Technology M&A: Software Valuations Report – Q2 2024

Software Valuations Insights

Our quarterly Software Industry Report is a vital resource for SaaS founders, CEOs, and investors, offering comprehensive analysis and insights into the valuation of public software companies.

The report is divided into ten benchmark segments, providing a detailed examination of the performance and outlook across various software verticals. It delivers essential data and trends, enabling informed decision-making in the rapidly evolving software industry. The report can be viewed in full and key highlights are listed below.

Key points from the Q2 Update include:

- Software sector valuations are being influenced by increased attention to AI adoption and a favourable macroeconomic environment, however outside of headline indices performance, many listed software companies have not returned to their 2021 high watermark valuations.

- While the “Tech Giants” have surpassed their 2021 highs, driving index highs, a wide range of listed software companies continue to pursue their 2021 peaks, with this pursuit aided by expected Fed rate cuts, rising consumer confidence, and positive corporate earnings momentum.

- In the first half of 2024, all sectors experienced a fall in M&A deal activity, with total deals down 30% compared to the same period in 2023. However, deal values across all sectors rose by 5%, mainly due to significant megadeals in the software sector. Higher interest rates and valuation gaps between buyers and sellers continue to persist, influencing M&A activity. With rates expected to fall and sustained access to capital, this will support conviction and capacity to transact.

