M&A Logistics Insights

Shape your focus – why a clear positioning is the key factor for a successful exit in the Logistics industry

The global logistics landscape is undergoing a profound transformation. A decade ago, stability and predictability defined Western societies. From a historical perspective, one might have even called it an uneventful time. Fast forward to today, and that perception has been turned on its head. Shifting geopolitical alliances, supply chain disruptions, and increasing regulatory requirements are reshaping market dynamics. While these changes present challenges, they also create significant opportunities – especially within the European logistics sector.

When selecting this year’s focus topic for MCF’s M&A Logistics Insights, several crucial market developments emerged. We considered the impact of Germany’s and Europe’s record-level investments in defence and infrastructure and their implications for logistics, the ongoing tariff war and its effect on intercontinental M&A, as well as the necessary evolution of former industrial and automotive logistics providers to serve the defence sector. However, at the core of our business, we are not strategic consultants – we are M&A advisors, creating value for our clients through successful transactions.

Hence this year, rather than focusing on broader macroeconomic trends, we are addressing a critical, actionable question: how can logistics companies optimise their positioning for a successful M&A process? Whether a company is entrepreneur-led or a PE-backed platform, its ability to present a compelling strategic rationale directly impacts valuation and deal success.

With that in mind, this edition of our insights report explores the key elements of strong M&A positioning, analyses recent landmark transactions and their implications for the market, provides an update on valuation trends across core logistics sub-sectors, and offers our perspective on market developments through 2025 and 2026.

Positioning as a success factor

As investment bankers specialising in the logistics sector, we witness M&A transactions unfold daily – yet our market intelligence also reveals the deals that fail to materialise. While logistics is less exposed to technological disruption than other industries, we observe significant variations in valuation levels and, perhaps even more critically, in the likelihood of a successful closing of a transaction. The key to achieving a strong exit lies in strategic positioning, which extends beyond financial performance to emphasise the company’s competitive advantages, service differentiation, and, most importantly, its positioning within key end-markets.

In M&A transactions, we frequently engage with highly successful entrepreneurs who have built their businesses with a strong capitalist mindset – seizing opportunities wherever profits can be made. This often results in well-diversified companies offering a broad range of services across all modes. While diversification can be a strength, both strategic and financial investors often prioritise companies with clearly defined capabilities, deep expertise, and strong customer access in high-growth niche markets, where differentiation and scalability drive long-term value.

When assessing M&A opportunities, multinational corporations ask themselves a simple, yet fundamental question: Do we already have the capabilities to compete in this market, and if so, can we grow organically by enhancing our existing operations? If the answer is yes, strategic buyers are likely to disengage from the process or participate only at lower valuation multiples.

As a result, strategic positioning – ideally in advance of a structured M&A process – becomes a critical factor in enhancing deal success and maximising valuation. To achieve this, positioning should be carefully refined across four key dimensions: Vertical Focus, Service Offering, Geographic Focus and the Financial Profile.

Conclusion and food for thought

When preparing a company for sale, its fundamental business model cannot be altered – a road freight forwarder will remain a road freight forwarder. However, a company’s strategic positioning can make the difference between an ordinary transaction and one that commands premium valuation. Investors, particularly strategic buyers, are not just seeking businesses that operate; they are looking for businesses that stand out.

To shape a compelling sell-side narrative and maximise valuation, entrepreneurs must critically assess their positioning across four key dimensions:

- Vertical Focus: Are we seen as a specialist in high-growth industries, or are we perceived as a generalist? How can we emphasise our expertise in sectors where differentiation commands a premium?

- Service Offering: Do we provide critical, value-added services that embed us in our customers’ supply chains? What makes our offering unique and difficult to replicate?

- Geographic Focus: Are we dominant in key markets? How can we position our geographic footprint as a strategic advantage rather than just coverage?

- Financial Profile: Does our revenue model reflect resilience, pricing power, and strong customer relationships? How can we demonstrate sustainable growth and financial stability to investors?

Without clear, compelling answers to these questions, a business risks being perceived as undifferentiated and replaceable, making ambitious growth projections difficult to justify. Investors want to understand why a business will continue to win in the future – not just how it has performed in the past.

