Setting the Flow

Welcome to our Spring 2024 edition of the Flow Control industry update. This report serves as your guide to the latest trends and hot topics, M&A activity, and valuation environment shaping the Flow Control sector.

Reflecting on the past year, the industry has seen substantial developments in areas such as water and wastewater management, alternative energy sources, and digitalization, each playing a pivotal role in steering the sector towards a more innovative and efficient future.

Water scarcity and the imperative for sustainability have brought to the forefront innovative solutions in water treatment and conservation. The push for cleaner energy sources has elevated the role of hydrogen and LNG, creating new opportunities for Flow Control technologies. Meanwhile, the digital transformation within the industry, through smart technologies and predictive maintenance, is setting new benchmarks for operational excellence.

Our report provides an update on global M&A activity, highlighting major transactions and strategic consolidation activity that continue to shape the landscape. With an eye on the year ahead, we explore the valuation environment, noting continued high valuation levels driven by strong strategic buying interest and a growing recognition of the sector’s potential by financial sponsors.

This year, we further solidified our commitment to providing tailored, relationship-driven M&A and debt advisory services. Our dedication to understanding the nuances of each client’s journey has enabled us to forge strong partnerships and deliver outcomes that exceed expectations.

We trust you will find valuable insights within these pages and look forward to the possibility of engaging in discussions about your ventures in the Flow Control landscape.

Hot Topics in the Flow Control Industry

Water & Wastewater Management

Sustainability and water scarcity

Rising global water scarcity is catalyzing innovations in sustainable water management. Population growth and climate change effects are amplifying the need for advanced flood protection equipment, water treatment, recycling, and conservation. Desalination emerges as a key solution to water shortages, benefiting from technological improvements that enhance its energy efficiency and cost-effectiveness.

Aging water and wastewater infrastructure

Deteriorating water systems, particularly in developed nations (e.g. Europe and the US), lead to substantial water loss and purity challenges. The move to modernize aging infrastructure is driven by the imperative to curb losses, elevate water quality, and meet increasing demands.

Alternative Energy Sources

Hydrogen

The push for cleaner energy sources has made hydrogen a prominent focus. The development of infrastructure for hydrogen production, storage, and distribution is a significant driver in the flow control industry, requiring specialized valves, pumps, and pipes. The EU’s Hy2Infra €6.9 billion investment into hydrogen infrastructure signals a robust market opportunity for specialized flow control solution providers.

LNG

The LNG sector is experiencing growth due to its role as a transition fuel towards a lower-carbon economy. The flow control industry benefits as LNG requires highly specialized cryogenic pumps, valves and control systems to handle the extreme temperatures and pressures involved in LNG processing, transport, and regasification.

Digitalization and Smart Technologies

Digital Monitoring and Predictive Maintenance

In the dynamic realm of flow control, digital monitoring and predictive maintenance are reshaping industry standards. Leveraging AI and IoT, these smart systems not only foresee potential failures, reducing unscheduled downtime but also optimize energy efficiency for greener operation.

Metering and sensors

The sensor and metering sector, as reported by AMA[1], has witnessed a revenue boost of 6% in 2023 and is gearing up for a 13% hike in investments in 2024, indicating robust industry health and a commitment to innovation. Automation’s surge necessitates advanced metering technology and sensors for accurate monitoring and feedback, essential in modern production.

Advanced Hygienic Flow Solutions

Stringent Hygiene and Safety Standards

The hygienic sector is governed by rigorous regulations requiring flow control products to meet high cleanliness, material compatibility, and sterilizability standards. This necessity drives the continuous innovation and upgrading of technologies to comply with evolving regulations and ensure product safety.

Adaptation to Global Health Challenges and Market Growth

The expanding global demand and the need to rapidly respond to health challenges, such as vaccine production, highlight the importance of efficient flow control systems. These industries require advanced, flexible solutions that can scale up quickly and integrate seamlessly with existing processes, catering to specific production needs and standards.

Ongoing Industry Consolidation

M&A activity in the global Flow Control market is predominantly driven by large corporates seeking to broaden their portfolios beyond their traditional offerings, strategically acquiring new technologies to enhance their product suite, extend their geographical and industrial expertise and cater to a shared customer base.

