Technology M&A: Travel & Hospitality Insights

Our Travel & Hospitality Software Industry Report is a vital resource for founders, CEOs, and investors active in travel and hospitality software. It offers comprehensive analysis and insights into market themes, M&A activity and fundraising activity in the space.

Key takeaways in this Travel & Hospitality Technology edition include:

- Market activity in European travel & hospitality software has increased markedly during 2024. This trend has been led by multiple, high-profile financing and M&A transactions, including Lighthouse’s USD 370m Series C led by KKR, Hostaway’s USD 365m raise led by General Atlantic and Access Group’s acquisitions of Paytronix and SHR

- AI is top of mind and top of the agenda at multiple industry events, with market leaders grappling with the opportunities and challenges across the traveler journey and their entire operation. It is still early days in terms of AI shaping the overall fundraising and M&A markets, but we expect this to change during 2025

- We see increasing interest in value-add solutions beyond the core PMS and other operational solutions. These include revenue management software and back of house, operational point solutions, all of which help improve margin performance for the end client

- Market outcomes have been divided sharply into the “haves” and “have nots”. During 2024, we have seen stronger market appetite (and valuation levels) for businesses with B2B solutions, at least EUR 10m in ARR and / or a strong Rule of 40 profile. In contrast, demand has been mixed for companies with B2C business models, continued cash burn and smaller niche players with revenue below EUR 10m

- Just as we noted in our previous edition, the market remains highly fragmented and we continue to expect PE-backed consolidators to take the lead in a higher velocity M&A market in 2025 and beyond. This includes horizontal software players moving into and building out their positions in hospitality tech, such as Access Group, Storable and Septeo, among others

What has been getting our attention in the Travel & Hospitality market

1. Market activity has increased markedly

- As we foreshadowed in our last report, M&A and fundraising activity in the European travel & hospitality tech market has increased markedly during 2024 and early 2025, driven principally by private equity capital supporting select platforms

- Davidson MCF has identified at least 15 transactions involving private equity investments of more than EUR 50m in European travel & hospitality tech businesses since the beginning of 2024; several of these processes have seen highly competitive multiples

- In addition, there have been several notable strategic-driven acquisitions during 2024, including Access Group’s acquisition of SHR, aiming to expand their hospitality business in the North American market, and Mews’ acquisition of HS3, aiming to bolster their presence in German-speaking Europe

- Hotel bed bank vendor HPX Group’s initial public offering in Spain in Jan-25, which saw Cinven and EQT sell part of their stakes, added a further proof point to strong market sentiment for travel technology. The IPO, Europe’s largest so far in 2025, raised EUR 725m

2. AI has not explicitly impacted M&A and fundraising activity yet, but we expect that to change rapidly

- Our industry conversations reiterate that everyone is considering how AI, in particular generative AI, will reshape the traveler experience and their business models. With that said, our impression is that most players have been in wait and see mode, in terms of AI shaping their M&A decisions. We expect that to change (rapidly) in 2025

- To give one example, travelers are already adopting ChatGPT as a key channel to search for travel experiences. Over time, travelers will receive fewer but higher quality recommendations on accommodation, transport and activity options which fit their needs. This of course introduces completely new dynamics to the existing OTA and metasearch business models and will increase the importance of reputation management tools

- We also expect AI to be transformative in how vendors use their data. See Lighthouse’s AI Smart Summaries, their first generative AI tool, which interprets revenue management data for hotel management and provides a natural language summary. There are a series of similar products which we believe will improve over time and become industry standard

3. Recent M&A activity points to vendors wanting to Adding value beyond the PMS & other core operational systems

- Within the software for lodgings, investor interest has historically been focused on PMS vendors, which often have a strong presence in a given geographical market or lodging niche (e.g. camping, city hotels or destination properties). This has also been mirrored in other hospitality and travel technology market niches

- We have seen increasing interest in other solutions around the PMS, including revenue management and back-of-house point solutions, all of which help the end client improve margin performance

