Logistics Valuation Update – Autumn 2024

Quarterly insights on valuation and operating metrics in the logistics sector.

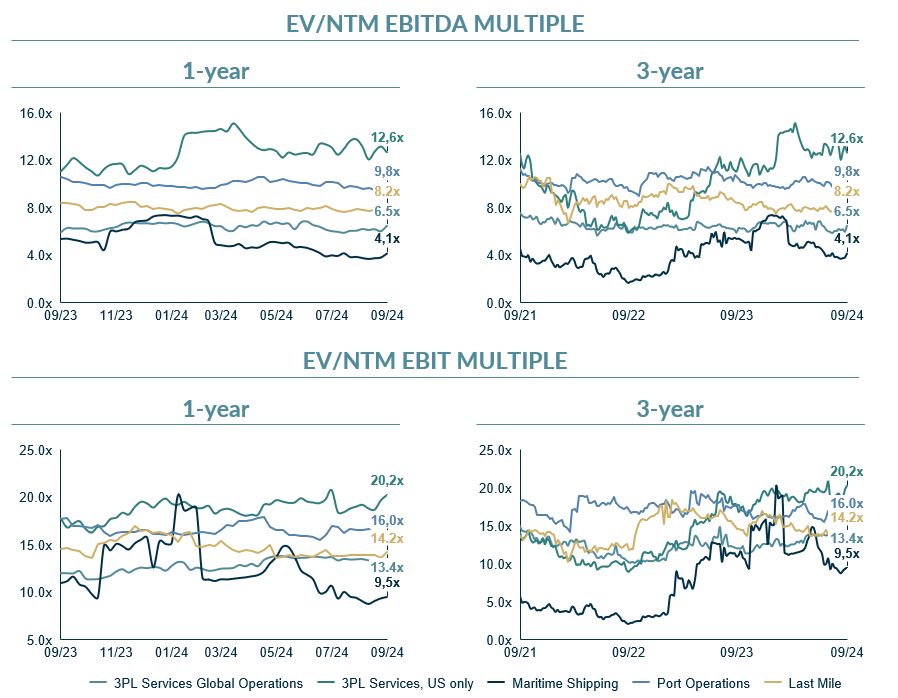

In 2024, the market environment has been noticeably more stable compared to 2023. Interest rates have remained steady and have begun to decline in both Europe and the US. Due to ongoing geopolitical uncertainties, container freight rates have shown significant volatility, peaking in July and August, followed by a sharp decline in recent months. These unsustainable profit levels have led to reduced NTM EBITDA multiples for maritime shipping companies.

Regarding M&A market activity, several substantial mid-cap transactions have been observed, in addition to the landmark deal of DSV acquiring DB Schenker. UPS acquired Frigo-Trans, and Nippon Express further expanded its European presence by acquiring the med-tech 3PL specialist Simon Hegele. We anticipate a sustained flow of deals in Q4 2024 and Q1 2025, with multiple sell-side processes in the logistics sector currently underway.

This valuation report aims to provide an overview of the current valuation levels across various logistics sub-segments, based on the NTM (next twelve months) EBITDA and EBIT metrics. MCF’s Annual Logistics Insights Report is scheduled for release in Spring 2025.

Source: S&P Capital IQ, MCF analysis

Get in touch with our logistics M&A experts

If you would like to discuss this report or how our team can help with your company’s M&A plans, please do not hesitate to get in touch. You can find more information on our Business Services team, including team members and previous deals here.

Related Logistics Insights:

M&A Logistics Insights: Industry Report – Spring 2024