Software Valuation Insights | Q3 2024

Our quarterly Software Valuations Insights Report is a vital resource for SaaS founders, CEOs, and Investors, offering comprehensive analysis and insights into the valuation of public software companies.

The report is divided into ten benchmark segments, providing a detailed examination of the performance and outlook across various software verticals. It delivers essential data and trends, enabling informed decision-making in the rapidly evolving software industry.

Key takeaways from the Q3 update include:

- Software valuations remain strong entering Q3, aided by faster-than-expected rate cuts. AI remains a key growth driver as companies heavily invest in AI capabilities. The rising demand for compute power – evidenced by chipmakers raising forward guidance and semiconductor ETFs achieving new highs during Q3 2024 – reflects ongoing AI adoption. This sustained focus on AI underscores its pivotal role in shaping the software sector’s growth, with this momentum expected to continue into 2025.

- Our Software Peer Groups are near all-time highs, driven by strong underlying company performance and the inclusion of a number of companies pioneering AI adoption, capturing the strong valuation growth momentum attached to AI and the influence this is having on investor sentiment.

- A more favourable macroenvironment, with lower inflation and decreasing interest rates, has supported M&A transaction momentum and sentiment. While this more favourable environment will be supportive of Software M&A, which has remained resilient throughout the cycle, Software related M&A activity is also benefitting from consolidation trends and verticalisation, with PE playing a prominent role thorough roll-up investment strategies.

Finally, this edition of the Software Valuations Insights Report reflects on the Private Equity influence across M&A activity, presenting a selection of recent PE involved transactions as well as perspectives across the wider M&A transaction environment in terms of deal value and volume, with the focus on Tech activity and PE involvement. These insights provide some notable findings alongside some observations on PE transaction activity over time.

KEY TAKEAWAYS | Q3 2024 public software valuations

AI expansion and Fed rate cuts push software valuations to record levels

The Peer Groups we track are broadly trading at all-time highs as at Q3 2024, driven by a combination of recent Federal Reserve rate cuts and the continued growth of AI technology use cases, which has significantly boosted demand for software solutions.

PE led tech mega deal appetite is gaining momentum

Financial sponsors are increasingly targeting larger Tech transactions, driven by high levels of Dry Powder and demand for AI, Cybersecurity and Software Assets. This reflects a focus on securing high-growth assets in transformative sectors, positioning PE to benefit from these growth dynamics.

Rule of 40 continues to trump growth at all costs as investors maintain focus on profitable growth

Software companies are increasingly focused on profitability, balancing cost optimisation with growth investment to maintain margin improvements. The shift to high-margin services and operational efficiency has turned investor focus to the Rule of 40, favouring balanced growth and profitability over pure expansion.

5.8x Current median EV / NTM Revenue estimate, all verticals1

47% Tech deals as a percentage of all PE led Megadeals2,3

25% Median CY2025E EBITDA margin estimate, all verticals1

Notes: 1) Based on 197 publicly listed software companies across all verticals – as at 30/09/2024; 2) CY2023 vs Q1-Q3 2024; 3) Announced/completed, majority, minority or asset acquisitions with a transaction value of at least $5bn where the buyer is or includes a PE or VC firm. Sources: D.A Davidson MCF International Research; PitchBook; S&P CapIQ

EUROPEAN PE MARKET OVERVIEW

M&A Activity – Observations Q3 2024

A favorable macroeconomic environment will likely underpin a stronger conviction to transact in the near term, supporting growth in M&A activity, with PE likely to continue to have a strong influence on the market due to high levels of dry powder and extended holding periods.

Key observations:

Favourable Macro Environment

- Central Banks have entered a rate cutting cycle, while also balancing underlying inflation. A prevailing lower rate environment will be supportive of M&A and investor conviction.

- European Deal Value rose c.31% YoY, reaching c.€439bn in H1241, indicating a rebound of larger transactions following a period of elevated inflation and higher interest rates.

Continued Tech Strength

- European Deal Volume fell by c.8% between H123 and H124, consistent with an overall weighting towards higher deal values across a lower deal volume.

- Tech remains the leading sector for European M&A, with a 77% YoY increase1, with deal value rising to c.€102 bn in H1241, with Vertical Software and AI & Data transactions driving activity.

PE Activity – Add-ons and Platforms

- Software remains a PE focus, led by consolidation activity linked to roll-up led value creation playbooks. This is coupled with European PE exit volume now increasing from recent lows.

- Headwinds prevail however, indicated by longer holding periods (5.7 yrs2), while continued fundraising momentum (c.$610bn3) coupled with a need to realise value, will support M&A activity.