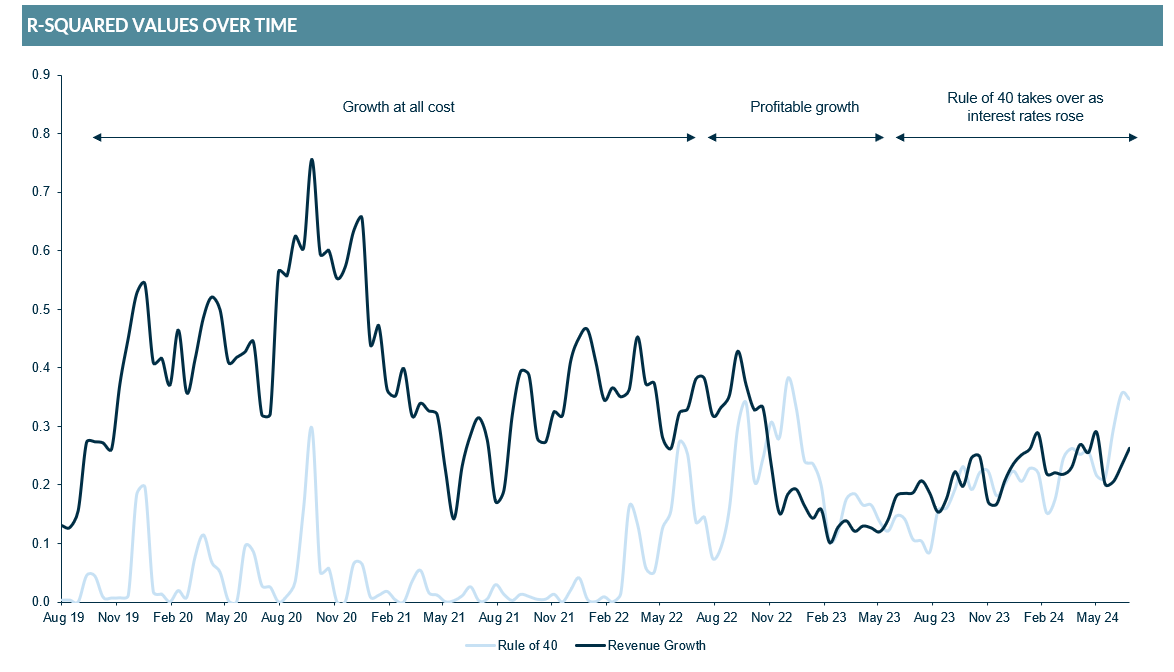

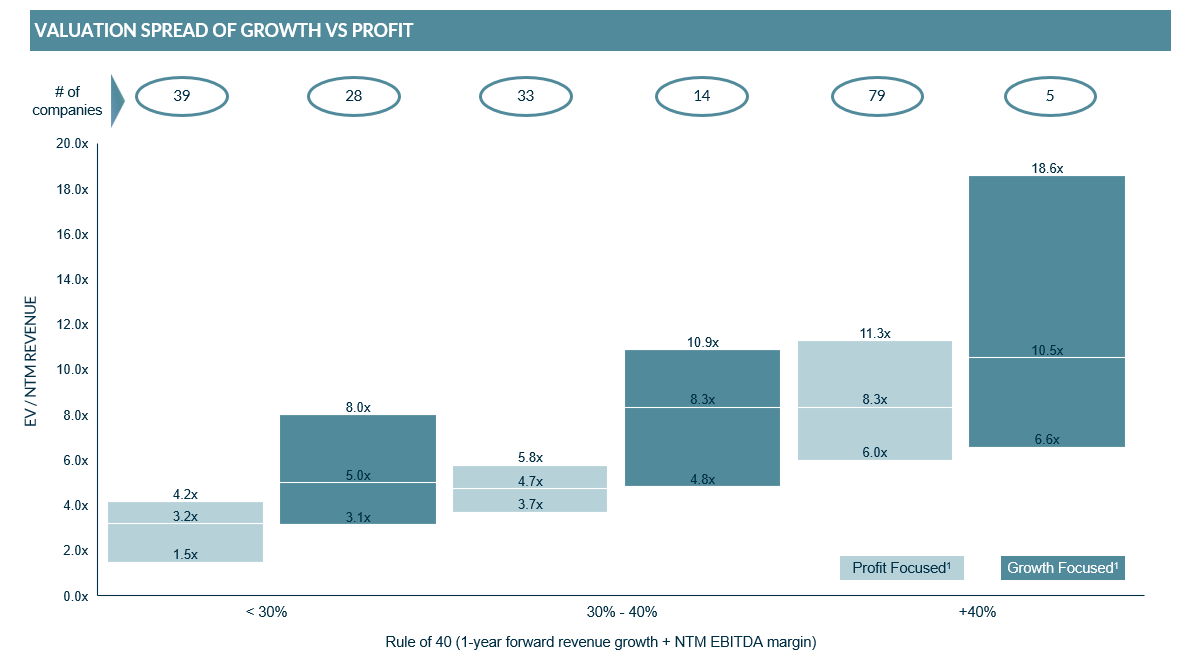

- While growth remains the primary driver of value, companies that have a “profitable growth” focus are being rewarded with premium valuations as Rule of 40 remains a clear focus for investors.

Finally, this edition of the Software Insights Report report features insights into the Public to Private (P2P) market with a deep dive into a selection of some recent P2P transactions and perspectives across the wider P2P deal value and volume activity. These insights provide some notable findings alongside some observations on the P2P market activity in the near term.

KEY TAKEAWAYS | Q2 2024 public software valuations

Healthy optimism persists in the market, as reflected by software valuation levels

Valuation levels continue their recovery trajectory through 2024 from the lows in 2022, supported by several factors pointing towards a more favourable macroeconomic environment.

M&A activity remains muted amidst AI’s impact on valuations and anticipation of rate cuts

Despite higher deal values, primarily driven by the influence of AI on software valuations, deal volume remains muted as investors look towards central banks for interest rate cuts.

Rule of 40 continues to trump growth at all costs as investors maintain focus on profitable growth

Investor demand is greater for companies that can prove Rule of 40 plus, sustained revenue retention metrics and preferably are tackling a mission-critical use case such as e.g., Compliance, Life Sciences, AI.

