Warehouse Automation – Market outlook & M&A trends for 2025

The warehouse automation sector is entering a new growth phase as economic conditions improve and businesses refocus on efficiency, scalability, and innovation.

Our latest report explores key market dynamics, adoption trends, and investment outlooks, with a special focus on M&A activity shaping the industry. From robotics and AI-driven solutions to software integrations, we analyze how companies are positioning themselves for the next wave of expansion.

What’s moving the market in 2025

Growth across the broader industrial automation and intralogistics sector stagnated in 2024 due to global economic challenges and geopolitical tensions. Over the last year and half, weak growth in the industrial sector, rising input costs, and high interest rates have deterred businesses from making sizeable investments in automation. While geopolitical concerns remain, economic conditions have improved incrementally and expectation is that investment in automation and supply chain optimization will return to more normalized levels.

Warehouse automation, now adopted by c. 25% of facilities (up from 5% a decade ago), remains a key focus. Despite high upfront costs and long ROI timelines, businesses prioritize automation to boost efficiency and reduce labor dependency. Small to mid-sized companies are adopting automation at an accelerated rate as the barrier to entry is lowered via tech costs coming down and the use of alternate pricing models (i.e., Robotics as a Service). Holistic solutions integrating hardware and software are in high demand for scalability and cost savings. Space availability challenges persist, with tight capacity in many regions of Europe and the U.S. which has further driven the need for vertical solutions. Businesses are debating centralized vs. forward-deployed inventory models to balance cost and delivery speed. Warehouse sizes continue to grow, now exceeding 100,000 square meters on average, necessitating the shift to AI and predictive analytics to better manage facilities of scale. The overall warehouse automation market is expected to realize high single digit growth in order intake and project revenue in 2025 and 2026 followed by a strong double digit growth from 2027 through 2030 driven primarily by investment in fulfillment center automation as retailers expand their networks to meet e-commerce demand.

Public valuations for warehouse automation firms remain strong, with a median NTM EV / EBITDA multiple of 13.6x. Attractive trading valuations reflect investors strong belief in the underlying growth prospect of companies that operate in the warehouse automation sector. Both these publicly traded and large private equity backed warehouse automation businesses have been actively pursuing M&A strategies that target acquisitions in specific areas to enhance their competitive edge by expanding their technology and solutions offering. Key focus areas include advanced automation hardware technologies like AMRs, AGVs, and AS/RS, which streamline material handling, reduce labor dependency, and increase a facility’s overall efficiency and productivity. In addition, Warehouse software platforms, such as Warehouse Control Systems (WCS), Warehouse Execution Systems (WES) and Warehouse Management Systems (WMS), have been a critical area of focus for the warehouse automation sector. As the brains of the warehouse automation systems, these products provide instruction to the various hardware technologies integrated into the automated solution and manage inventory, orders and logistics. Warehouse system integrators are eager to expand their software capabilities through acquisition or internally developed platforms (or a combination thereof). With improving macro-economic conditions and the forecasted growth in the warehouse automation market, we expect to see a near-term pick up in M&A activity in the sector. This report examines trends in warehouse automation shaping the M&A landscape in 2025.

Development of the global M&A market in the warehouse automation segment

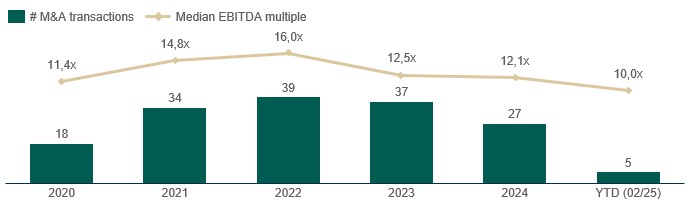

The Warehouse Automation sector has shown continuous M&A activity throughout the 5 years, with a healthy mix of sponsor-backed and strategic transactions. While valuation levels came down starting in 2022, the number of M&A transactions remained more of less stable with a light dip in 2024. Although valuation levels came down in 2024, the Warehouse Automation segment is still characterized by stable high double-digit EV/EBITDA valuations – we expect this to continue in 2025. This is mainly driven by greater competition from strategic investors and financial sponsors for high-quality assets focused on growth markets such as health-care, Third-Party Logistics (3PLs) and data centers.

Trends in Warehouse Automation

The Rise of AGVs and AMRs

Automation of the warehouse continues to be a key investment for management teams as it reduces labor dependency and exposure to rising wages, while increasing long-term flexibility, efficiency, and productivity of the warehouse operation. The growth of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) in modern warehouses are minimizing labor-intensive bottlenecks, while allowing businesses to quickly scale operations in-line with demand.

Annual shipments of AMRs are expected to grow from ~547,000 units in 2023 to ~2.79 million by 2030, representing a CAGR of nearly ~25%. Accordingly, revenue generated from mobile robots will rise from ~$18 billion in 2023 to ~$124 billion by 2030. While warehousing and logistics will remain the primary adopters, hospitals, agriculture, retail stores, and last-mile delivery providers (amongst other verticals) are nearing mass adoption of mobile robots and will fuel growth through the end of the decade.

Vertical Expansion

Maximizing warehouse capacity has become more critical than ever as e-commerce surges, real estate costs rise, and space availability declines. As such, warehouse operators are turning to space-saving solutions within their current footprint as opposed to costly relocations. This is especially true in environments with high SKU counts and rapid fulfillment requirements – when designing floorplans, businesses are looking up as opposed to out.

This push to optimize storage capacity has given rise to the use of vertical solutions like automated storage and retrieval systems (AS/RS). There are different types of AS/RS technologies that have been designed for specific applications and can consist of unit and mini load cranes, shuttles, carousels, vertical lift modules, etc. These technologies provide for a more efficient use of space, increase storage density and throughput, and reduce reliance on labor. The global AS/RS market is expected to grow from ~$10 billion in 2025 to ~$15 billion by 2030, representing a CAGR of ~8.5%.

AI & Robotics

Companies are increasingly adopting AI-powered robotics to manage a more diverse set of tasks, allowing robots to adapt to evolving warehouse environments with greater efficiency. These AI-powered robots use machine learning in real-time, helping to reduce downtime, increase productivity, and create flexible workflows capable of scaling with demand.

The evolution of AI and robotics has led to several notable transactions and strategic partnerships across the sector. In January 2024, ABB acquired Sevensense, a Swiss start-up specializing in AI-enabled 3D vision navigation technology for AMRs. In September 2024, Toyota Industries announced a strategic investment in Gideon, a robotics and AI company specializing in automating material handling using AMRs. In January 2025, Symbotic announced a $200 million deal to acquire Walmart’s Advanced Systems and Robotics division. In January 2025, KION announced a collaboration with NVIDIA and Accenture to integrate “Physical AI” into warehouse operations.

AI Within the Supply Chain

Artificial intelligence is driving transformative changes in supply chain management by providing companies enhanced inventory management, demand forecasting, and preventative maintenance capabilities. Access to, and analysis of, real-time data is providing strategic decision-makers the tools needed to swiftly adjust procurement, production, and distribution tactics to address changes across the broader marketplace. As computing power continues to increase, so will the adoption of AI in the warehouse. Of the 1,700+ supply chain survey respondents in MHI’s 2024 Annual Report, 85% of respondents are expected to adopt AI technologies over the next five years.

The Full Report

For more information please access the full report available at the top of this page.

Contact us

If you have any questions about the report or the warehouse automation market, please contact Franz Schranner.

Sources: ABI Research, MarketsandMarkets – AS/RS report 01/2025, MHI 2024 Annual Report, Kardex Warehouse Insights

Contact us