Forest Products Insights | Q4 2024

The forest products industry serves as a cornerstone for sectors ranging from construction to renewable energy. Core products like timber and pulp remain vital, while by-products are essential for paper-based packaging solutions and innovations in bio-based materials and energy.

A growing global sustainability awareness is driving substantial investments and consolidation, which is transforming the sector. As a result, demand for forest products and access to raw materials will continue to fuel significant M&A activity going forward, further increasing the market’s appeal to domestic and international buyers.

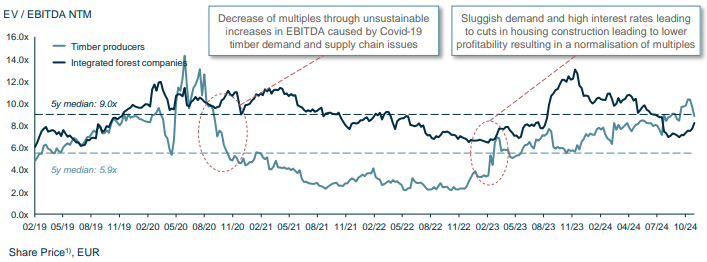

Public Valuation Environment

After having experienced a particularly volatile environment caused by COVID-19, high roundwood prices, and sluggish demand for sawn products, the market seems to be stabilising. Analysing the median NTM EV/EBITDA over a 5-year period, the long-term median for timber producers and integrated forest companies were 5.9x and 9.0x, respectively. Currently, timber producers are trading at an NTM EV/EBITDA of 8.8x and integrated forest companies at 8.2x, indicating that the valuation levels are above the long-term median levels for timber producers and slightly below the long-term median levels for integrated forest companies. The share prices of timber producers have risen by 42.7% in the last 5 years. Integrated forest companies have followed a similar trend with the share prices having increased by 43.7% during the review period.

Notes: 1) Based on a non-weighted average share price development

Sources: MCF Analysis, Capital IQ

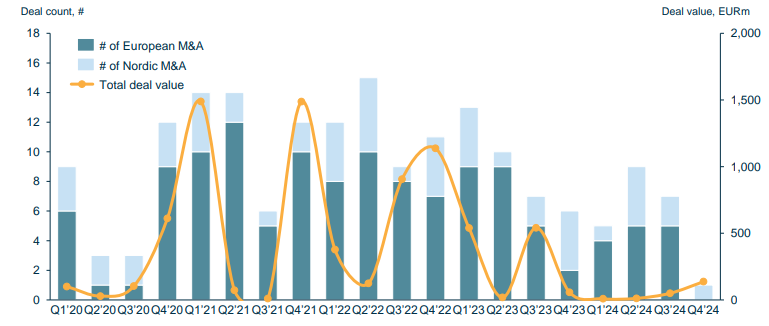

M&A Activity

Deal activity in the forest products sector has been driven by market consolidation, access to raw material, sustainability demands, and technological advancements. Players in the sector seek to improve economies of scale, optimise resource management, and expand market presence. Additionally, the rising global demand for paper, packaging, and bio-based products is driving interest in strategic acquisitions to secure raw materials and diversify product offerings, in particular as consumer preferences are shifting toward more eco-friendly options.

European forest products M&A Activity by deal count and value

Notes: 1) Disclosed deal value

Sources: MCF Analysis, Mergermarket (industry search on Forestry excluding selected transactions that do not fit into category)

Forest Products Market Overview

During 2024, the global macroeconomic environment has shown more stability compared to the volatility seen in 2023. Interest rates, which had previously risen rapidly to combat inflation, have now steadied and are beginning to decline in Europe, alleviating borrowing costs and encouraging renewed investments in the forest products space. Furthermore, as inflationary pressures have started to ease, it is assumed that prices will start to normalise from the levels experienced in recent years.

The decrease in interest rates has also positively impacted the construction industry, as financing for construction projects has become more accessible and eased cost pressures on developers. This has enabled more investments in construction projects, which in turn supports demand for timber and related forest products solutions.

While geopolitical uncertainties continue to affect global supply chains, the forest products sector has proven resilient. Many companies have diversified their supply sources and adjusted logistics strategies to better navigate the disruptions.

Looking ahead, the forest products sector is well-positioned to benefit from the transition to a lower-carbon economy. Rising consumer and regulatory demand for wood construction, renewable materials, bio-based products, and other sustainable solutions offers opportunities for growth. As interest rates continue to fall and geopolitical impacts are managed, the sector can look forward to a more favourable economic environment that supports both growth and innovation.

Key Market Trends

Sources: MCF Analysis, Pliteq, FAS Finland, Natural Resources Institute Finland, Statista, FAO, UN Urbanisation Prospects, Utilities One

Our Forest Products Expertise

MCF has a long and established track record in the forest products sector, with excellent coverage across the UK, the Nordics, the Baltics, Germany, and Austria. Through our extensive network and continuous forest products deal flow, we maintain regular exchanges with leading market players and remain up-to-date on all relevant market trends and drivers.

We have successfully sold businesses to both strategic trade buyers and private equity investors, with deal values reaching up to EUR 500 million. Beyond our published transactions, we are currently engaged in several other buy-side and sell-side projects with major European players in the forest products sector.

Our industry sector team includes Partners with a proven track record of executing successful M&A transactions, having recently advised on the sale of Junnikkala to Stora Enso, the sale of BSW to Binderholz, and the sale of Scott Group to BSW, as well as multiple joint-office cross-border transactions.

Get in touch