M&A has been key for Atlas Copco’s expansion strategy with >80 acquisitions since 2018, complementing the existing product portfolio but also entering new segments such as pumps and machine vision solutions:

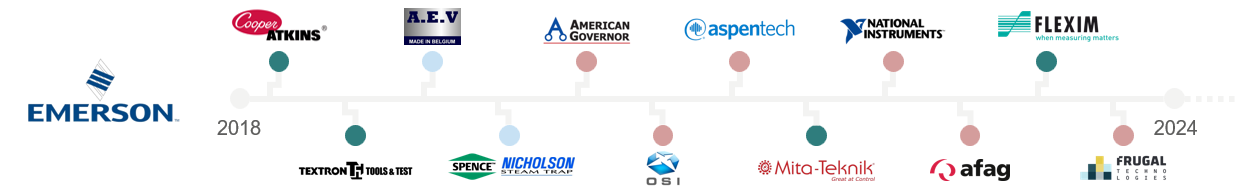

Acquisitions such as National Instruments have been a key step in Emerson’s portfolio evolution, advancing the position as a global automation leader and diversifying technology into test & measurement automation:

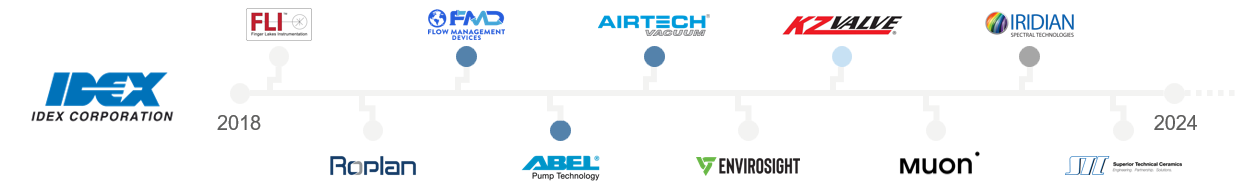

M&A continues to be a top focus for IDEX, building out adjacencies to the current technology portfolio, maintaining strong focus on customer-centric, highly engineered products for mission critical-applications:

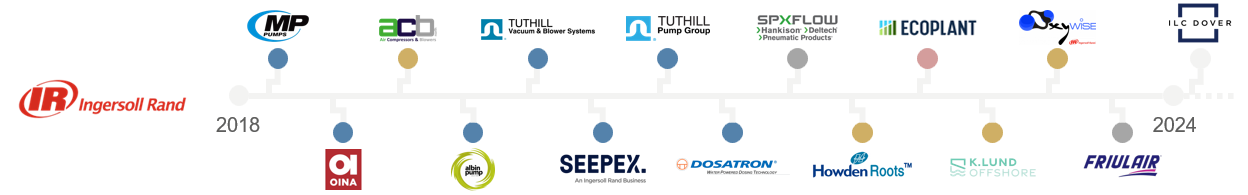

Continued focus on acquisitions fortifying IR’s core (i.e. compressors, blowers, vacuums and pumps) and expanding the addressable market through acquisitions of adjacent technologies such as air treatment:

Focus on acquisitions reinforcing Dover’s position as diversified global manufacturer, looking for businesses that align with its operational excellence strategy and add adjacent technology to the portfolio, e.g. metering:

![]()