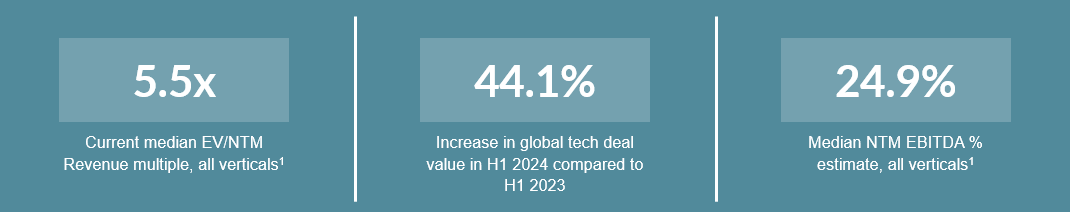

Notes: 1) Based on 199 publicly listed software companies across all verticals – as at 30/06/2024

Sources: D.A Davidson MCF International Research; PitchBook; S&P CapIQ; PWC 2024 Mid-Year Outlook

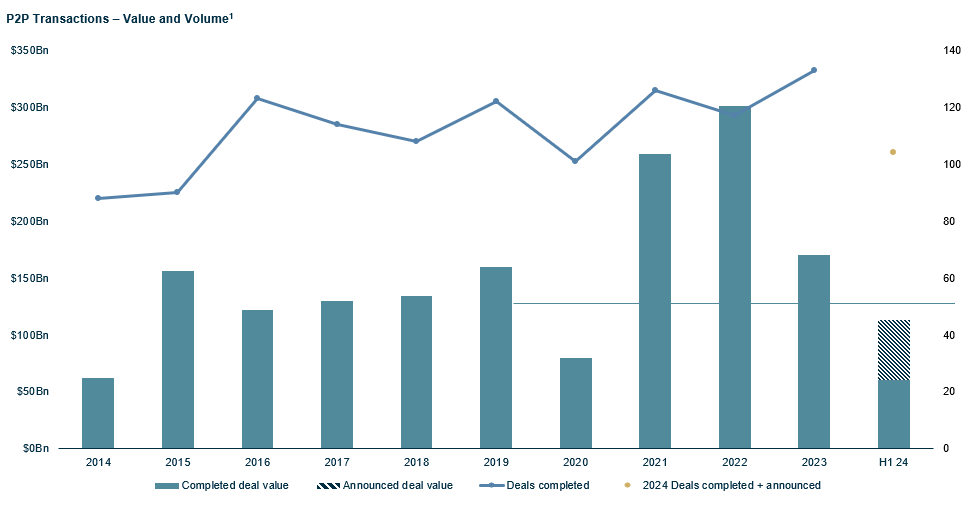

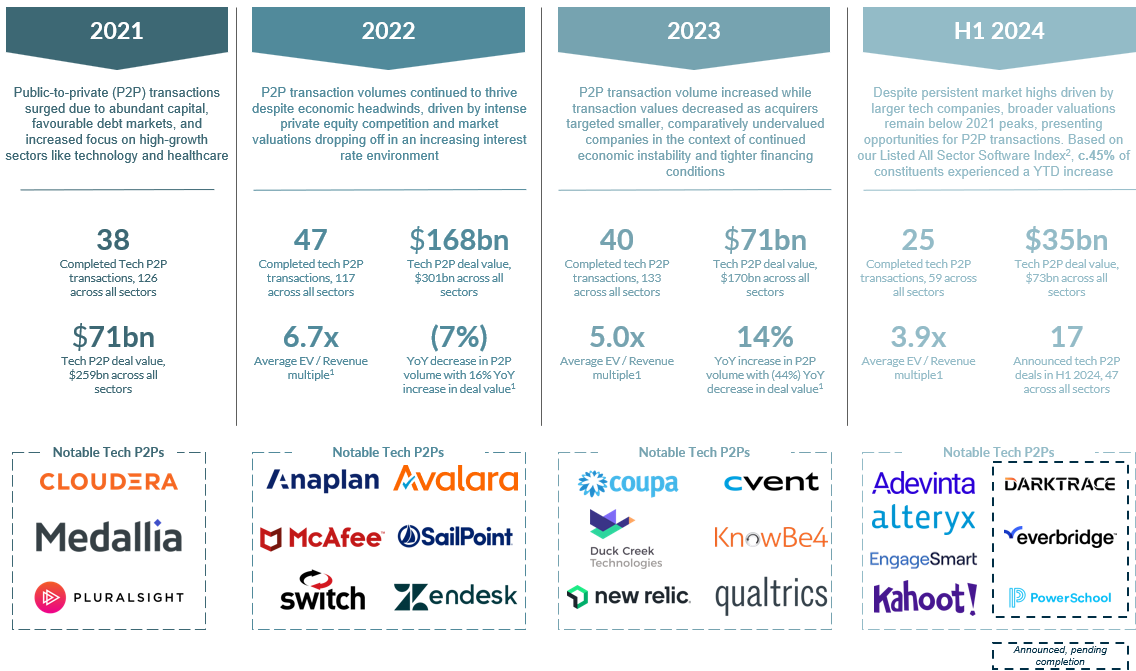

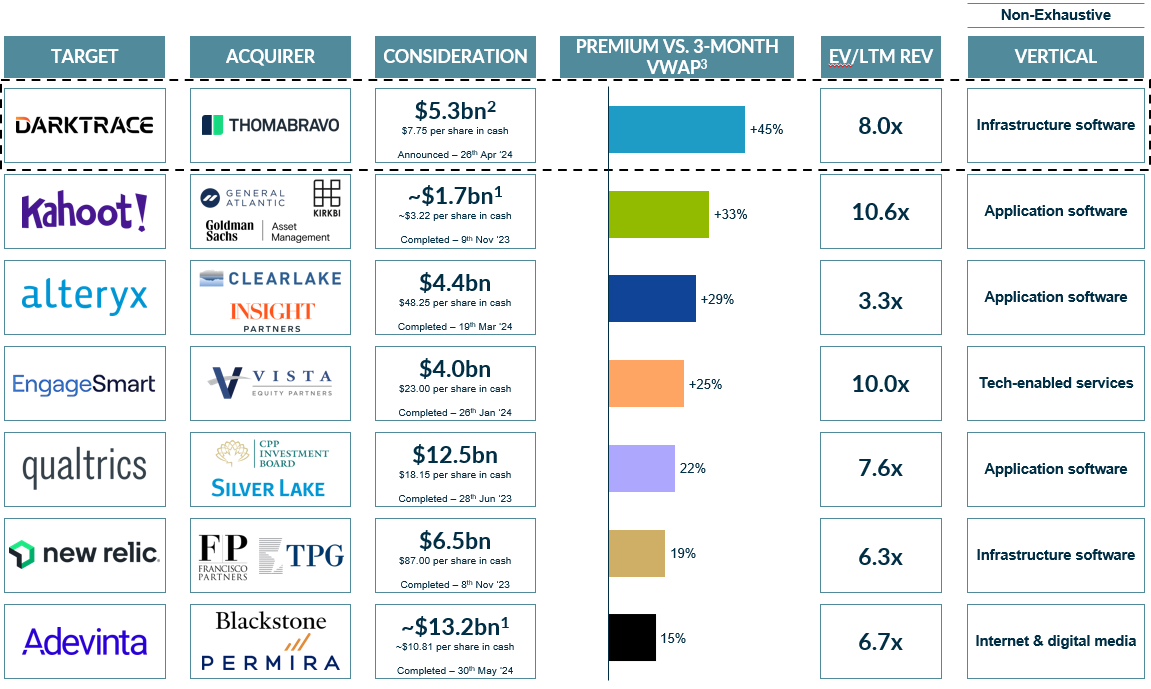

DEEP DIVE INTO THE PERFORMANCE OF RECENT TECH P2Ps

2024 Continues the Strong Trend in P2P Activity

- STRONG P2P ACTIVITY LEVELS

- Strong market sentiment underpinned by robust transaction activity across H1 2024.

- Completed technology deals volume totaled 25 at an aggregate transaction value of $35bn.

- Announced technology deals volume totaled 18 at an aggregate transaction value of $24bn.

- SMOOTHER MACRO ENVIRONMENT

- Interest rates have stabilised with rate-cuts on the horizon, laying the foundations for a favourable macroeconomic outlook.

- This has in turn supported renewed investor confidence and conviction to transact across the wider technology sector.

- PRIVATE CREDIT AVAILABLITY

- The calmer macro environment has also supported enhanced access to and availability of private credit.

- Improved access provides the foundation for activity levels and future transactions will be supported by lower borrowing costs.

