Technology M&A: SMB SaaS Insights

Our SMB (small to medium-sized business) SaaS Insights Report provides founders, CEOs, and investors, with market analysis by end vertical and insights into the valuation of comparable publicly listed companies. The report focuses on four end market verticals, providing an overview of the main drivers and key players across each vertical, while providing a visual representation of the SMB SaaS market via a detailed market map capturing an ever-evolving competitive landscape.

Additionally, the report features a case study on our recent involvement on the sale of the market leading DACH SMB SaaS solutions provider Shore to Cinven backed group.one, as well as a wider look at the Buyer Pools seeking opportunities in the SMB SaaS market.

Key M&A Drivers in the SMB SaaS sector

Localisation

- Solutions tend to fit local market and regional needs. This leads to a natural barrier to entry for new entrants

- The result is M&A is often the best approach to grow in new markets, increasing demand for local market leaders

Verticalization

- Sector specialists and point solutions tend to win out vs. generalists tailoring solutions to satisfy multiple verticals

- This leads to increased demand for end market focused providers who can best serve specific sector demands

Value Chain

- Control across delivery of the customer journey enhances customer experience, loyalty and relationships

- Deeper relationships can deliver an enhanced share of wallet via service integrations and cross-sell opportunities

Key Market Dynamics

Cloud

- Cloud adoption is particularly strong in hospitality and gastronomy, where a need exists to manage reservations, inventory, and staffing across multiple sites

- Mobile led flexible solutions tend to be in high demand

Integration

- A growing demand for interoperable platform solutions that integrate across existing CRM, accounting, payments and marketing software

- Interoperability facilitates a holistic view of business KPIs

CX and AI

- High demand for customer experience solutions with bespoke engagement, loyalty, and automated marketing

- Demand for AI to enhance service levels and operational efficiencies through automation and predictive analytics

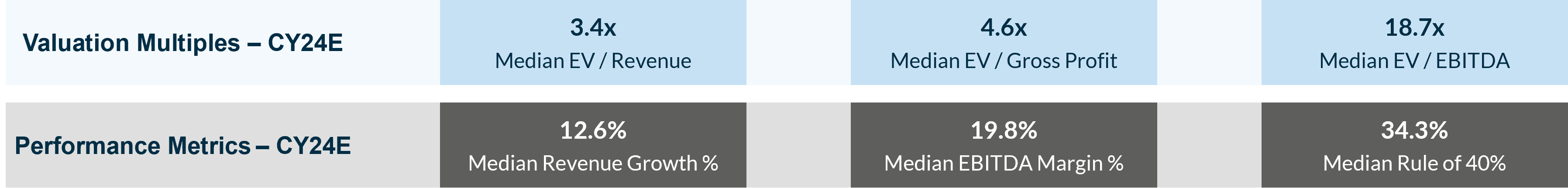

Valuation and Performance – Listed SMB SaaS

Source: S&P Capital IQ as at 09-Aug-24

Case Study: MCF advised Shore on the sale to group.one, a portfolio company of Cinven and OTPP

Shore, an end-to-end SMB software solution provider in the DACH region, has been acquired by group.one, a portfolio company of Cinven and the Ontario Teachers’ Pension Plan (OTPP).

Shore, serving over 10,000 customers in the DACH region, offers a suite of cloud-based tools including POS systems, 24/7 appointment scheduling, customer relationship management, and digital marketing services to streamline operations for local service providers across various verticals.

This strategic acquisition aligns with group.one’s customer demands, introducing online appointment booking, customer communication, and Point-of-Sale payments—attractive adjacencies representing significant double-digit revenue growth over the coming years.

Transaction Highlights

- The deal represents a strategic expansion for group.one, integrating Shore’s online appointment-making and Point-of-Sale solutions into its platform, enhancing existing offerings for brands like one.com, Hostnet, and checkdomain.

