European Supply Chain Software – Industry Update

Spring 2024 Supply Chain Software Insights

M&A activity in sector expected to increase over next 12 months

Spring saw an increase in M&A transaction volumes and valuation levels in the European supply chain software sector, giving us reasons to be optimistic. Companies in this space have shown resilience over the last two years against challenging market conditions. Financial sponsors continue to compete for high-quality software businesses, seeking profitable growth based on strong retention metrics. Over the past year, many companies have focused on securing retention and profitability; however, the emphasis is shifting to growth, backed by successful go-to-market strategies.

The supply chain software sector offers plenty of opportunities for further consolidation, which is one of the main factors supporting the strong M&A outlook. Private equity-backed sector companies are advancing their growth strategies with add-on acquisitions, and strategic players are acquiring targets with complementary product suites. We also expect decreasing interest rate levels and an overall improvement in economic activity to boost interest in this sector. Overall, our outlook for M&A activity in the sector is optimistic, and we expect to see strong interest over the next 12 months.

Our view on key software sector topics

Market Sentiment:

Market sentiment for supply chain software companies was cautious in early 2024. However, by spring, sentiment shifted to a more optimistic outlook based on future growth and development opportunities. This change is reflected in the valuation levels of our stock exchange-listed sector peer group, currently trading at an NTM/Revenue multiple of 6.6x compared to a 10-year median of 5.4x.

Growth:

Growth was the main sector-wide challenge for Q4 2023, with many end customers opting to delay decision-making on new supply chain software agreements.

Retention:

The sector’s mission-critical nature has kept churn relatively low, but challenges related to upselling and winning new clients have put pressure on the short-term growth outlook. Median growth estimates for 2024 for our stock exchange-listed sector peer group have decreased to 9.2% from 12.2% in 2023.

Product Improvements:

The focus on customer experience and efficiency improvements prompted companies to invest in their products, enhance automation, and embrace cloud adoption. With greater product efficiency, companies are targeting improved sales and profitability.

Continued Consolidation:

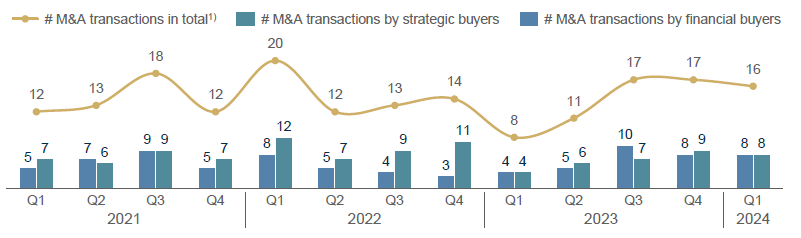

Two channels drive continued consolidation in this space: private equity funds keen to invest in supply chain software platforms and add-on acquisition strategies by private equity-backed companies. During Q2/2023-Q1/2024, 31 out of 61 acquisitions in the European supply chain software sector were executed by financial sponsors. We expect PEs to remain highly active in this sector over the next 12 months.

An overview of key supply chain software segments

Sales & Operations Planning

- Business Planning Software

- Demand & Sales Forecasting

- Inventory & Capacity planning

Manufacturing Execution & Production Planning

- Production scheduling, and information sharing between managers, workers, ERP, and systems.

Warehouse Management & Inventory Optimization

- Inventory availability

- Location control

- Stock and replenishment planning

- Logistics

Procurement & Sourcing Management

- Supplier management

- Sourcing process

- Purchase orders

- Order status & raw stocks

Order Tracking & Last Mile Delivery

- Order and distribution tracking

- Last mile delivery management

- Customer interface

Freight planning & Fleet Management

- Fleet monitoring

- Vehicle tracking & route planning

- Cost management

- Driver management

M&A Environment

Development of the European M&A market in the supply chain software segment

The European M&A landscape for supply chain software has shown notable resilience despite fluctuations in capital markets and valuation challenges in recent years. From Q1 2021 to Q1 2024, the sector saw substantial activity driven by both strategic and financial buyers, with strategic buyers making up 56% of all recorded transactions. This underscores the importance of supply chain software in organisational operations, a factor that remains steadfast even during periods of economic uncertainty.

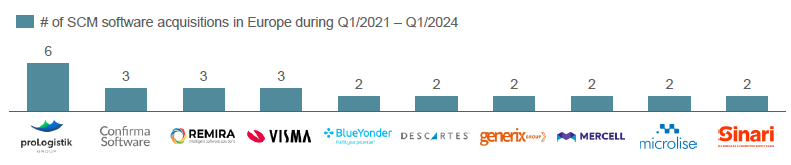

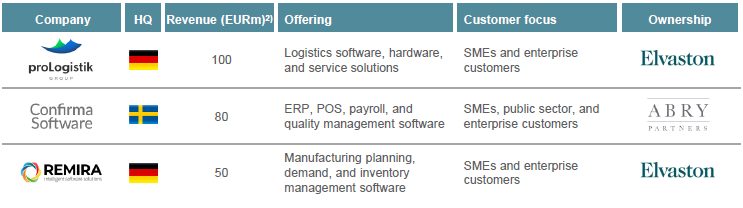

ProLogistik emerged as the most active among the strategic buyers, completing six acquisitions during this period. Confirma Software, REMIRA, and Visma each completed three transactions within the sector.

Most active consolidators in Europe

Selected consolidator profiles

Notes: 1) Includes Supply Chain Software majority transactions with deal values of at least USD 5m and minority share transactions as reported by Mergermarket, within Mergermarket’s „Computer software“ sector;

2) Latest available estimate

Sources: Mergermarket, MCF analysis

Public Valuation Environment

Public trading multiples of European & North American supply chain software companies

Valuation levels remain high in 2024 but have decreased from the record levels in 2021. With an NTM EV/Revenue multiple of 6.6x, European and North American diversified supply chain software companies are trading above the historical 10-year median of 5.4x.

NTM EV/Reveunue Development of Supply Chain Software Companies

Source: S&P Capital IQ

Case Study: Voyantic

The Deal:

Voyantic, a leading provider of RAIN RFID test and measurement solutions, was acquired by Impinj Inc., a wireless RAIN RFID communication technology company. Impinj sees that Voyantic’s RAIN RFID test and measurement solutions enable closer engagement with label & service bureau partners and advance Impinj platform’s leading position in RAIN quality, reliability, and readability. Voyantic sees that the transaction creates more opportunities to grow and strengthen offering to the RAIN RFID industry. Furthermore, the parties view their values and cultures highly similar – valuing expertise and achievement.

The Buyer:

Impinj (NASDAQ: PI) helps businesses and people analyse, optimise, and innovate by wirelessly connecting billions of everyday things – such as apparel, automobile parts, luggage, and shipments – to the Internet. The Impinj platform uses RAIN RFID to deliver timely data about these everyday things to business and consumer applications, enabling a boundless Internet of Things. If it’s a thing, the Impinj platform can connect it. The company enables digital transformation by extending the Internet’s reach from the cloud, through edge connectivity devices, all the way to physical items. You can read the full press release on this transaction here.

Our Technology Team

We offer honest, relationship-driven and informed advice to clients in sell-side and buy-side M&A, capital raises, strategic transactions as well as debt advisory. We provide clients with access to an international investor universe in addition to a team of sector experts. For more information on our technology team and services, you can find information here. You can also find our previous Supply Chain Software 2023 report here.

Related Technology Insights

Software valuations report Q1 2024

European Supply Chain Software – Industry Update 2024

Technology M&A: Software Sector Update – Q1 2024

Technology M&A: Travel & Hospitality Insights – Q1 2024

Get in touch