Source: Mergermarket

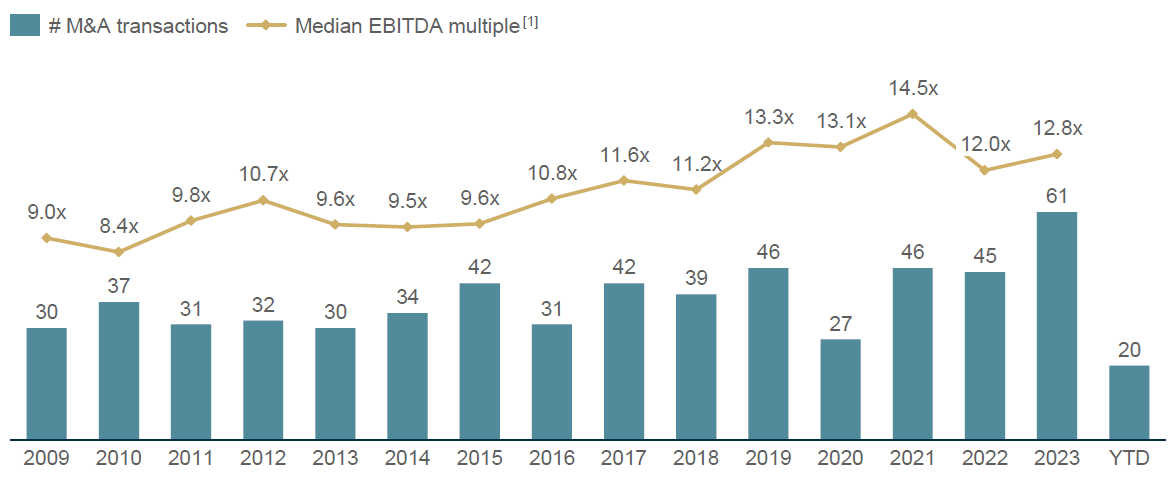

Development of the global M&A market in the Industrial Flow Control segment

The Industrial Flow Control sector has shown continuous M&A activity throughout the past decade, mainly in the Americas and Europe. While valuation levels came down in 2022, the number of M&A transactions completed worldwide in 2023 rose to an all-time high. The Flow Control segment is characterized by stable high EV/ EBITDA valuations and could continue a double-digit valuation in 2024. High valuations are due to strong buying interest from strategic consolidators and an increasing number of financial investors who have identified the overall Flow Control universe as an attractive target sector.

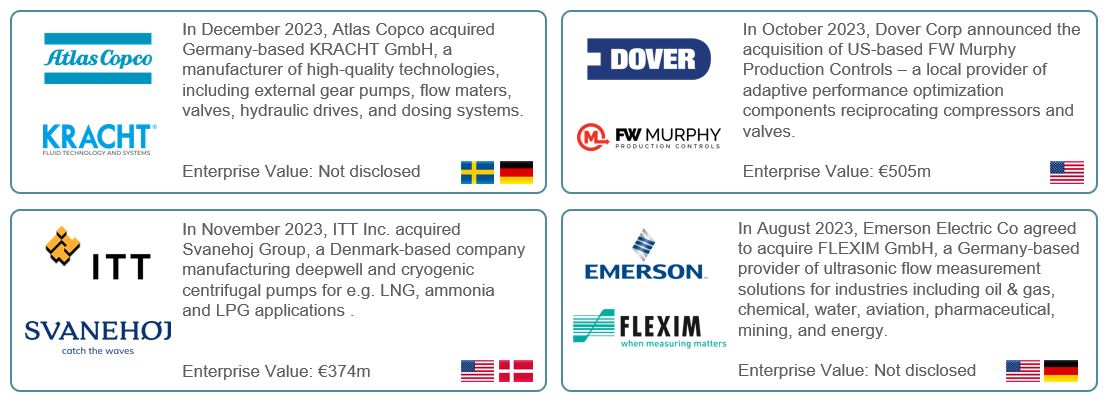

Selected M&A Transactions in the Flow Control Segment

Source: Mergermarket Notes: [1] Enterprise Value / Earnings Before Interest, Tax, Depreciation & Amortization