- The transaction adds to the Technology team’s recent record in SMB SaaS software and the value added by D.A. Davidson MCF International’s cross border platform

SMB SaaS market map – how we segment each SMB software vertical

SMB SaaS Market map – end market verticals

Buyer pools

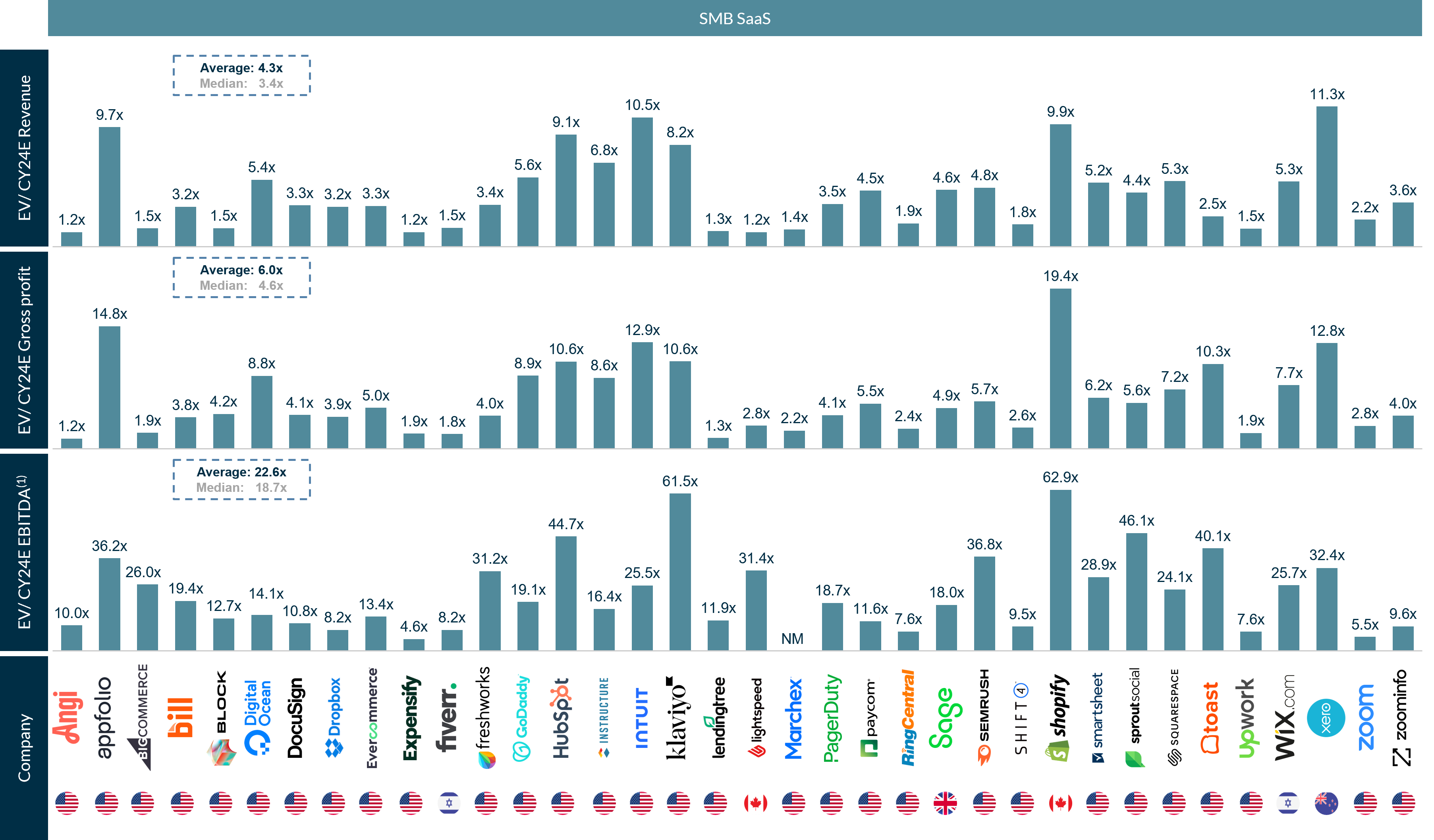

Comparables by Software Vertical – SMB SaaS

Comparable public companies analysis – Valuation Multiples

Note: (1) Marchex’s EV/EBITDA multiple excluded from graph and average calculations as deemed anomalous