- SHIFT TO SMALLER ACQUISITIONS

- While borrowing costs are set to decline, rates remain elevated compared to recent historical levels that persisted across 2021 and 2022.

- This has led in a shift to smaller transactions with a strong value creation focus, and requirement for comparatively lower debt levels.

- TECHNOLOGY SUB-SECTOR ACTIVITY

- While broad sector volumes remain strong, certain sub-sectors, such as AI, Cloud Services and Compliance, attract outsized interest.

- Acquirers continue to focus on profitable growth in high growth, high demand B2B software sub-sectors providing mission critical solutions.

P2P Deal Activity Observations

- Active Market: Private Equity continue to leverage substantial dry powder to capture private vs. public markets valuation gap opportunities, maintaining and supporting market activity.

- Volume vs. Value: Deal volume remains consistent, but overall deal value remains low compared to 2021 / 2022, indicating a shift towards smaller, more digestible transactions that require less leverage to complete.

Evolving Trends

- Macro Environment: Stable interest rates and greater debt availability will support the attractiveness of listed companies to Private Equity investors where valuation gaps persist. This may lead to greater competition for assets which in turn may lead to less obvious opportunities.

- Regulatory Scrutiny: In Europe, technology deals and those involving foreign state investors are expected to face enhanced scrutiny. In the US, the FTC is closely monitoring Private Equity and roll-up transactions.

Notes: 1) Across all technology sub sectors 2) Announced but not completed in the period

Sources: D.A Davidson MCF International Research; PitchBook

Public-to-private deal activity is above historical levels

Headline indices performance mask broader valuations which remain below 2021 highs, creating P2P opportunities for overlooked assets

Overview of selected recent public to privates in the technology space

Darktrace announced, pending completion.

QUARTERLY INSIGHTS ON PUBLIC SOFTWARE VALUATIONS

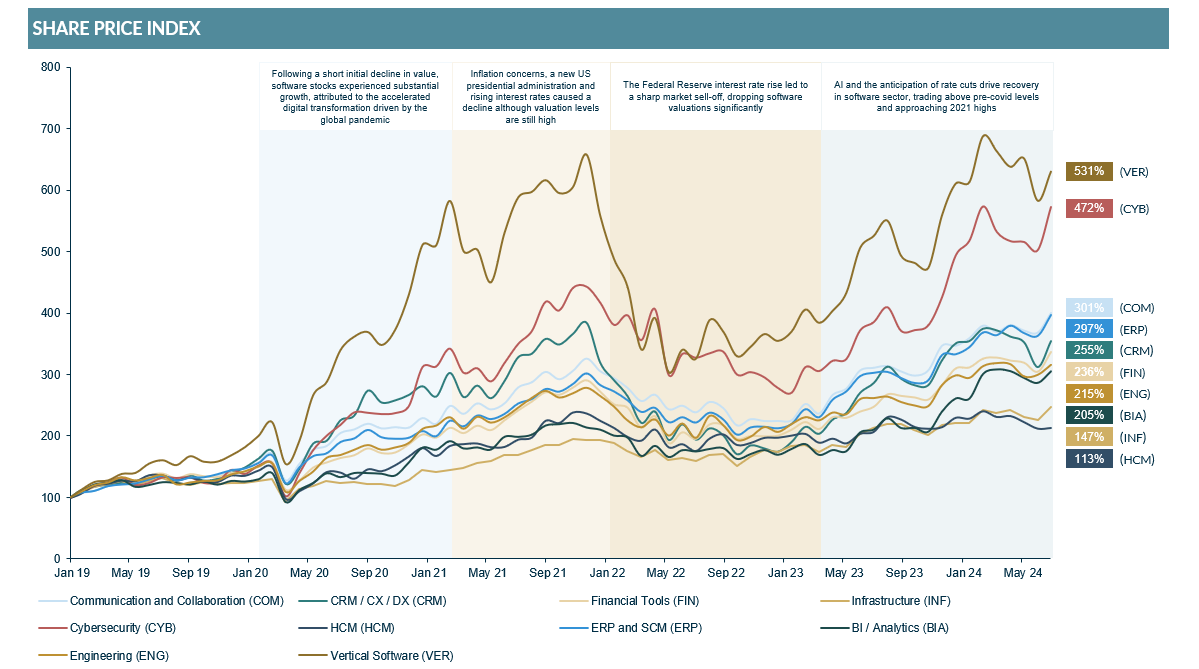

Software is broadly trading close to 2021 highs

AI innovation and anticipated rate cuts see public software company valuations approach 2021 highs

