Consumer M&A: Outdoor & Active Lifestyle – Spring 2023

Industry Update

In the Spring 2023 edition of our „Outdoor & Active Lifestyle,“ our Consumer Team reviews the shifting trends in the market. There’s no clearer sign of spring than witnessing people emerging from their homes, basking in every bit of sunshine, and striving to regain fitness after a long winter of hibernation. In this report, we explore both sides of the Atlantic, examining public company valuations and aggregate deal values in the consumer middle market. Highlights of the report are provided below, with full details, including valuations, available in the downloadable report.

Consumer behavior has clearly shifted, those spending most time exercising and being active are increasingly looking for more premium, higher quality products that are more comfortable and stylish, rather than just functional. This trend is showing no signs of slowing down either.

Strong efforts are being made by emerging brands to attract these customers and make them identify with their brand – Hoka, the French running footwear brand, has been exceptionally good at this, recently surpassing EUR 1bn in sales, and has +50% YoY revenue growth the last 4 years. – Have you ever met someone running in Hoka shoes not trying to convince you that you need a pair?

Social media impact, like it or not, is an obvious force in consumers’ purchasing decisions. With 100m+ users sharing their active lifestyle – Strava has nearly 90m photos uploaded into its system and has for many

become as frequently used as the Instagram’s of the world to showcase their active lifestyle.

The unfolded demand for new technical fabrics, innovative textiles and technologies are all factors that have been driving the premium segment for established brands’ top products the last few years. Thus, as Strava records marathon participation doubling between 2022 and 2021, it would be wise to assume the trend will continue; and you should not be surprised if you see an increasing number of runners wearing boutique

brand t-shirts, carbon sole technology shoes and contrast enhancing sunglasses that would only be recognisable to the trained eye, fighting hard to cross the finishing line sub 4 hours.

Views from our US partners

Active Apparel, Footwear, and Accessories

Company Guidance remains “optimistic but cautious” for the second half of 2023 and into 2024. Despite several positive earnings reports and double-digit sales growth for companies such as Nike, Moncler, Canada Goose, On Holding and Deckers, management teams are still feeling uneasy with respect to current market conditions, geopolitical unrest and other short-term challenges. The outlook is less bright for certain names such as Adidas as a result of terminating its partnership with Kanye West. Overall, this sector has held its own with companies recently indicating that they will double down on factors within their control, such as

product innovation, thoughtful pricing strategies and continuing to reach new customers through additional investments in marketing.

Outdoor Equipment

While we have seen some inevitable slowing, outdoor participation remains above pre-pandemic levels and many companies are forecasting solid growth including Acushnet and Fox Factory. Upward cost pressures have also lightened in key areas like transportation and manufacturing. Despite positive signs for many, certain companies continue to struggle including Shimano which is forecasting a 20.5% drop in net sales for 2023 citing poor economic conditions, among other factors. The companies best positioned against these various near-term headwinds have been successfully able to offset higher input costs, have well diversified product offerings and are looking at taking full advantage of the upcoming spring and summer selling seasons including Polaris and Clarus. There is a universal confidence that the industry will return to significant growth levels.

Tactical / Safety Gear

The outlook for tactical and safety companies remains mixed for 2023 and into 2024. Unlike the other outdoor industries, volatility remains a consistent component of the tactical/safety industry. The latest slew of earnings reports have been poor, including Colt CZ having 1Q 2023 sales down 15.2% YoY, Sturm, Ruger & Company’s 4Q 2022 sales down 18% from the prior year and Smith and Wesson’s Fiscal 3Q 2023 sales down 27% YoY. Consumer demand has fallen from the unprecedented levels that began in early 2020 and lasted through 2021 and have just returned to prepandemic levels, with optimistic projections in the coming months. Companies in this sector have responded to these demand fluctuations by adjusting their product cycle, optimizing headcount and incorporating other cost cutting measures. Despite many of these challenges, there are still plenty of opportunities for growth in this sector, including the increasing number of US gun owners, several new planned product launches and a growing international market.

Fitness / Recovery

After a rough last few years for many companies in this sector, including past forecasts that were significantly revised downward, things are starting to return to much better days. Gyms and Fitness Centers continue to have strong momentum going into the second half of 2023, with generational groups back to pre-pandemic levels, continued overall lower cancellation rates and companies like Planet Fitness are anticipating system-wide same store sales in the high single-digit percentage range for 2023. The swift rise, fall and rebirth of Peloton and other subscription-based fitness services has also forced at-home-fitness companies to change their business models (reducing the price of hardware and expanding their subscription offerings) in an effort to adapt to the current environment and remain successful long-term.

Retailers / Resorts

Although the brick-and-mortar retail outlook is mixed for 2023, Active & Outdoor retailers have proven to be more resilient over time. Certain brands are in expansion mode such as DICK’s, which has introduced two new concepts (Public Lands and House of Sport), while Boot Barn has been pushing for square footage growth via new store openings and continues to have a robust store pipeline. Increased focus on margin accretion from exclusive brands, valiant effort in obtaining lower freight charges and effectively managing existing cost structure also appear to be key areas of focus. Although companies like Foot Locker and Big 5 are less optimistic short term, DICK’S Sporting Goods, Academy Sports, Boot Barn, Tractor Supply and Sportsman’s Warehouse remain optimistic in the coming months, with strong conviction that they will be able to execute on their respective business plans and continue capturing additional market share. Overall, the Active & Outdoor Retail segment remains positive for the remainder of 2023 and 2024.

