M&A Logistics Insights Report – Spring 2024

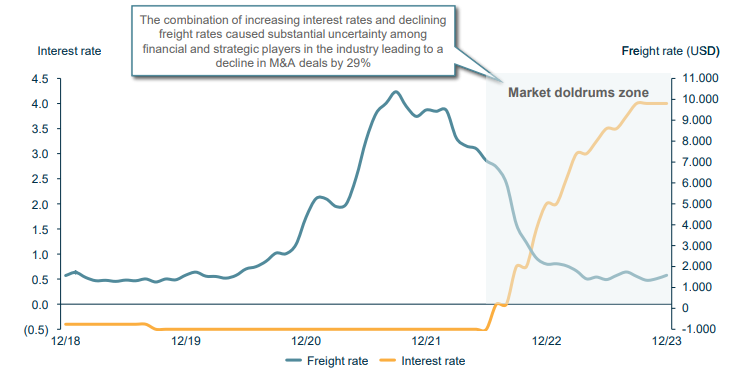

With the combination of increasing interest rates and declining freight rates, the logistics sector has experienced a very challenging market in 2023. Despite some major landmark transactions such as the acquisitions of Bollore by CMA CGM or CVC’s acquisition of Scan Global Logistics, M&A activity has decreased significantly.

However, for 2024 our logistics team expects a comeback of M&A activity given the still very high liquidity levels of maritime shipping companies and the record-levels of dry powder in the private equity market.

Further M&A trends and dynamics are presented by our sector team in the 2024 edition of „M&A Logistics Insights“.

Challenging M&A market in 2023 – But positive outlook

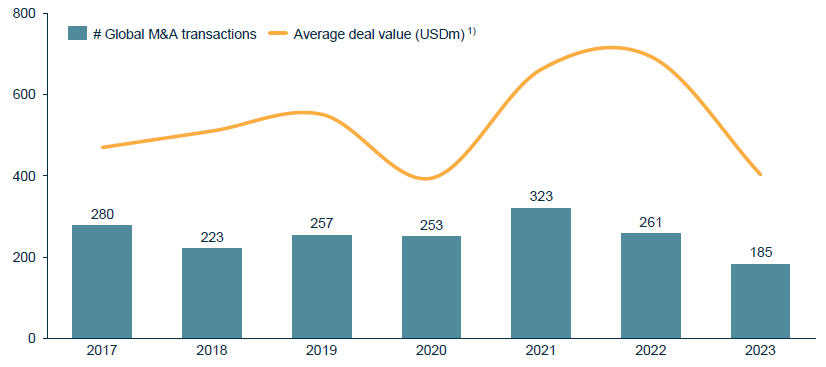

In our 2023 edition of M&A Logistics Insight, we forecasted the logistics market to experience further M&A consolidation driven by large cash reserves of maritime shipping companies and an increasing awareness on logistics as a key value differentiator making the industry attractive for financial investors. Partially we have been right, given landmark transactions such as the acquisition of Bollore by CMA CGM or the acquisition of Scan Global Logistics by CVC. However, the M&A dynamic has been significantly impacted by the mix of increasing interest rates, declining freight rates and geopolitical uncertainties. This led to a substantial decline in M&A activity for operating logistic companies.

Container freight rate index and ECB interest rates

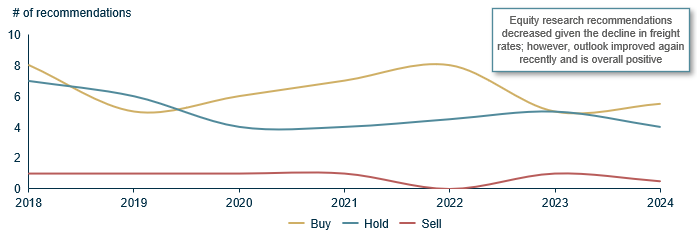

Despite a geopolitical environment that bears significant risks for global trade, such as a potential escalation of conflict in the middle-east, path-breaking elections in the US, India and the European Union and a further weakening of the Chinese economy, we expect a better year for M&A in 2024. Why this optimism? We still see record-levels of liquidity in the logistics market that will either be used for share buybacks or M&A, the ongoing DB Schenker sale will heavily impact the market dynamics and private equity sits on a massive level of dry powder to be invested. This market mix offers opportunities on the sell- as well as on the buy-side, which will be touched upon in this market report.