As M&A advisors specialising in logistics, our role is to guide entrepreneurs in defining and articulating these differentiators early in the process for a well-structured and successful transaction.

M&A Transaction Analysis

2024 in Logistics M&A transactions

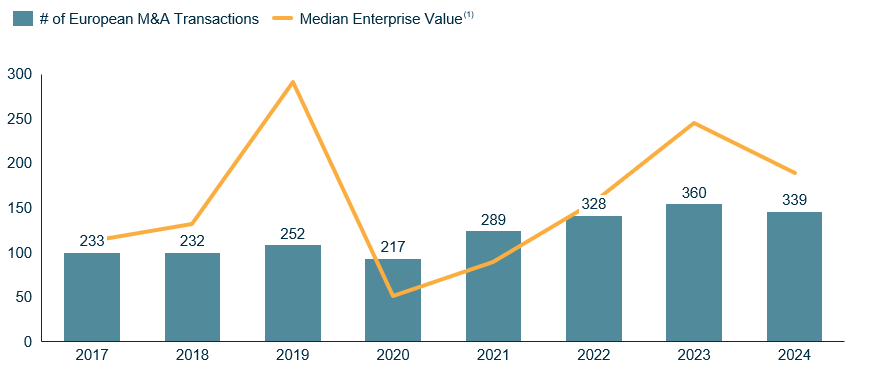

2024 has been a pivotal year for European logistics M&A. While overall transaction volumes declined – largely due to a sharp drop in deals within Germany – the market still witnessed several standout transactions. Dominating headlines was the landmark sale of DB Schenker to DSV for an enterprise value (EV) of EUR 14.3bn, reflecting an EV/EBITDA multiple of 7.5x. However, beyond this high-profile deal, several other transactions achieved remarkable valuations. Notably, med-tech logistics specialist

Simon Hegele was acquired by Nippon Express, while Frigo-Trans, a leader in ultra-low-temperature transportation, secured an exceptional 14.5x EV/EBITDA multiple in its sale to UPS.

With DSV intensifying competitive pressure, market leader DHL and #3 Kühne+Nagel responded with strategic expansions across the Atlantic. DHL’s acquisition of INMAR Intelligence reinforced its e-commerce footprint, while Kühne+Nagel’s EUR 825m purchase of IMC Logistics (51% stake) bolstered its intermodal capabilities in the US, expanding its North American service portfolio.

Beyond the global leaders, several noteworthy transactions reshaped the landscape. DFDS’ acquisition of Ekol Logistics was particularly surprising, given Ekol’s strategic significance as one of Turkey’s largest privately held logistics providers (EV of EUR 221m, EV/EBITDA multiple of 7.6x). Meanwhile, bpost’s EUR 1.3bn acquisition of Staci, previously owned by French private equity giant Ardian, reaffirmed that e-commerce and pharma logistics continue to command premium valuations (EV/EBITDA multiple of 12.0x). This trend was further underscored by GXO’s EUR 1.1bn acquisition of UK-based eCommerce specialist Wincanton (EV/EBITDA multiple of 11.9x).

Development of European M&A Deals in the Logistics sector

Notes: 1) Based on disclosed EV value Sources: MCF Analysis, Mergermarket

M&A Logistics Market Outlook

European comeback of unity will fuel growth

In last year’s edition, we discussed the global uncertainties surrounding elections in the US, India, and the EU. Now that these elections have concluded, has uncertainty faded? Unfortunately not. Instead, new challenges have emerged, with rising trade tensions and tariff wars adding further complexity to global supply chains.