PE Mega Deals on the Rise

- YTD24 has seen an increase in PE Megadeals (>$5bn). Activity is driven by high levels of dry powder and quality Tech assets delivering digitalisation solutions and recurring revenue models.

- Europe has become a focus for PE led Tech M&A, with demand for AI-driven software solutions, while FinTech, Cyber and RegTech remain as sectors of significant interest.

QUARTERLY INSIGHTS ON PUBLIC SOFTWARE VALUATIONS

Software broadly trading at record levels

Continued AI interest and commencement of Fed rate cuts have supported public software valuation towards record levels.

Source: S&P CapIQ as of September 30, 2024

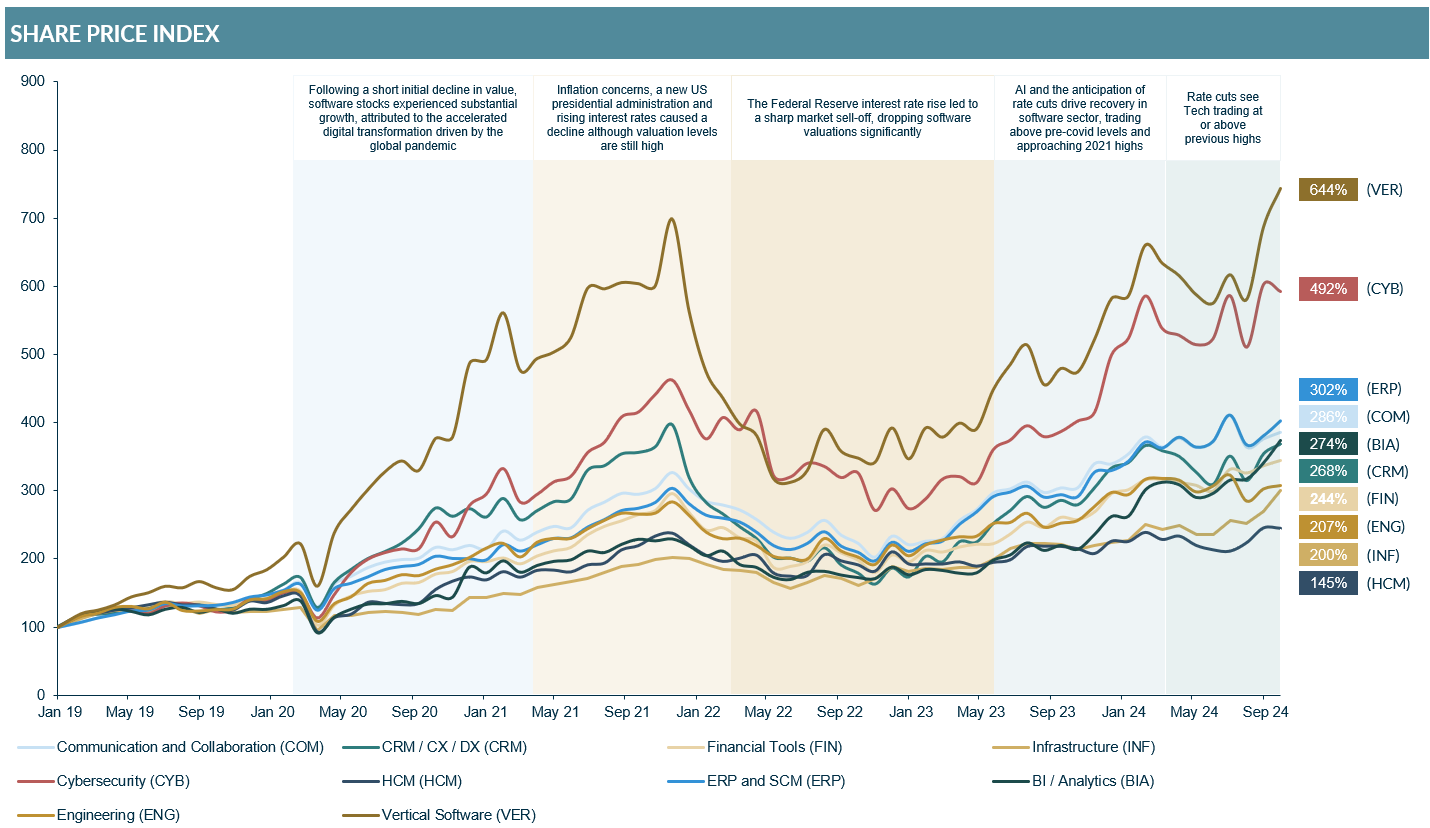

Strong growth of public market valuations across all software verticals

EV/NTM revenue valuations are seeing growth, with the highest valued verticals also having the highest profitability, demonstrating the shift from growth at all costs to increased importance of Rule of 40 as a valuation driver.