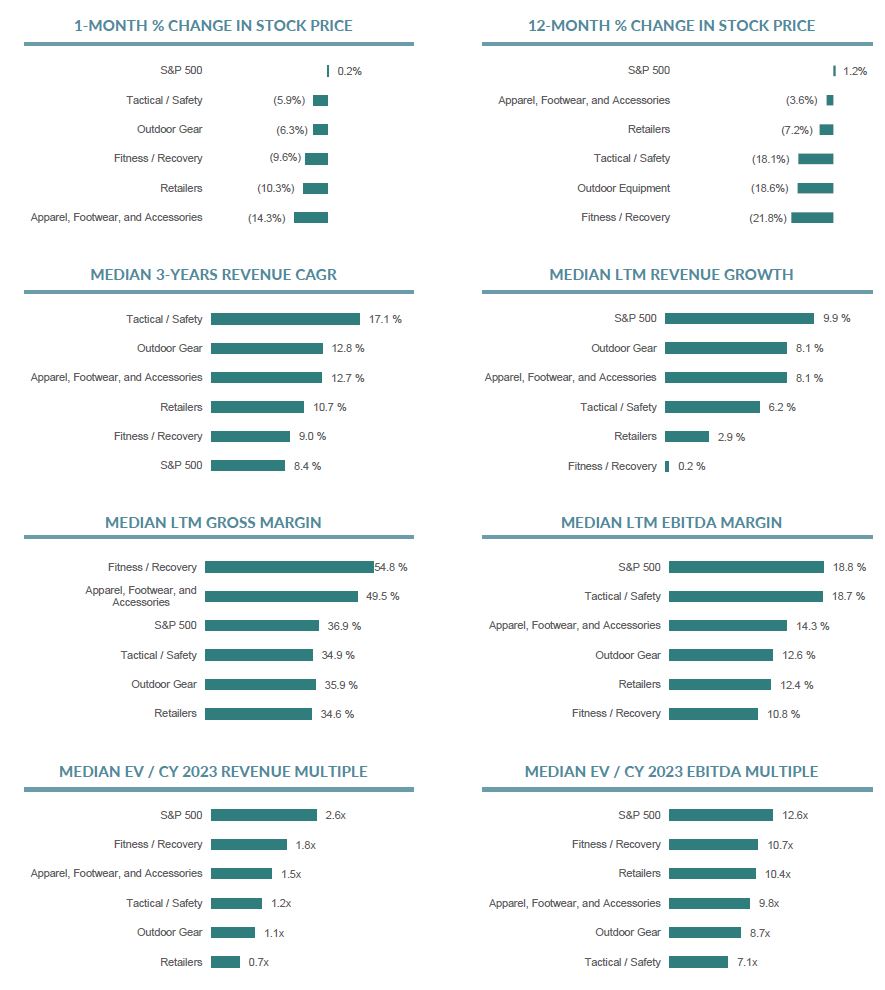

Public Company Valuation & Operating Metrics

Source: S&P Capital IQ, as of 05/31/23

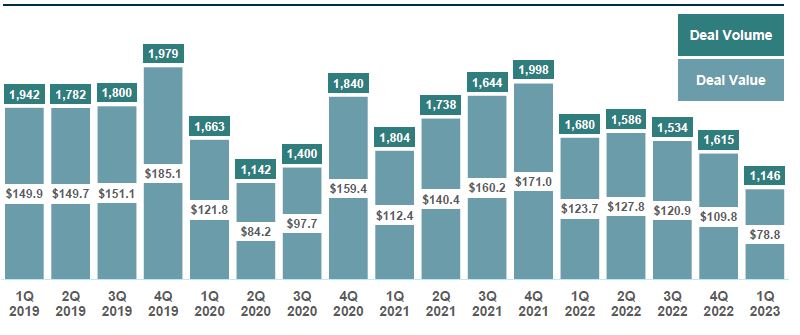

Quarterly Consumer Middle Market M&A Volumes

Aggregate deal value ($ billion)

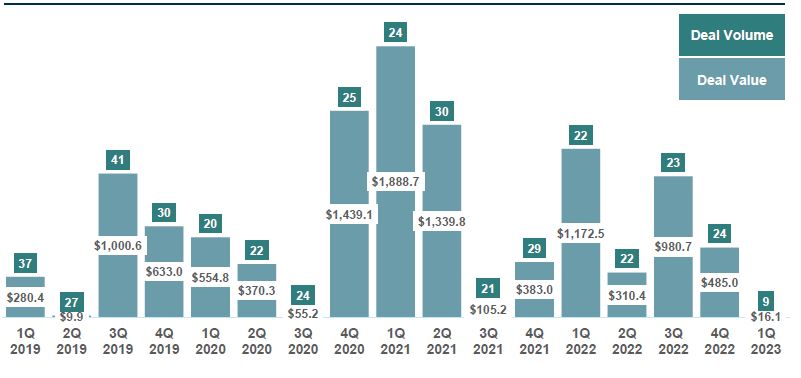

Quarterly Active and Outdoor Middle Market M&A Volume

Aggregate deal value ($ billion)

Get in Touch

To speak to use regarding plans for capital, acquisitions, or succession, please contact one of our investment bankers. You can find more information on our Consumer M&A services and team here.

Related Consumer Insights

Consumer M&A: Active & Outdoor – Q1 2024

Consumer M&A: Products – Spring 2023

Get in touch