Food, Beverage & Agriculture – M&A Industry Update – Q1 2025

M&A Recovery in European Food, Beverage & Agriculture – What’s Next?

2024 saw a strong rebound in M&A activity across the sector, with deal volumes up 51.1% compared to 2023. While macroeconomic conditions improved, challenges remain – from shifting consumer habits to financing constraints on mid-sized deals.

As we look to 2025, three key trends will shape deal-making:

- Sustainability & Ethical Sourcing – ESG-driven acquisitions gain momentum as brands prioritize transparency, recyclable packaging, and ethical sourcing.

- Strategic Portfolio Repositioning – Large FMCG companies are divesting non-core assets, creating opportunities for PE and strategic buyers.

- Expanding Demand for Global Cuisines – International food brands are well-positioned for growth, driven by consumer appetite for diverse flavors.

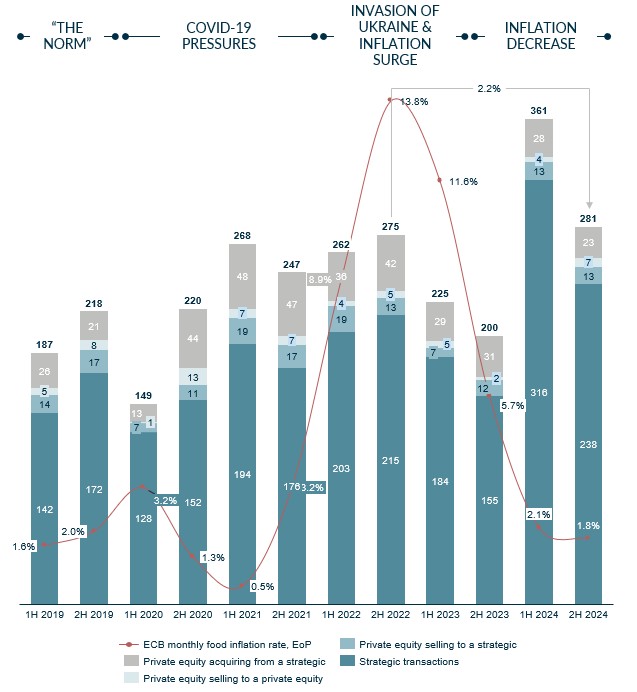

An improved year for M&A, with signs of stabilisation

2024 presented an improved environment for European Food, Beverage, and Agriculture M&A. Deal volumes increased by 51.1%, with a total of 642 transactions compared to 425 in 2023. Despite this improvement, challenges remain. Consumer spending, while recovering, continues to be influenced by fluctuating household confidence and shifting purchasing behaviours. The impact of higher interest rates in prior years has also constrained leveraged buyouts, particularly for smaller and mid-sized transactions. However, private equity and international buyers remain active, seeking opportunities in resilient and high-growth sub-sectors.

Moving through 2025, we identify three key areas where we see a positive outlook for M&A activity:

- Emphasis on Sustainability & Ethical Sourcing: In both food and beverage, sustainability-driven acquisitions are gaining traction as businesses respond to regulatory pressure and ESG considerations. With consumers prioritising ethical ingredient sourcing and recyclable packaging, those brands demonstrating environmental responsibility and transparency will continue to be attractive targets for investors.

- Strategic Repositioning by Multinational Food & Beverage Giants: Large FMCG firms have increasingly been divesting non-core assets and focusing on strategically relevant and stronger performing brands. This trend is driving carve-outs and spin-offs, creating opportunities for private equity and strategic acquirers to acquire and reposition brands that no longer fit within broader corporate strategies.

- Growing Consumer Interest in Diverse Cuisines: This has led to an increased demand for authentic international food products. Q4 2024 saw strong interest in world food brands, and they are positioned favourably for expansion in 2025 and beyond making them attractive targets for M&A activities.

Engaging in future opportunities

As we progress through 2025, the food, beverage, and agriculture sectors are poised for a more stable M&A environment, supported by easing economic headwinds and structural growth trends.

With a strong pipeline developing, we anticipate a steady increase in deal-making activity throughout the year. We welcome the opportunity to discuss how we can support your strategic objectives in this evolving market landscape.

Over the pond – 2024 US review and 2025 outlook

2024 Review

Overall deal volume was up in 2024 vs. 2023, driven by an improving macroeconomic environment, lower interest rates, lower inflation and supportive capital markets. Some of the largest deals in recent memory such as Mars/Kellanova successfully closed, and Mondelez took a good run at Hershey. Other supporting deals at the end of the year included PepsiCo/Siete, Keurig Dr Pepper/Ghost, and the new year opened with Flowers Foods/Simple Mills and Ferrero/Power Crunch.

2025 Backdrop

GLP-1 Weight Loss Drugs. 6% of the U.S. population is thought to currently be on a GLP-1 weight loss drug with 12% having taken one in the past. The rapidly gaining popularity of these drugs is leading to increased demand for nutrient-dense foods with Big Food repositioning brands to promote added protein and gut-health.

RFK Jr as Health and Human Services Director. RFK Jr’s focus on healthy ingredients will be of significant interest to Big Food, as well as the QSR industry.

Tariffs. The start of March saw tariffs implemented on Canada, Mexico and China, with 25% tariffs on Mexico and Canada, with an additional 10% to the existing 10% tariffs on China. Immigration enforcement is likely to lead to wage inflation and is already impacting food agriculture, manufacturing, and the hospitality sectors. All the above has led to significant uncertainty in markets.

2025 Sector Theme

From our discussions, recurring sector themes are discussed below.

Snacking and value-added protein go hand-in-hand. Protein bars have been active in the market recently and there appears to be no end of new brands. Have the large strategics made their beds already in that category or will a brand with unique characteristics still manage to push through? Maybe bars closer to healthy snacking, rather than out-and-out protein, will appeal even more.

Hispanic foods are ripe for further activity. We’ve seen Siete trade to PepsiCo but there remains a plethora of family-owned businesses out there – large and small. Tortillas, tortilla chips, hot sauces and salsas would appear to be the more exciting categories.

Better-for-you frozen brands. These have come to market or traded recently, and Hispanic/Asian/Indian frozen prepared meals are seeing increased as flavor and authenticity remain key drivers and family businesses look for growth capital or to cash out completely. The niche specialty distribution companies that service the local ethnic retailers and restaurants are also seeing a lot of activity.

Finally, the baking category continues to be of great interest. In-store bakeries are one of the fastest growing segments in the retail store planogram and remain one of the highest margin. Bakery roll-ups are also remaining popular.

Snapshot of European Food, Beverage & Agriculture M&A deal activity

TAKING THE LONG VIEW – DEAL VOLUMES REBOUND TO RECORD LEVELS, EXCEEDING PREVIOUS YEARS

Number of announced acquisitions of European-based FB&A companies (deal value below USD 500m) & food inflation index rate from ECB.

Source: Mergermarket, European Central Bank

You can find more information on our Consumer Team here.

Latest F&B transactions

For more information please access the full report available at the top of this page.