Consumer M&A: Active & Outdoor – Q1 2024

Industry Update

Heading into 2024, the M&A market has picked up pace, presenting a more active outlook than the previous year. The 2023 M&A landscape was challenging, characterised by a decrease in the number of completed transactions across all active and outdoor sectors.

In this report we explore the factors behind our team’s optimistic outlook, market trends and recent noteworthy transactions.

Consumer M&A

The market has picked up pace, presenting a more active outlook than the previous year. The resurgence of optimism is primarily driven by:

- The renewed willingness of creditors to lend to consumer product companies, as fears of a recession have significantly diminished.

- The prevailing sentiment is that Federal Reserve rates have peaked and are expected to start decreasing within the year.

- Private Equity firms are anticipated to become more active buyers and are likely to bring a number of their portfolio companies to the market.

Moreover, we predict that strategic buyers will again pursue growth through acquisitions. A key trend across the industry for 2024 is the universal desire to avoid overstocking; instead, there’s a preference to manage inventory levels closely. This approach is complicating financial projections more than usual.

The latest guidance by consumer sector:

Soft Goods:

The overall sentiment for 2024 remains mixed, with companies emphasizing inventory management and adaptability to meet changing consumer demands. After stabilizing the post-pandemic inventory surplus, businesses are pivoting towards growth, guided by sustainability and regulatory shifts.

Key highlights include:

- The inventory surplus from the pandemic era has stabilized, allowing for strategic restructuring towards growth.

- Many companies are introducing new, sustainable products to adapt to the evolving regulatory environment.

- Following major cost-saving initiatives, like Nike’s plan to reduce costs by $2 billion over three years, the focus is shifting towards enhancing revenue through innovative pricing and promotions in 2024.

- The long-term outlook is optimistic, anticipating accelerated growth as consumer buying habits and inventory levels normalize.

Hard Goods:

The Hard Goods sector shows a positive outlook, particularly spotlighting the Golf Equipment subsector for its standout performance. Topgolf Callaway leads the way with remarkable third-quarter results and forecasts for unprecedented sales.

However, challenges such as higher interest rates and factors affecting short-term consumer spending on durable goods call for cautious procurement strategies.

Key highlights include:

- The Golf Equipment subsector shines, with Topgolf Callaway setting an example through strong third-quarter outcomes and sales forecasts.

- Despite the optimism, channel partners are advised to adopt prudent procurement tactics due to economic pressures impacting consumer purchases.

- A significant strategic move is GoPro’s acquisition of Forcite Helmet Systems, showcasing a commitment to technological integration in products, indicating a trend towards innovation-driven growth in 2024.

Fitness & Recovery:

The Fitness/Recovery sector is entering 2024 on a wave of optimism, with the Commercial and Strength categories poised for growth.

Peloton’s groundbreaking partnership with TikTok symbolizes the innovative strategies companies are employing to expand their market presence. This collaboration, merging culture with creativity, sets the stage for a new era of fitness content.

Key highlights include:

- Anticipated growth in the Commercial and Strength categories reflects a positive outlook for the sector.

- Peloton and TikTok’s partnership highlights a trend towards creative solutions for market expansion, aiming to inspire a new wave of fitness enthusiasts and content creators.

- The success of rightsizing strategies, like those of Planet Fitness under its „New Growth Model,“ demonstrates the potential for reduced capital requirements and enhanced performance.

- Companies that effectively adapt to the shifting macroeconomic landscape and evolving consumer preferences are well-positioned for success in 2024.

Sporting Goods Retailers:

The 2024 market outlook for Sporting Goods Retailers presents a varied picture, reflecting the sector’s adaptation to ongoing macroeconomic uncertainties.

Companies such as Big 5 are adjusting their forecasts to reflect these challenges. However, there’s a silver lining as conditions like inflation pressures begin to subside and inventory hurdles are navigated.

Key highlights include:

- Mixed Market Outlook: The sector faces a blend of optimism and caution due to macroeconomic hurdles, with some businesses, including Big 5, revising their financial outlooks downward.

- Shifting Consumer Preferences: As inflation pressures recede, consumer sentiment is expected to improve. This shift will likely lead consumers to prioritize durability and longevity in their purchases, benefiting retailers offering high-quality, functional products.

