Technology M&A: Travel & Hospitality Insights

Travel & Hospitality

Our Travel & Hospitality Software Industry Report is a vital resource for founders, CEOs, and investors active in travel and hospitality software. It offers comprehensive analysis and insights into market themes, M&A activity and fundraising activity in the space.

Key takeaways:

- There has been a healthy cadence of fundraising and M&A activity in the European travel & hospitality software space during 2023 and early 2024.

- Market activity has stepped up as travel volumes have recovered from COVID-19 and we expect this to continue during 2024.

- Payment orchestration is an increasingly important topic and forms a key part of investors’ thesis in the space. Capturing payment flows both simplifies clients’ existing payments strategies and creates an attractive revenue source on top of existing business models.

- The market remains highly fragmented and well capitalised consolidators are appearing to create scalable platforms in the space.

- Fundraising activity continues to concentrate around experiences, business travel management and vacation rentals software solutions.

- Valuations on both public and private markets vary markedly, however, there is a clear path to premium, revenue-multiple driven valuations for firms exceeding the Rule of 40 with profitability.

Deals in Focus

Visit Group received a strategic growth investment of more than €100m from PSG Equity

Visit Group received a strategic growth investment of more than €100m from PSG Equity

Visit Group, a Nordic-based travel & hospitality software player, completed a majority sale to PSG Equity. As part of the transaction, Visit Group’s Founder Magnus Emilson and the existing management team remain as significant shareholders, while Nordic technology investor Standout Capital sold its shareholding.

Visit Group is the Nordic market leader in hospitality and travel technology, providing collaborative software to in-destination experience vendors. The Company boasts more than 2,200 customers in over 25 countries.

The new partnership aligns with Visit Group’s vision to become a leader in the European travel and hospitality technology space, giving the Group significant firepower to help accelerate its ambitious agenda for both organic and inorganic growth.

Transaction Highlights

- The deal represents a strategic growth investment of more than €100m and marks PSG Equity’s first platform investment in Sweden and Norway.

- The transaction adds to the Technology team’s recent record in travel and hospitality software and the value added by D.A. Davidson MCF International’s cross border platform.

“Bringing PSG Equity on board as our new growth partner marks a significant milestone for Visit and will help accelerate our growth agenda. The collaboration with MCF played a crucial role in making this deal happen. Their deep expertise in travel tech, understanding of our business and insightful guidance helped us find the best possible partner in PSG. As a result, we are in the ideal position to realise our vision of establishing a digital ecosystem for the travel and hospitality industry.”

