Technology M&A: Cloud Consulting Services – Spring 2023

Industry Update

The Tech-Enabled Services sector is undergoing a period of rapid change and innovation. Emerging technologies such as artificial intelligence (AI), machine learning, and IoT are transforming the way companies operate and serve their customers. As a result, companies are increasingly turning to Tech-Enabled Services providers for expertise and support.

In this report our Technology team explore the developing trends and present two case studies from GOFORE and Cloudflight, key players in the sector.

Cloud Consulting Services are a rapidly expanding area with enormous growth potential. With the increasing demand for digital transformation and

remote work solutions, cloud services are becoming a critical component of business operations. As the industry continues to evolve, we expect

to see continued investment and M&A activity in this space.

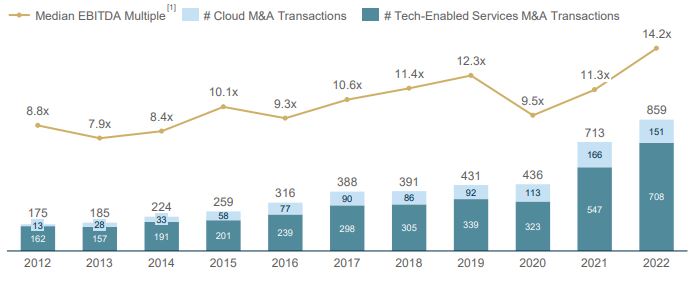

The Cloud Consulting Services sector has experienced high M&A activity in recent years due to the rapid growth of cloud computing and the resulting demand for these services. This has led to consolidation within the industry, as larger firms acquire smaller ones with niche expertise and technology to offer a comprehensive suite of services to clients. This has led to increased competition and valuation levels within the sectors, as investors seek to capitalize on the strong market demand for these services.

Industry Trends and Drivers in Cloud Services

Cloud Migration

As more companies move their IT infrastructure to the cloud, cloud migration consulting services are in high demand. This involves assessing an

organization’s current infrastructure, identifying what can be migrated to the cloud as well as planning and executing the migration.

AI & Machine Learning

Cloud computing is a key enabler of artificial intelligence (AI) and machine learning (ML), and many firms are seeking the expertise of consulting firms to help them leverage these technologies. Services include developing custom AI and ML applications or optimizing existing models as well as

integrating AI and ML into existing business processes and IT infrastructures.

Security

Security is a top concern for companies moving to the cloud, and cloud consulting firms are offering services to help ensure that their clients’ data

and applications are secured. This includes implementing security controls, monitoring systems for potential threats, or providing training for staff.

Hybrid Solutions

Many firms are opting for hybrid cloud solutions, which combine the benefits of both public and private clouds. This trend is driven by the need for

flexibility and scalability, while also maintaining security and compliance.

Server-less Computing

Serverless computing allows organizations to run code without the need for dedicated servers, reducing costs and increasing scalability. Cloud

consulting firms are offering services to help clients implement serverless architectures and optimize their use of serverless technologies.

Case Study: GOFORE

The deal:

Gofore a leading Finnish digital transformation consultancy listed on Nasdaq Helsinki acquired eMundo , a German specialist in digitalization and software development. In this transaction MCF advised Gofore from the identification and approach of eMundo through the entire process, resulting in the successful closing of the acquisition.

MCF’s role in the transaction

Our team possesses significant expertise in the German IT consulting environment and has a broad network of German SMEs. This combination of in-depth industry knowledge and extensive connections was instrumental in navigating the complex landscape of potential sellers. By leveraging our insights and relationships, we were able to efficiently identify and approach eMundo, a perfect match for Gofore’s strategic objectives.

We played a crucial role in facilitating a bilateral process with eMundo, ensuring a smooth and effective dialogue between both parties. Our expertise not only expedited the search and due diligence processes but also provided Gofore with a competitive edge in negotiations. By understanding the nuances of the German market and effectively communicating Gofore’s value proposition, we were able to bridge cultural and business practice differences, fostering a mutual trust that was pivotal to the transaction’s success.

Furthermore, we managed the due diligence process and assisted the shareholders in negotiating and structuring the transaction. Our strategic guidance helped optimize both the valuation and the terms of the future cooperation, ensuring a win-win outcome for all parties involved. Our involvement did not merely facilitate the transaction; it ensured that the foundation was laid for a successful partnership based on shared values and goals.