Source: S&P CapIQ as of September 30, 2024

Gross Profit Multiples Rise as Investors Prioritise Profitability

Rising demand for high-margin tech services and profitability drives higher EV/NTM GP multiples.

Source: S&P CapIQ as of September 30, 2024

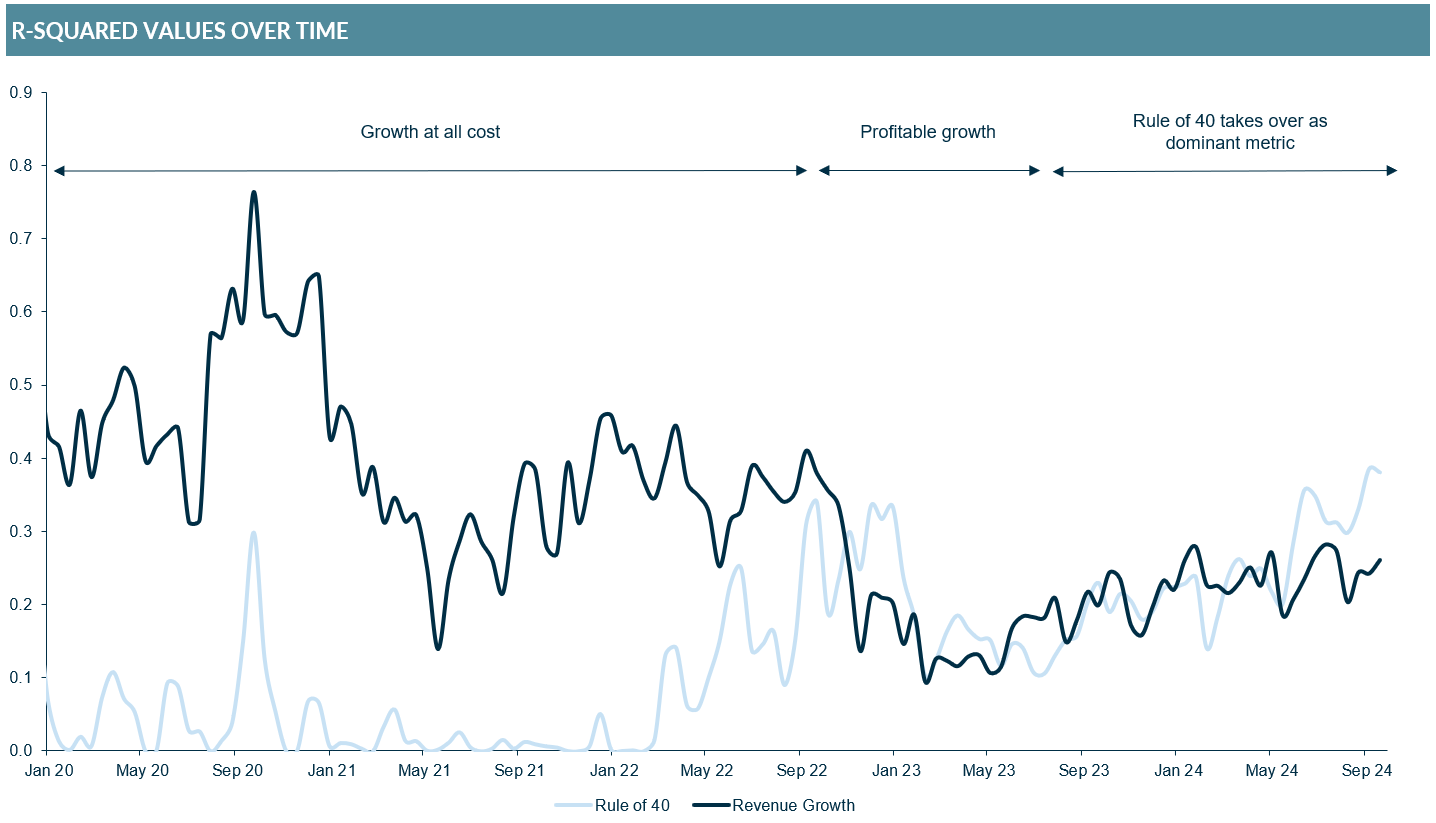

Increasing relevance of Rule of 40 as growth slows down…

Whereas growth was the primary driver of valuation during Covid, the combination of profitability and growth (i.e. “profitable growth”) has taken over (Rule of 40).