Development of global M&A deals in the logistics sector

Notes: 1) Disclosed EV value | Sources: MCF Analysis, Mergermarket, Refinitiv

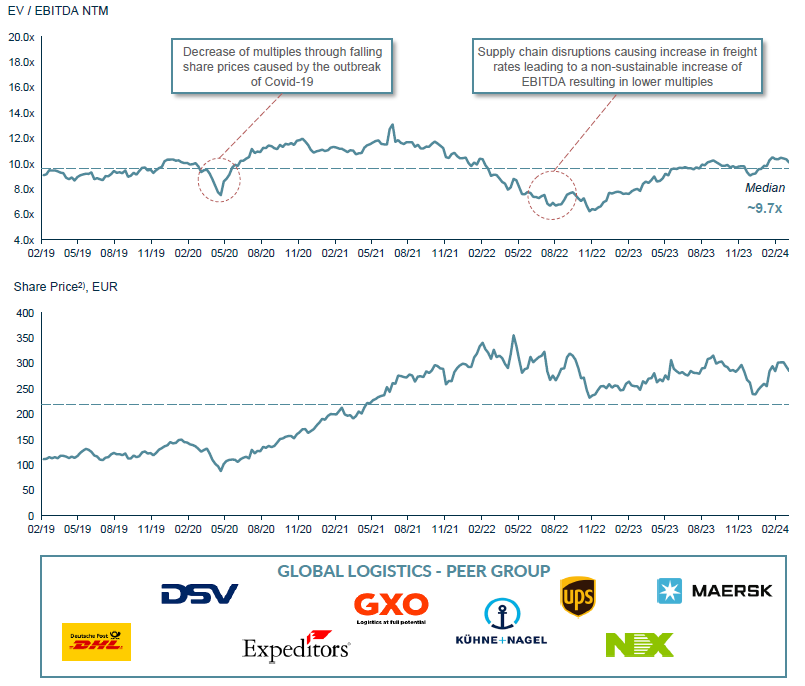

Persistent stability in valuation levels

The valuation environment for logistics companies has remained stable and its current valuation level is in line with the historical average, trading at approx. 9.7x EBITDA1) . The valuations for historical transactions have remained in line with expectations. For transactions exceeding a valuation level of EUR 100m to EUR 1bn, we observe valuations between 6.5 – 8.5x EBITDA as the industry average. Whether the upper or the lower end of this range is met depends significantly on the end-markets of the customers, the infrastructure base of a company as well as the proof of growth in recent years. Valuations can significantly exceed the aforementioned valuation range, in case synergies are priced-in – which most often happens in well-structured M&A processes. Thus, we observe multiples of more than 10x EBITDA (and by that in line with public valuation levels) for transactions with an enterprise value of more than 1bn valuation.

Selected comparable publicly listed companies

Notes: 1) Based on the expected EBITDA of the next twelve months (as of 29.01.2024); 2) Based on a non-weighted average share price development | Source: MCF Analysis, Capital IQ