Magnus Emilson, Founder and Executive Chair, Visit Group

What we have been noticing in the market

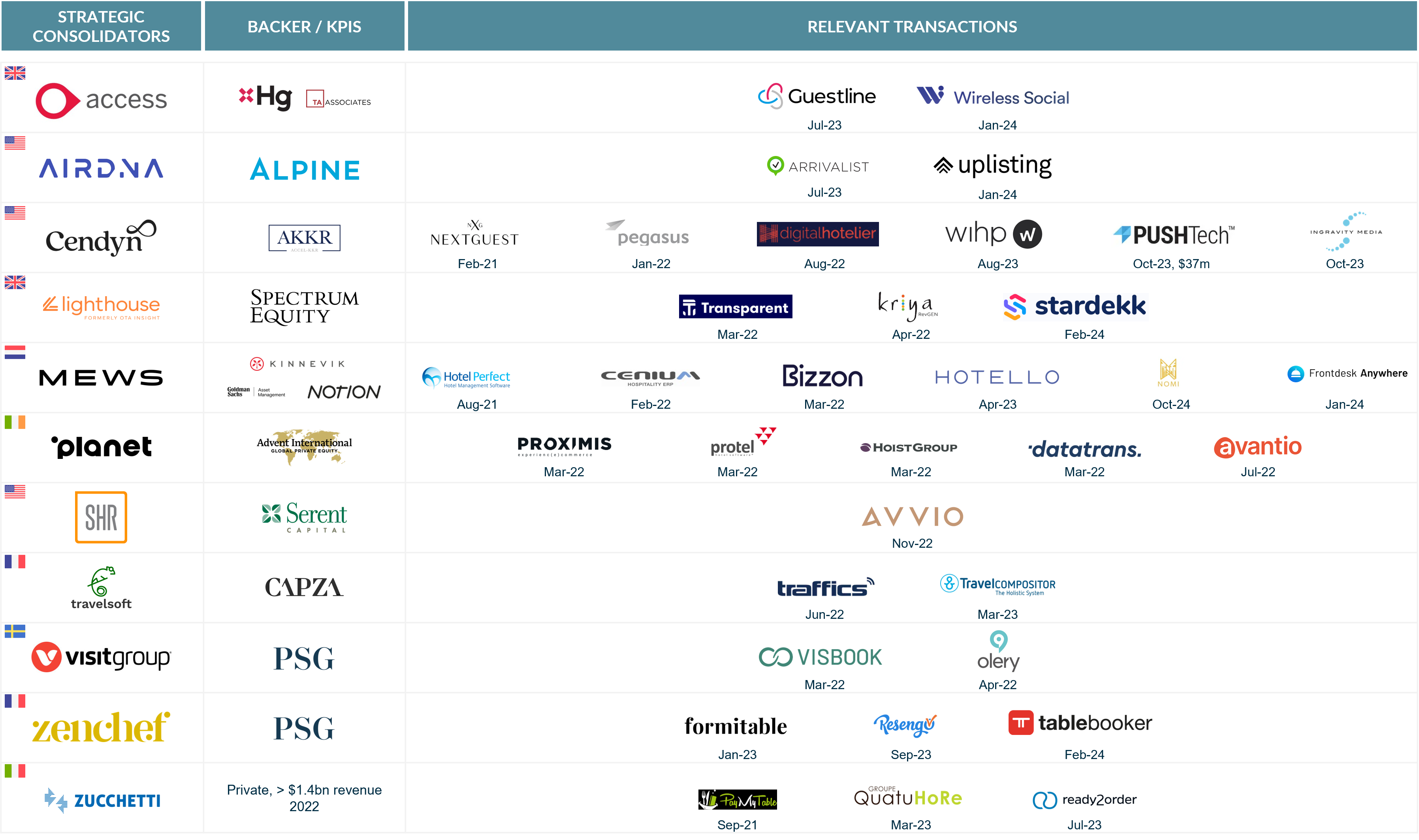

Consolidators are emerging across European travel & hospitality software

- The European travel & hospitality software landscape remains highly fragmented

- The presence of local champions and innovative start-ups has created an environment where many European vendors need to acquire or be acquired to expand their products internationally and have critical scale to optimise their go-to-market and product strategies.

- There are now several strategic players backed by private equity capital which are driving consolidation, pointing towards continued M&A activity during 2024.

Payments are increasingly a critical business pillar and are driving investor interest

- Travel & hospitality software enables high-velocity transactions, but historically there has been low digital maturity in streamlining and automating the complex, cross-border payment flows in the industry.

- Software vendors, such as Planet and Mews, are increasingly using embedded payments both to simplify clients’ tech stacks and to create revenue & margin upside through payment fees. Investors are similarly looking to business models where there is potential for financial performance uplift via payments.

2023 saw travel volumes return to post COVID levels, revealing the true winners

- The post-COVID travel volume recovery has sustained revenue growth across the travel & hospitality software ecosystem since the lows of 2020.

- However, 2023 also saw the true leading players emerge: software vendors which won clients during the COVID period saw the true revenue potential of client acquisition since 2020 in their 2023 figures. This often translated into significantly higher revenue in 2023 compared to 2019, often with improved margins.