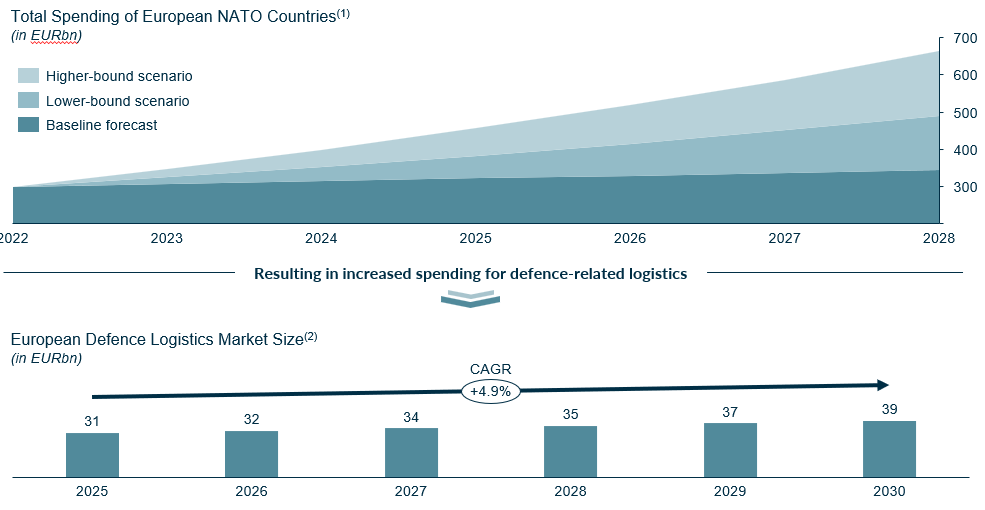

What does this mean for M&A in the logistics sector? We anticipate a rise in intercontinental deal activity, as companies seek to secure strategic footholds in key markets – a trend already evident in the recent acquisitions of K+N and DHL in the US. At the same time, geopolitical shifts are reshaping defence strategies, with NATO reinforcing its eastern flank. In this context, Germany’s decision to allocate over EUR 900bn to defence and infrastructure marks an unprecedented level of fiscal spending, poised to revitalise Europe’s old economy. This surge in investment will not only drive logistics demand across the defence supply chain but also create substantial opportunities for logistics providers with industrial and automotive expertise. Coupled with anticipated ECB interest rate cuts, we expect investment activity in logistics to accelerate by late 2025, as companies position themselves to capitalise on this structural shift.

European Defence Logistics Market

5 forecasts about M&A in 2025 and beyond

Intercontinental Deals to mitigate tariff risk

The escalating tariff war, driven by the newly elected U.S. administration’s decision to impose tariffs on goods from multiple regions, adds further complexity to global trade. As companies seek to mitigate the impact of these trade barriers, we anticipate a surge in intercontinental M&A. Businesses will look to restructure supply chains and secure strategic footholds in key markets to navigate the shifting trade landscape.

The Middle East will drive M&A

The Middle East has solidified its position as a prime destination for global investment, driven by ambitious economic reforms, long-term strategic vision, and competitive labor costs. Saudi Arabia, with its rapidly growing population exceeding 40 million, stands at the forefront of this transformation. Local logistics players are aggressively pursuing global expansion, positioning the region as both an investment hub and an emerging force in international trade.

Europe’s logistics activity will see a great comeback

Despite being Europe’s largest economy, Germany has remained largely absent from European politics over the past three years. However, with a new government taking shape, Europe appears to be regaining cohesion, and Germany is positioning itself once again as a leading force. This shift is underscored by its historic commitment to invest more than EUR 900bn in the defence and infrastructure sectors.

Special logistics capabilities will be driven by defence

Europe is reinforcing its borders and ramping up defence operations in response to growing geopolitical tensions. The construction of NATO’s largest European base in Romania marks a significant step in strengthening military infrastructure. This expansion is driving increased demand for specialised logistics, including the secure transportation of arms, military vehicles, and critical defence equipment across the continent.

Warehousing demand will see record levels

M2C business models, led by Chinese giants like Shein and Temu, have rapidly expanded their market share over the past years. However, the European Union’s plan to eliminate the EUR 150 duty-free threshold poses a major challenge to this model, as expected delays in customs clearance will disrupt operations. As a result, demand for warehousing space from Chinese logistics providers and manufacturers is set to surge.

Get in touch

If you have any questions on the report or how we can help your company on its M&A journey, please reach out to our team.

The full report including public valuation metrics and the latest M&A transactions can be downloaded at the top of the page.

Get in touch