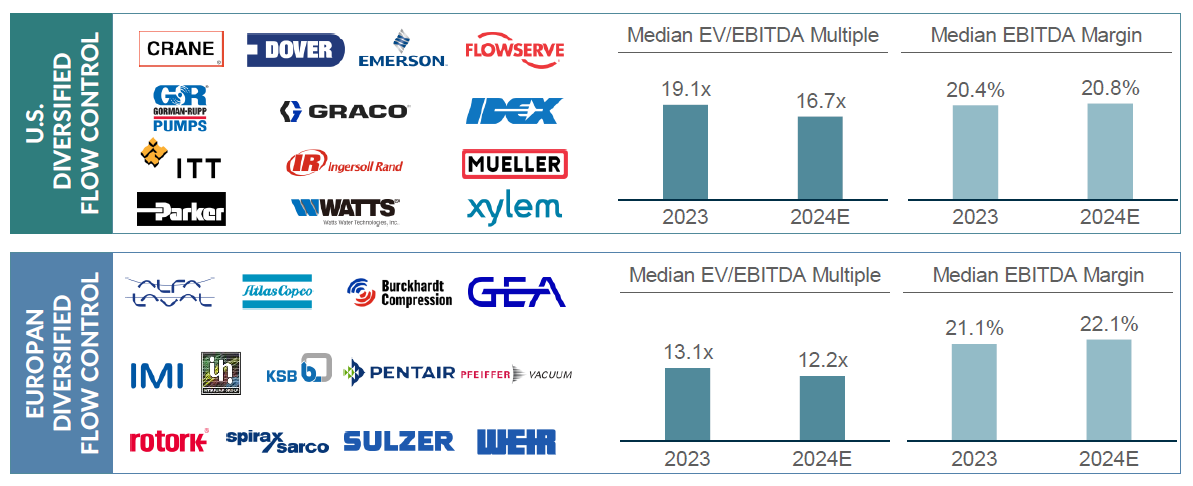

Public Trading Multiples of European & US Flow Control Companies

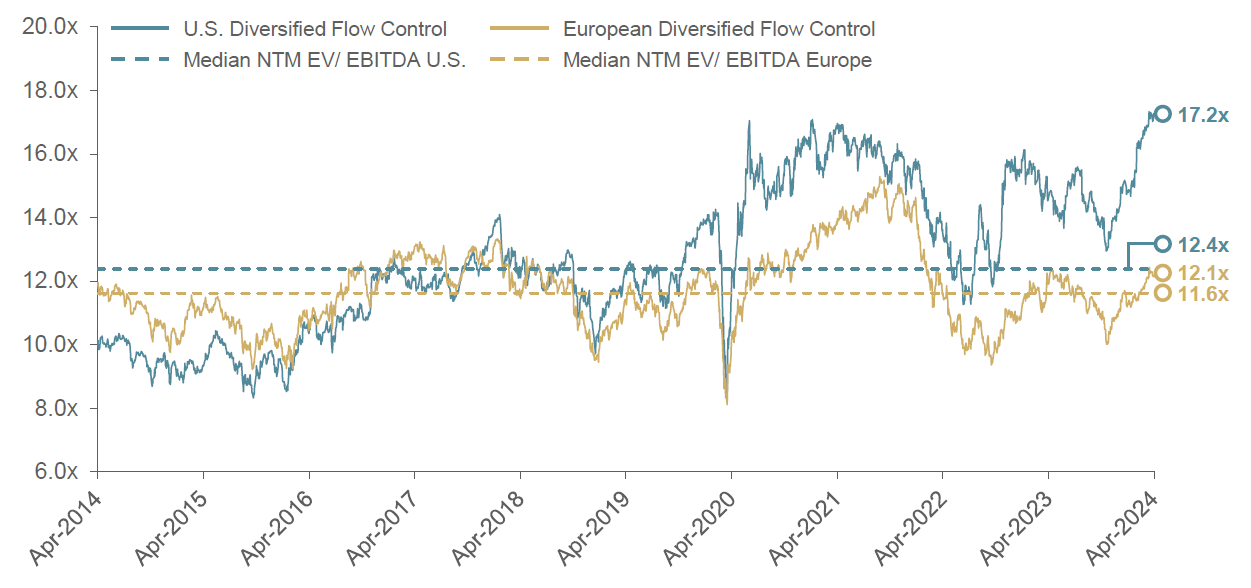

NTM EV/EBITDA Development of Flow Control Companies

Valuation levels are up from last year, however, still below the level of peak valuation in 2021. With a NTM[1] EBITDA multiple of 17.2x[2], U.S. based diversified Flow Control companies are still trading well-above the historical median of 12.4x. Simultaneously, European diversified Flow Control companies are trading at 12.1x[2] – only slightly above the historical median of 11.6x.

Source: S&P Capital IQ Notes: [1] Next Twelve Months; [2] weighted by market capitalization

Get in touch