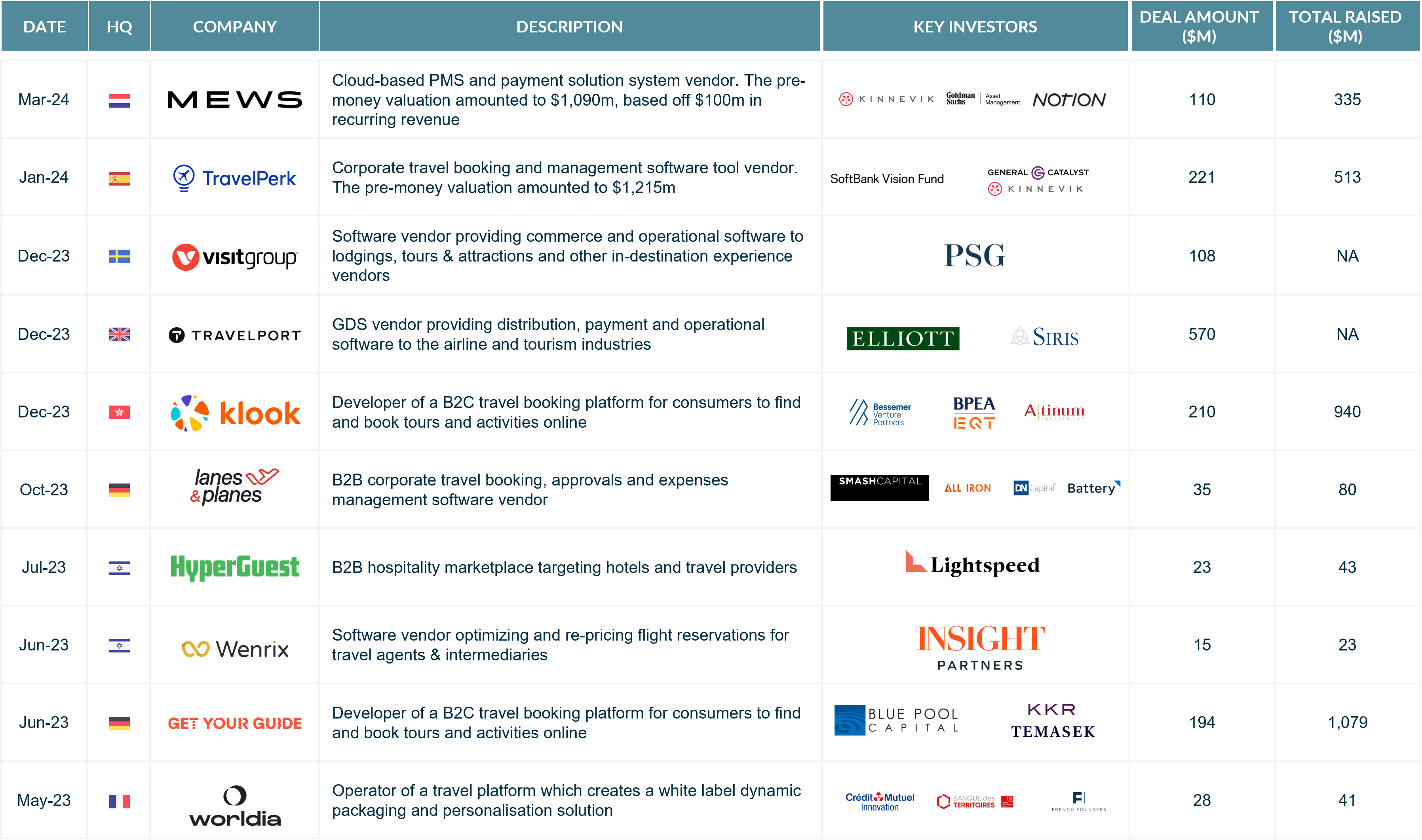

Corporate travel, vacation rentals and experiences are attracting attention in the fundraising market

- TravelPerk and Lanes & Planes, both corporate travel management software vendors, raised $221m and $35m respectively – M&A activity in the space is also notable, such as SEB’s $450m acquisition of AirPlus International.

- B2C experience software vendors, GetYourGuide and Klook, have similarly raised three-digit sums as the tours & attractions space increasingly digitalizes. This has been mirrored with high interest in B2B vendors focused on this segment.

- Finally, Hostaway’s $175m raise demonstrated ongoing interest in the B2B vacation rental software space, adding to players like Guesty and Lodgify.

AI is a hot topic, but there are other factors shaping the market

- There is no doubt that AI is dominating industry forums & product conversations.

- However, there are other factors shaping the industry, including simplifying complicated tech stacks, helping clients deal with labor shortages, and increasing digitalization & automation in the long tail segment.

- Each subsegment is seeing innovative tech emerge. Take the example of technology for travel agents & intermediaries, where NDC adoption is continuing to create an outsized opportunity for independent vendors with innovative tech.