Source: S&P Capital IQ as at 09-Aug-24

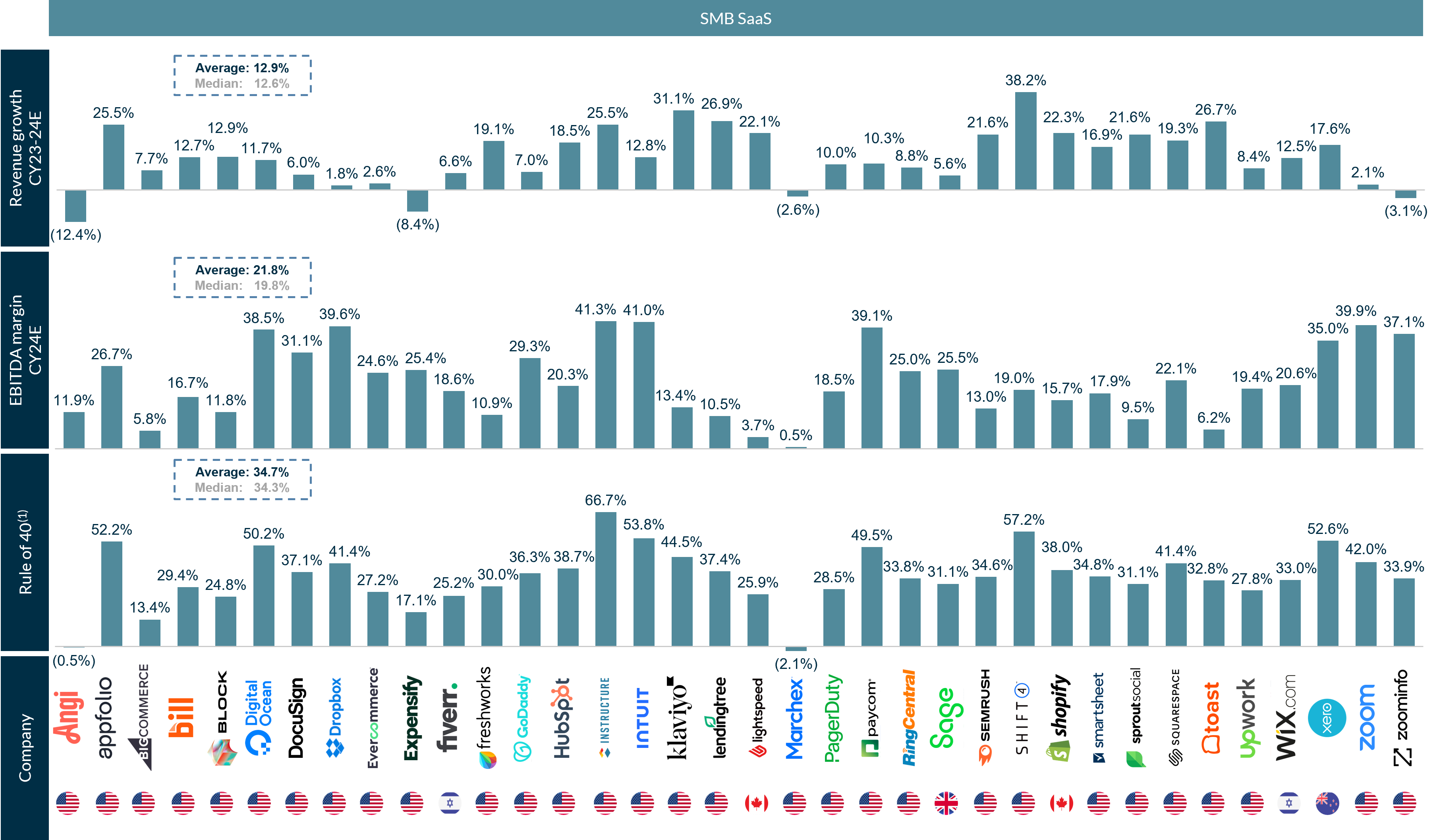

Comparable Public Companies Analysis – Performance metrics

Source: S&P Capital IQ as at 09-Aug-24

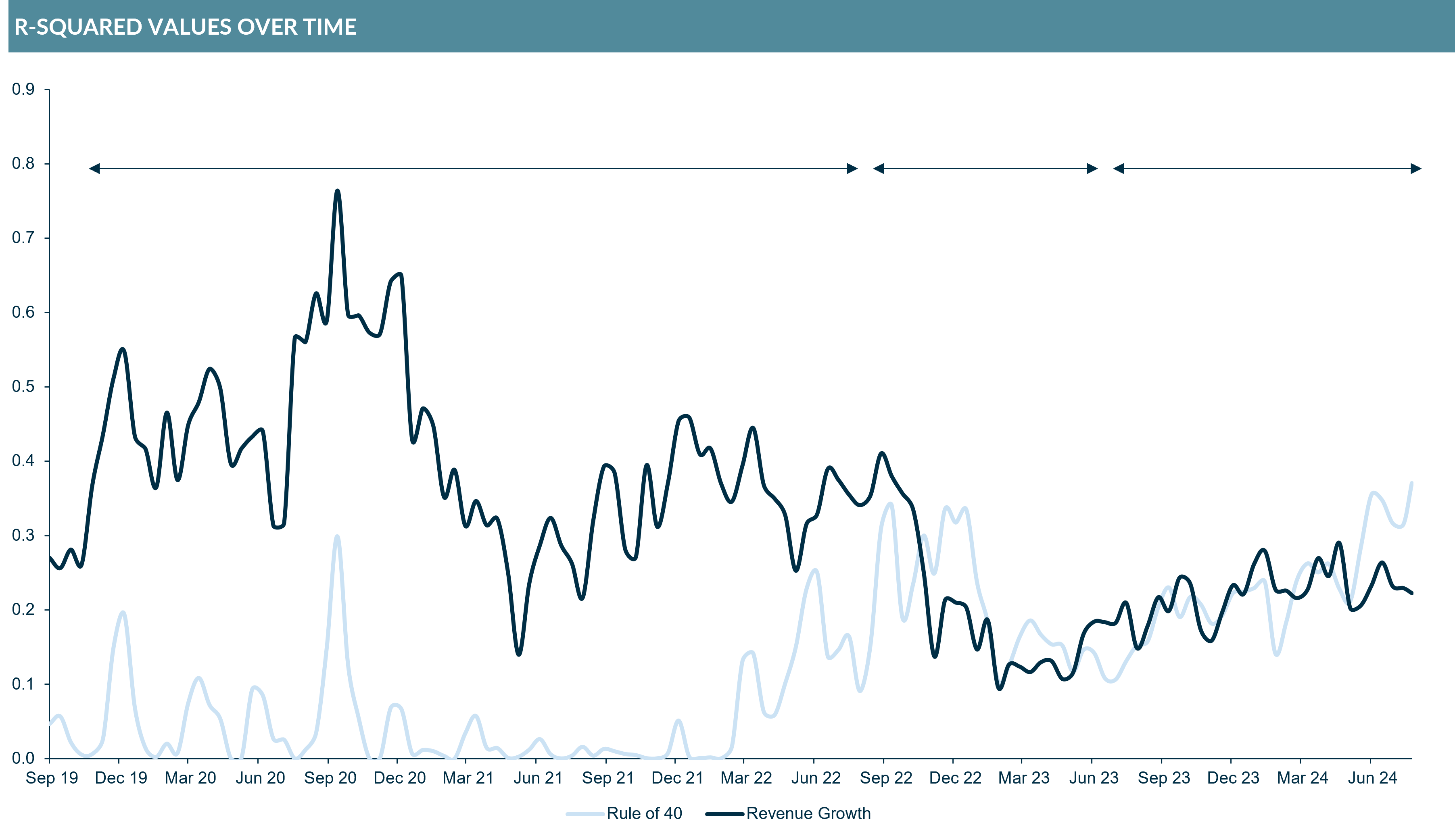

Increasing relevance of Rule of 40 as growth slows down…

Whereas growth was the primary driver of valuation during covid across the wider B2B Software market, the combination of profitability and growth (i.e. “profitable growth”) has taken over (Rule of 40) for technology companies.