- Inventory Management: Retailers continue to approach inventory management with caution, drawing lessons from the pandemic’s excess inventory challenges to avoid similar pitfalls.

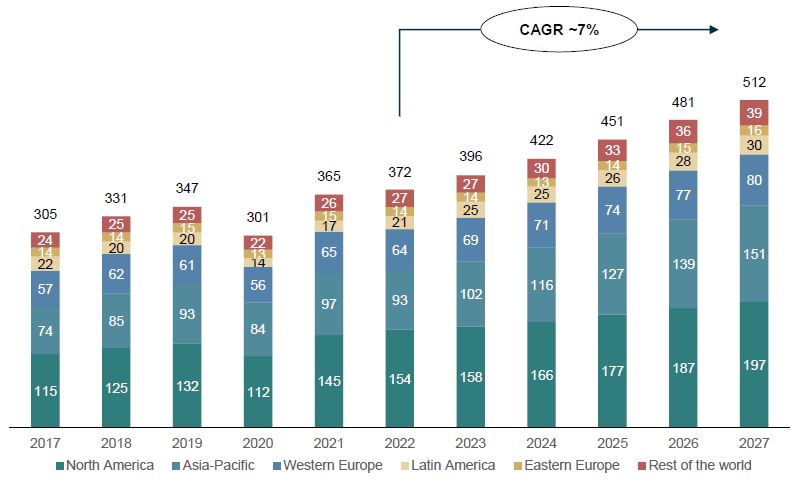

Sportswear Market Outlook

Global Sportswear Market Size* (USBBN)

Market Trends

Notes: *) Retail sales prices

Source: McKinsey Sporting goods 2024 report

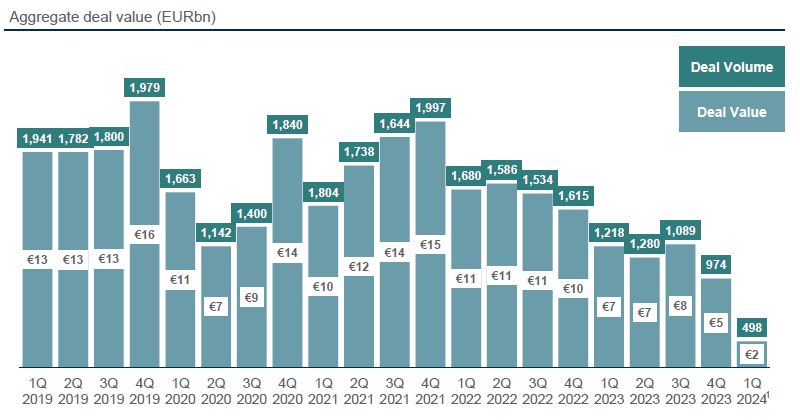

Consumer Quarterly Middle Market M&A Volume

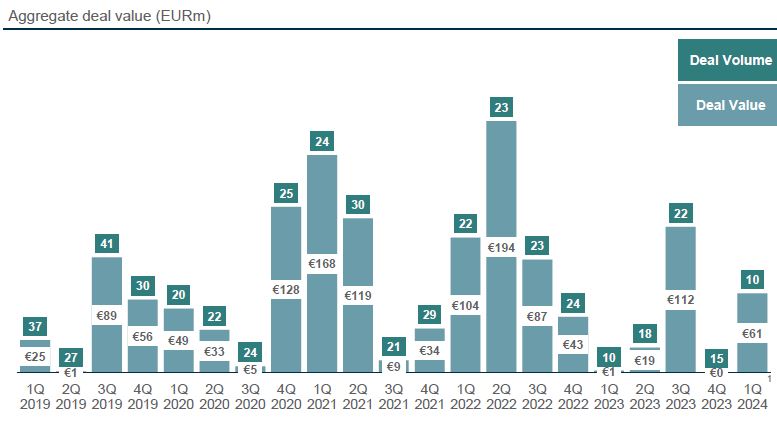

Active & Outdoor Quarterly Middle Market M&A Volume

The full report including public company valuations and our latest transaction, Headrush, can be found here: full report PDF.

Get in Touch

To speak to use regarding plans for capital, acquisitions, or succession, please contact one of our investment bankers. You can find more information on our Consumer M&A services and team here.

Related Consumer Insights

Consumer M&A: Outdoor & Active Lifestyle – Spring 2023

Get in Touch