Source: S&P CapIQ as of June 30, 2024

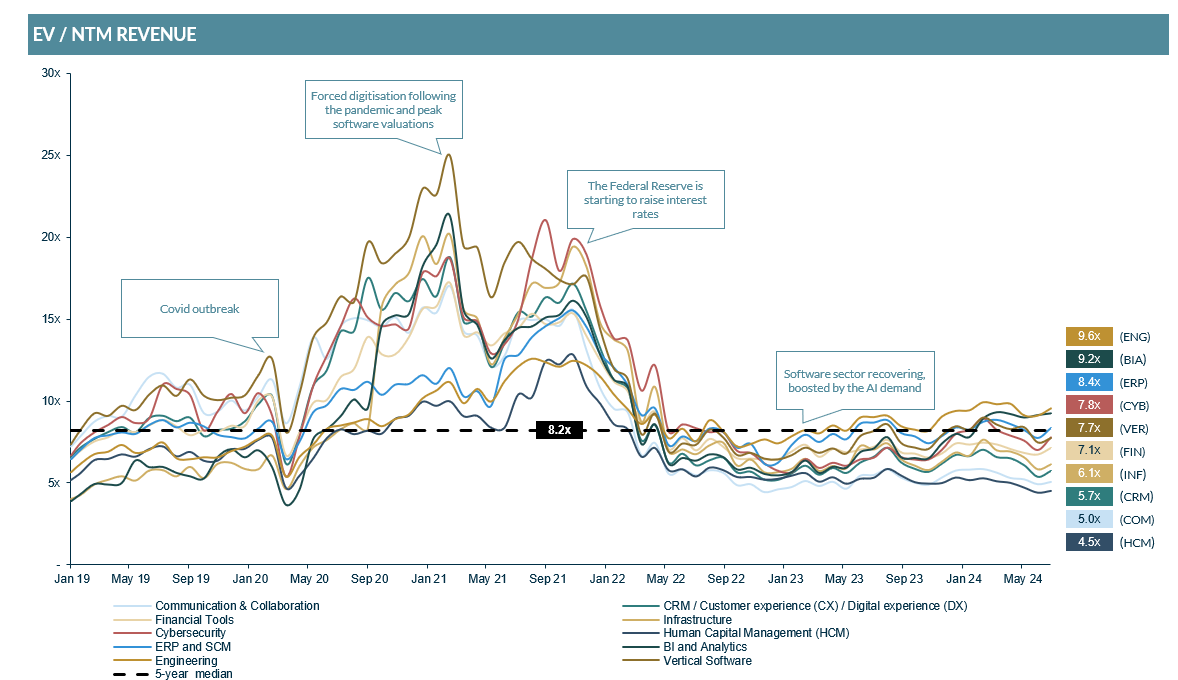

Strong growth of public market valuations across all software verticals

EV/NTM revenue valuations are seeing growth, with the highest valued verticals also having the highest profitability, demonstrating the shift from growth at all costs to increased importance of Rule of 40 as valuation driver.

Source: S&P CapIQ as of June 30, 2024

Increasing relevance of Rule of 40 as growth slows down…

Whereas growth was the primary driver of valuation during covid, the combination of profitability and growth (i.e. “profitable growth”) has taken over (Rule of 40)

…although growth remains the dominant value driver over profit

Related Technology Insights

Software valuations report – Q3 2024

Software valuations report Q1 2024

European Supply Chain Software – Industry Update 2024

Technology M&A: Software Sector Update – Q1 2024

Technology M&A: Travel & Hospitality Insights – Q1 2024

Contact us

For more information on our technology team and services, please visit our technology home page.

The full report including public comparable by software verticals can be viewed at the top of the page.

Get in touch