Source: S&P CapIQ as of September 30, 2024

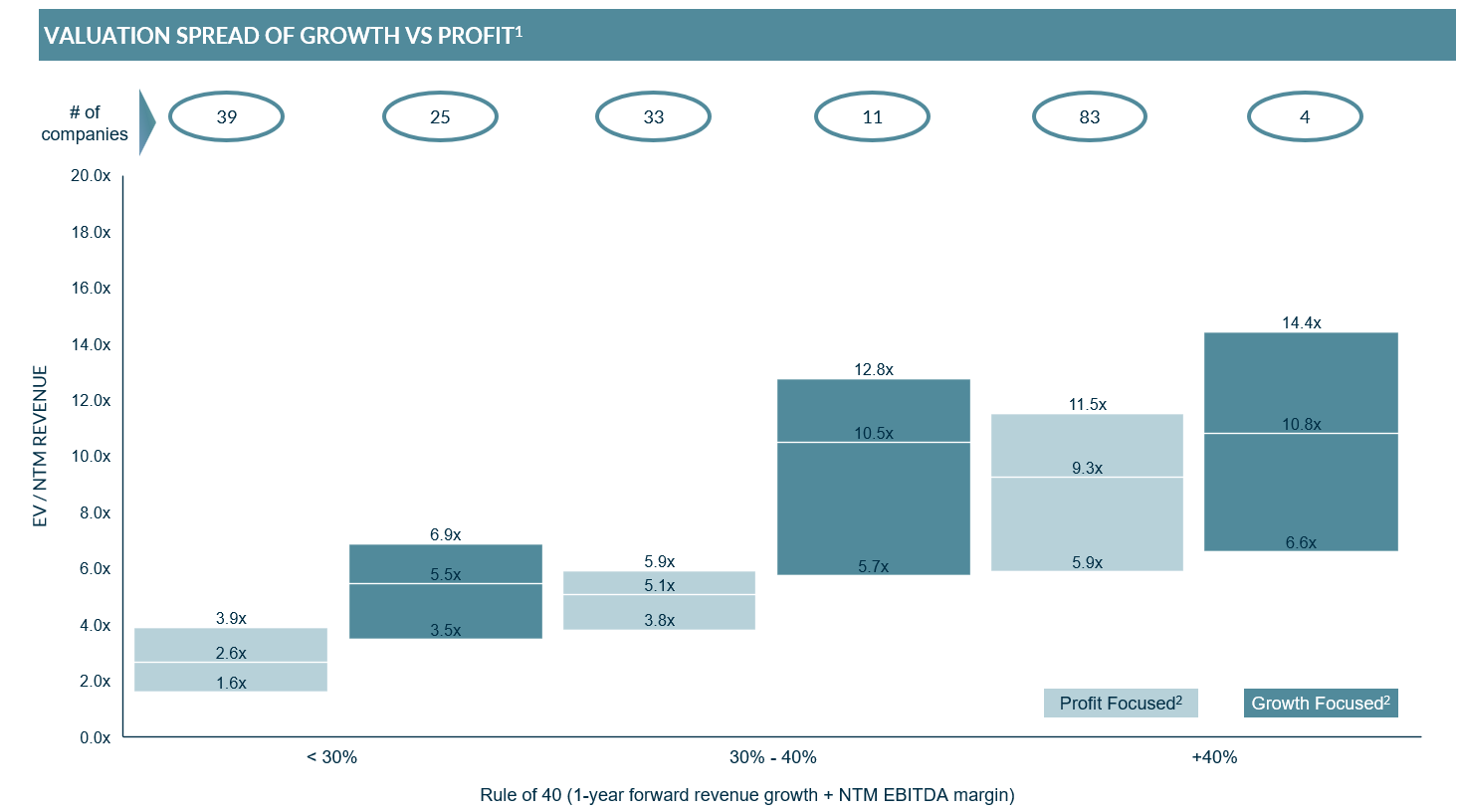

…although growth remains the dominant value driver over profit

Investors now look at a combination of profit and growth to determine valuation, while growth remains the more important constituent in the Rule of 40 rather than profitability

Notes: 1) 2 peers from 197 peers deemed NM and therefore omitted; 2) Growth focused means that the growth component within the Rule of 40 is larger than the profit component and vice versa for profit focused. Sources: S&P CapIQ as of September 30, 2024.

For more information including public comparable by software vertical please see the full report.

Get in touch

If you have any questions on the report or how we can help your company on its M&A journey please reach out to one of the team. Our full tech coverage can be found here.

Previous software reports:

Technology M&A: Software Valuations Report – Q2 2024

Technology M&A: Software Sector Update – Q1 2024

Technology M&A: SMB SaaS Insights

Get in touch