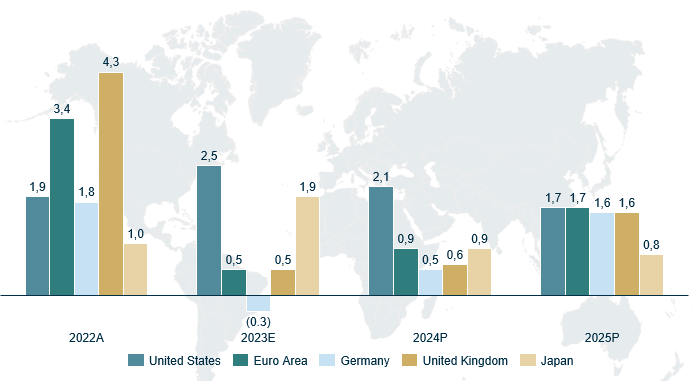

Global economic resilience – apart from Germany

2024 could certainly have started better: with the red sea under constant attack by the Houthi rebels, global shipping companies are avoiding the area leading to increasing freight rates and challenges to global supply chains. With elections affecting 3.5bn people globally (i.e., US, India and EU) in 2024, the political risk associated to policy changes does not help. Further, the weakening of China’s economy exhausts the global growth engine of recent years.

However, global growth has demonstrated remarkable resilience, with inflation steadily decreasing. In 2023, stronger private and government spending sustained demand despite stringent monetary conditions. On the supply side, the resolution of supply chain bottlenecks, and reduced energy prices bolstered activity. International Monetary Fund projects a growth rate of 3.1 percent for the world economy in 2024, consistent with 2023. Apart from Germany, that suffers from a challenging regulatory and political environment, all major economies have experienced GDP growth.

GDP growth expectations

Annual percentage change

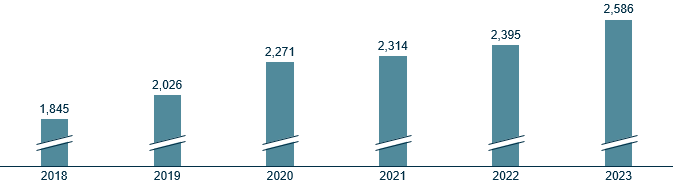

Record-level of non-allocated capital will drive M&A

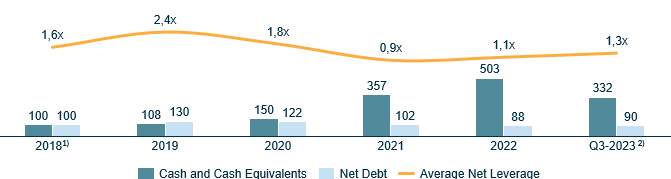

We expect that the M&A market in the logistics sector will experience a comeback in deal activity in 2024 driven by the (still) extraordinary high cash reserves of the largest strategic consolidators (+300% to Covid-19 levels) as well as the record-level of dry powder of the private equity industry (USD 2.6tn). The challenging macroeconomic environment might be an opportunity to buy into the market or gain market share at relatively lower valuation levels in the private market, which will most likely lead to an increase in M&A activity rather than share buybacks (given all-time high valuations at the stock exchange). However, scarcity assets with the right equity story will still fetch premium valuation.

We expect to observe three strategic drivers for M&A: i) sea & air freight players expanding their value chain by strengthening their road capabilities, (ii) American and Asian players trying to strengthen their European footprint – especially in UK, Benelux and Germany and (iii) private equity consolidating the market across various services and geographies to build one-stop-shop solutions.

Analysis of Indexed cash and cash equivalents, and net debt development among major players (equal weighting)

Global private equity dry powder trends, 2015-2023, USDbn

Notes: 1) 2018 as base year; 2) Reported figures for full-year 2023 have not been released yet | Sources: MCF Analysis, Capital IQ

Equity Research analyst recommendations – Global Logistics 1)

Notes: Financials in EURm; 1) Based on peer group displayed on page 5 | Sources: MCF Analysis,, Capital IQ, Company Information

Get in touch

If you would like to discuss this report or how our team can help with your company M&A plans, please do not hesitate to get in touch. You can find more information on our Business Services team, including team members and previous deals here.

Related Logistics Insights:

M&A Logistics Insights: Industry Report – Spring 2023

Get in Touch