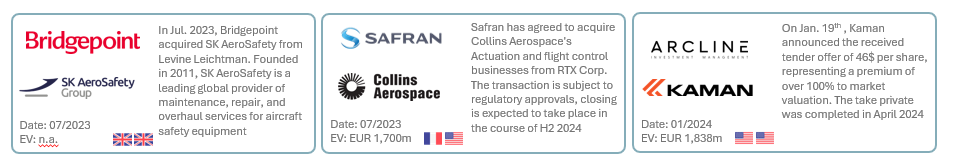

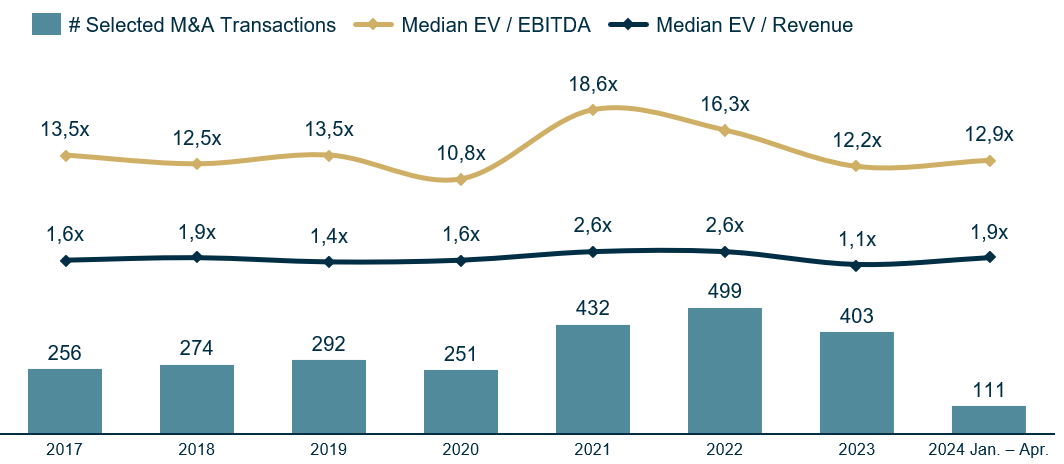

M&A activity in the A&D space by number of transactions has seen a slight decline in 2023. On the back of the various global conflicts and increased defence spending, there is an increased demand for investments and capital, in particular, in A&D .Both strategic and financial investors see the need and/or the opportunity to invest in this industry. Valuations as shown below are the median for transactions with available data. However, we know of several transactions with higher multiples than those shown below.

Apart from the tombstones shown above, the following deals are worth mentioning

(i) the acquisition of Hawaiian Airlines by Alaska Airlines, (ii) the acquisition of the international LSG catering business from Lufthansa by PE investor Aurelius, (iii) the BAE Systems acquisition of Ball Aerospace, (iv) Heico’s acquisition of Wencor Group and (v) the still pending Thales acquisition of Cobham. Starting from March and looking further into 2024, we are optimistic about the A&D M&A market with interesting deals emerging, driven by strategic goals to secure the supply chain.

DEVELOPMENT OF GLOBAL M&A DEALS IN THE A&D SECTOR

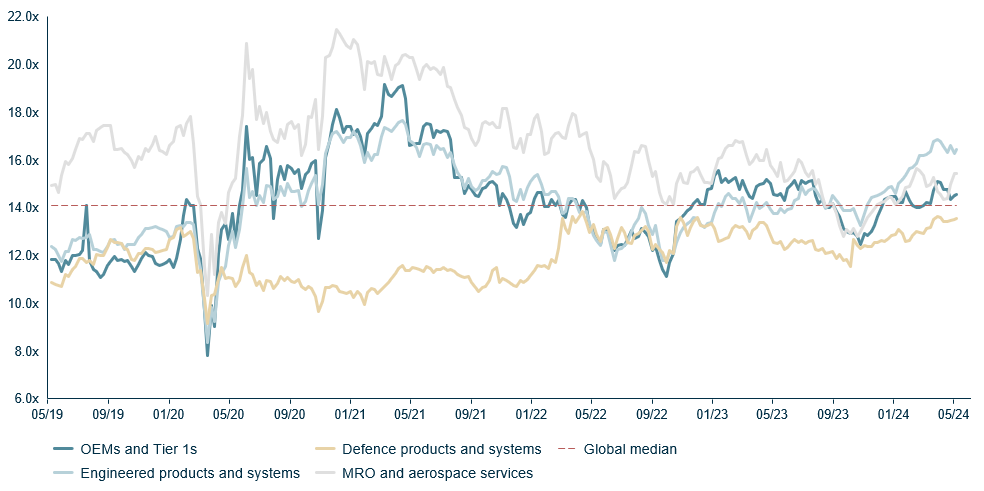

Public Valuation Environment – Aerospace & Defence

Public trading multiples of Aerospace & Defence Companies (EV/ NTM EBITDA)

Source: Capital IQ 07.05,2024

Related Aerospace & Defence Insights:

In 2024, our A&D team headed to the Farnborough International Airshow. Find their key take-aways here.

Get in touch

If you found this report insightful and would like to explore how it applies to your specific needs, our Industrial M&A team is here to help.

Get in touch