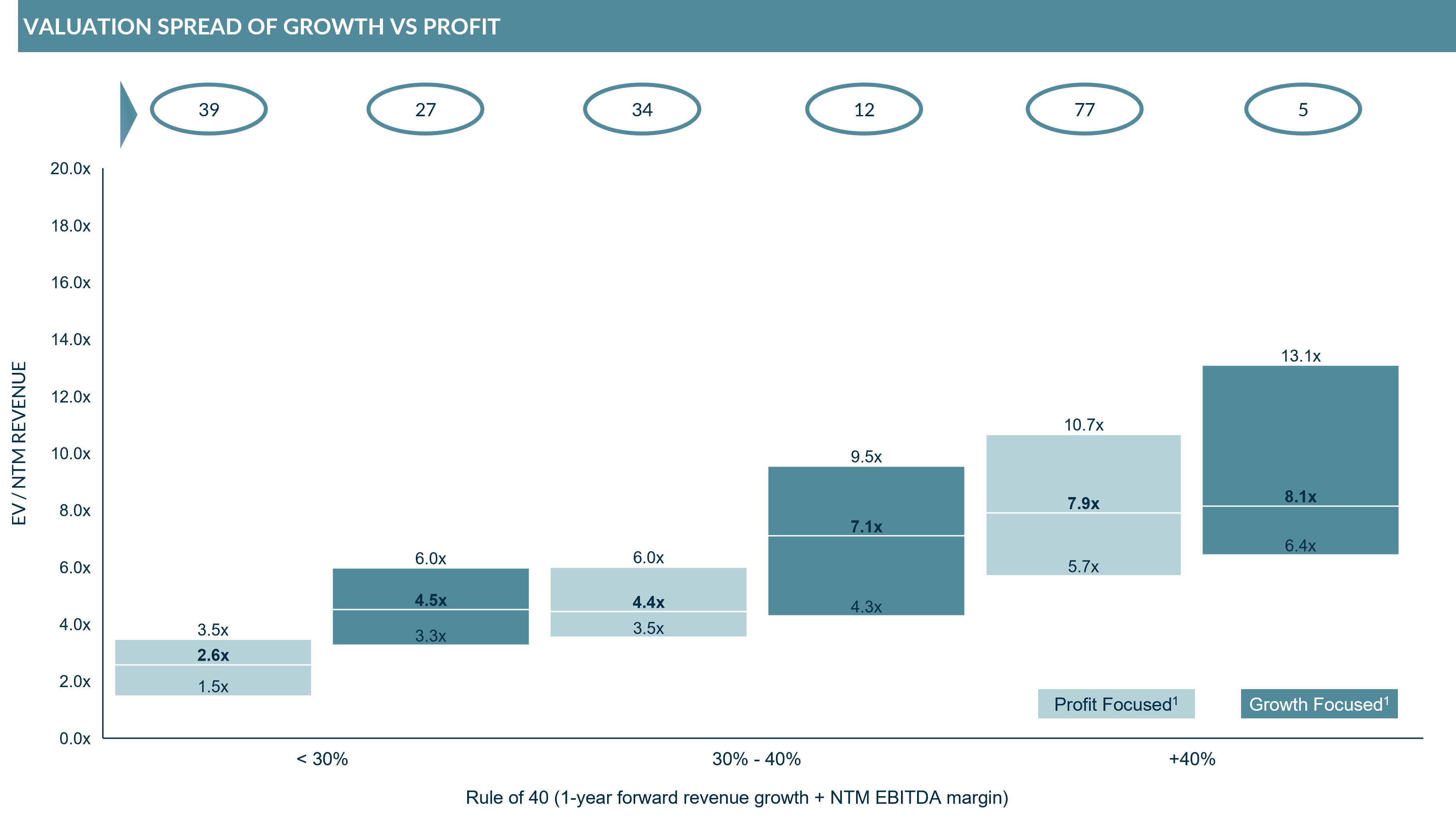

…although growth remains the dominant value driver over profit even in the SMB SaaS sector

Across the wider B2B Software market Investors now look at a combination of profit and growth to determine valuation, while growth remains the more important constituent in the Rule of 40 rather than profitability for technology companies.

Note: (1) Growth focused means that the growth component within the Rule of 40 is larger than the profit component and vice versa for profit focused; (2) Analysis conducted using a broader list of 194 listed technology companies.

Source: S&P Capital IQ as at 09-Aug-24

Access the Full Report

For a comprehensive look at our findings, including additional case studies and detailed information about the MCF Technology team, please download the full report using the link at the top of this page.

Connect with Us

If you have any questions about the report or wish to explore how MCF can support your M&A ambitions, please don’t hesitate to reach out to our team. We’re here to help guide you through every step of the process.

Related Technology Insights:

Software valuations report – Q3 2024

Software valuations report – Q2 2024

Software valuations report Q1 2024

Get in touch