Together, eMundo and Gofore will leverage their combined capabilities and reach to drive growth with existing and new customers. Our expertise and network have not only helped Gofore achieve a key milestone in their expansion strategy but have also positioned them for sustained success in the competitive digital transformation landscape.

“eMundo is a big step in our consistent development in the German market, where we want to invest in local expertise and substantial customer relationships. eMundo shares the values we have followed throughout our 20-year journey: to be the best possible workplace and to succeed through the success of our customers.”

Mikael Nylund, CEO at Gofore

Case Study: Cloudflight

The deal

In 2019, DBAG, a premier private equity investor listed on Germany’s SDAX, successfully acquired Austrian Catalysts GmbH and German Crisp Research AG. Austrian Catalysts GmbH is renowned for its expertise in agile software development, while Crisp Research AG is a leading research and consultancy firm with a focus on cloud computing. These strategic acquisitions culminated in the creation of the Cloudflight group. Throughout this transaction, our technology team played a pivotal role in supporting DBAG by orchestrating the acquisition’s debt financing arrangements.

MCF’s role in the transaction

Leveraging our expertise in the financing market and our proficiency in structuring competitive financing processes, our team successfully advised DBAG on arranging a unitranche financing for the acquisition of Catalysts and Crisp Research. The financing structure incorporated an acquisition facility to facilitate strategic add-ons.

MCF spearheaded the selection of suitable financing parties, overseeing the communication with lenders and the negotiation of financing documentation. With the formation of the new group, DBAG utilized their combined expertise to assist public sector clients, SMEs, and corporates in implementing and accelerating their digital transformation efforts.

“We are now in a position to pursue a European growth strategy, which will be offering a holistic portfolio of services to our clients, as well as exciting areas of activity and attractive locations to our software developers.”

Christian Federspiel, Co-Founder and CEO Catalysts

M&A Environment

Development of the European M&A market in the tech-enabled services segment

The European Tech-Enabled Services market has seen a significant surge in demand, propelled by the shift towards automation and digitization across industries, the need for innovative software solutions, and the acceleration of remote working and online services prompted by the COVID-19 pandemic. Investors and acquirers are increasingly interested in Tech-Enabled Service companies with strong growth potential, especially those offering cloud services. This interest is reflected in the spike in M&A activity within the sector, further fueled by private equity firms actively searching for investment opportunities in high-growth, innovative companies. This trend is expected to persist in the near future, as the demand for digital services and innovative software solutions continues to grow. More companies are embracing digital transformation, seeking ways to enhance efficiency and reduce costs.

Public Valuation Environment

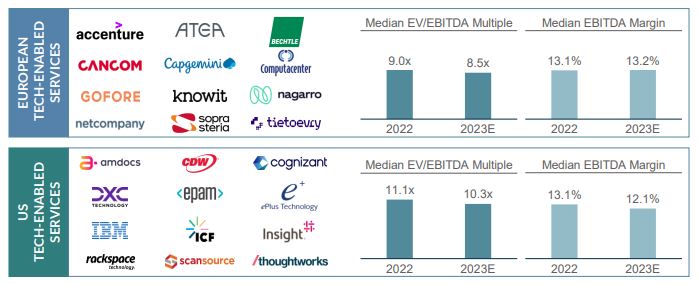

Public trading multiples of tech-enabled services companies

Since most companies in this sector focus on offering Tech-Enabled Services that are as holistic as possible, the peer group is divided based on regional origin. The European sector achieves stable profitability and is currently trading slightly lower than US competitors but above the European median. US companies have lower EBITDA multiples year-on-year due to the decline in Technology stocks in the US last year. As with European peers, the US companies are currently trading above the 10-year median.

For more information including EV/EBITDA development of tech-enabled services companies please see our full report.

Get in touch

If you have any questions on this report or would like more information on how we can support your company regarding plans for capital, acquisitions, or succession, please contact one of our investment bankers.

You can find additional insights and explore our Technology M&A services here.

Related Technology Insights

Software valuations report Q1 2024

European Supply Chain Software – Industry Update 2024

Technology M&A: Software Sector Update – Q1 2024

Technology M&A: Travel & Hospitality Insights – Q1 2024

Technology M&A: CE CX Software – Q1 2024

Get in touch