- There are two opposite drivers: PMS businesses (and to an extent booking engine & channel manager vendors) traditionally have low churn and steady subscription or subscription-like revenue streams, but low growth. On the other hand, “solutions around the PMS” often have higher growth but higher churn and lower quality revenue streams. Ultimately, end clients will benefit from deeper integrations between fewer software vendors, boosting NPS scores, average revenue per logo and ultimately retention figures

4. Market outcomes have been divided into the „haves“ and „must nots“

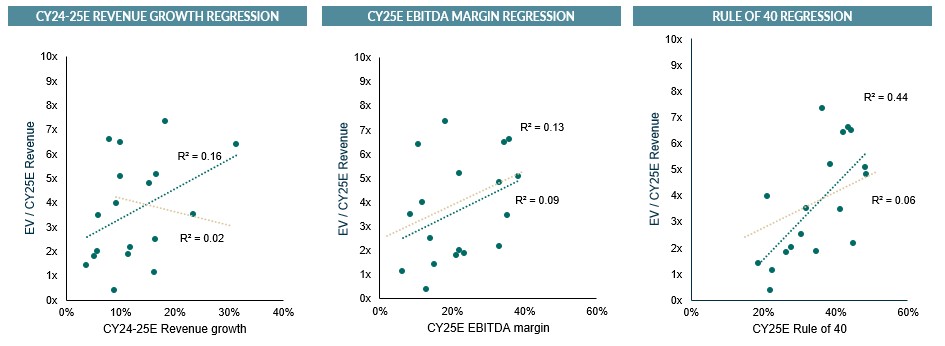

- All things being equal, we have seen stronger market appetite (and valuation levels) for companies with B2B business models, at least USD 10m in ARR and / or a strong Rule of 40 profile. In contrast, demand has been mixed for companies with B2C business models, revenue below EUR 10m and continued cash burn

- B2C business models in particular have been under scrutiny with consumer sentiment languishing. However, deals have been getting done; Vitruvian’s USD 100m investment in Klook and Quadrille’s EUR 60m investment in Exoticca both demonstrate appetite for select, leading assets in the space

5. The industry remains highly fragmented and Europe continues to have multiple local champions

- The presence of local champions and innovative start-ups has created an environment where many European vendors need to acquire or be acquired to expand their products internationally and have critical scale to optimise their go-to-market and product strategies

- Although consolidation is ongoing, the reality remains that the European market is highly localised. We expect to continue to see geographic-driven transactions like Mews’ acquisition of HS3 as a way to short cut long sales cycles and reach critical scale in key geographical markets

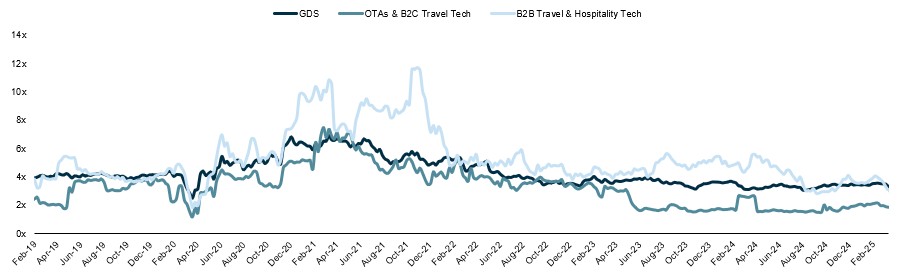

Time Evolution of valuation multiples across travel and hospitality

MEDIAN EV / NTM REVENUE EVOLUTION

Source: S&P Capital IQ as of 16th March 2025

Travel & Hospitality tech companies that adhere to the rule of 40 today attract higher valuation multiples

Source: S&P Capital IQ as of 16th March 2025

Get in touch

If you have any questions on the report or how we can help your company on its M&A journey, please reach out to our team. Our full Technology coverage can be found here.

The full report including public valuation metrics and the latest M&A transactions can be downloaded at the top of the page.

Get in touch