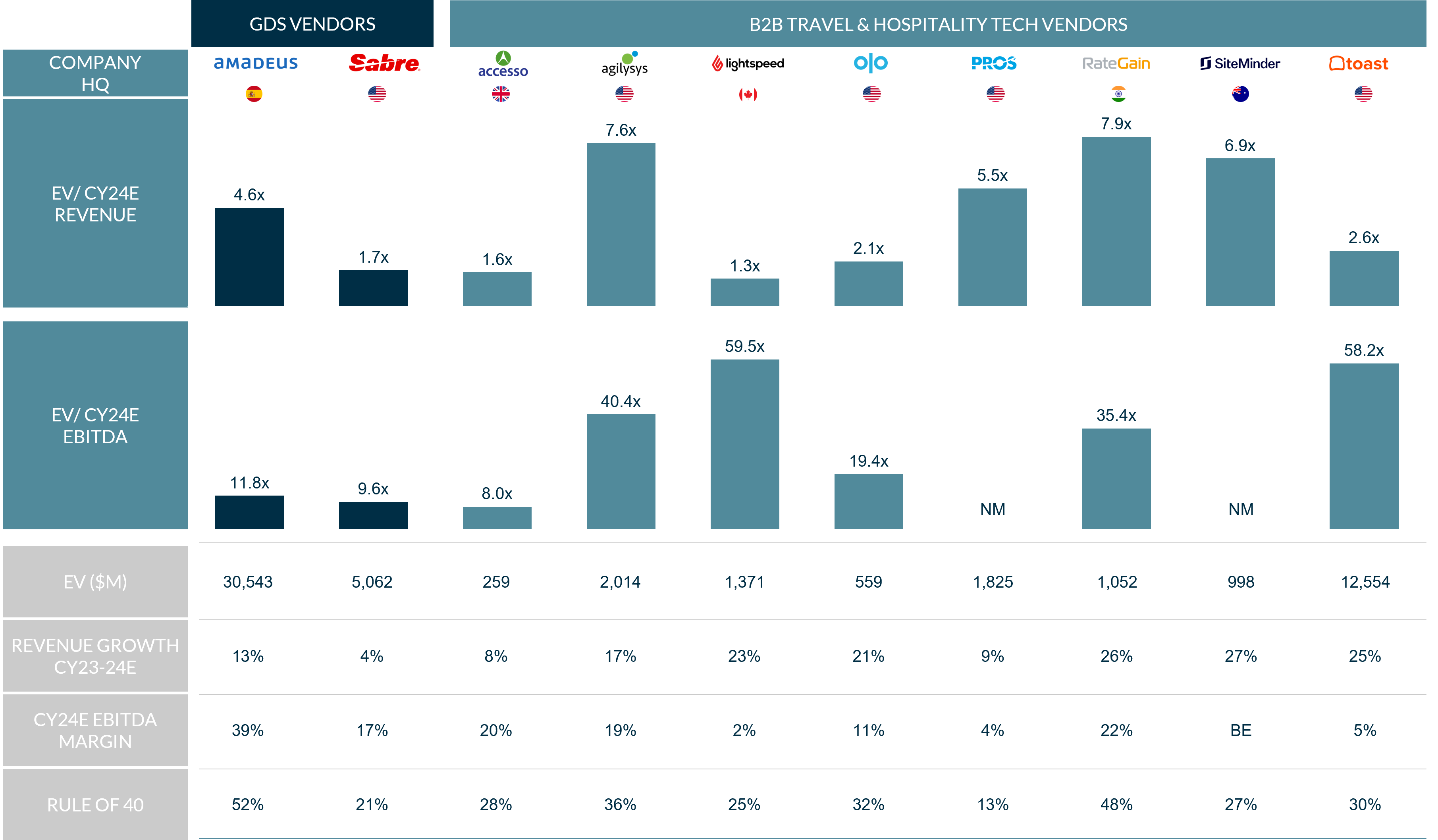

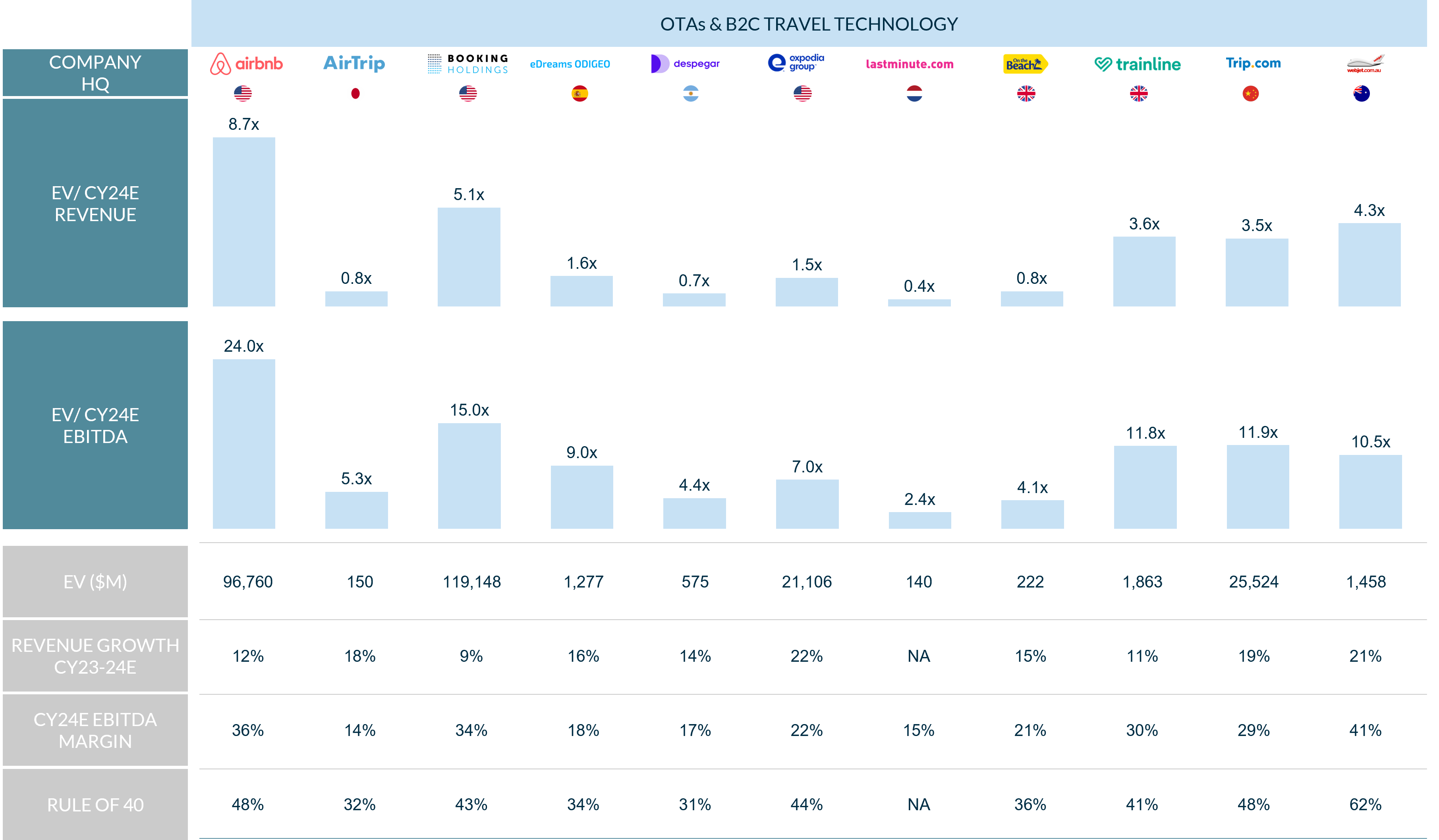

Businesses with strong rule of 40 profiles are trading at attractive premium valuations

- There continues to be a wide variation in valuation multiples in both public and private markets for travel & hospitality software assets.

- Private market transactions have been completed at attractive revenue multiples – see Mews’s recent fundraise (~12x EV/Revenue) and Amadeus’ acquisition of Voxel (implied ~14x EV/Revenue) as examples.

- Similarly, public market multiples are trading up to 8x revenue for high growth, profitable businesses meeting the Rule of 40, such as Agilysis and RateGain. However, EBITDA multiples continue to be the primary driver for established GDS and OTA vendors.

Well capitalised strategic players are poised for further M&A

Selected players in the travel and hospitality space with M&A records and financing backing

Selection of relevant financing

Recent capital raises demonstrate interest in tech related to corporate travel management, vacation rentals and B2C experience platforms.

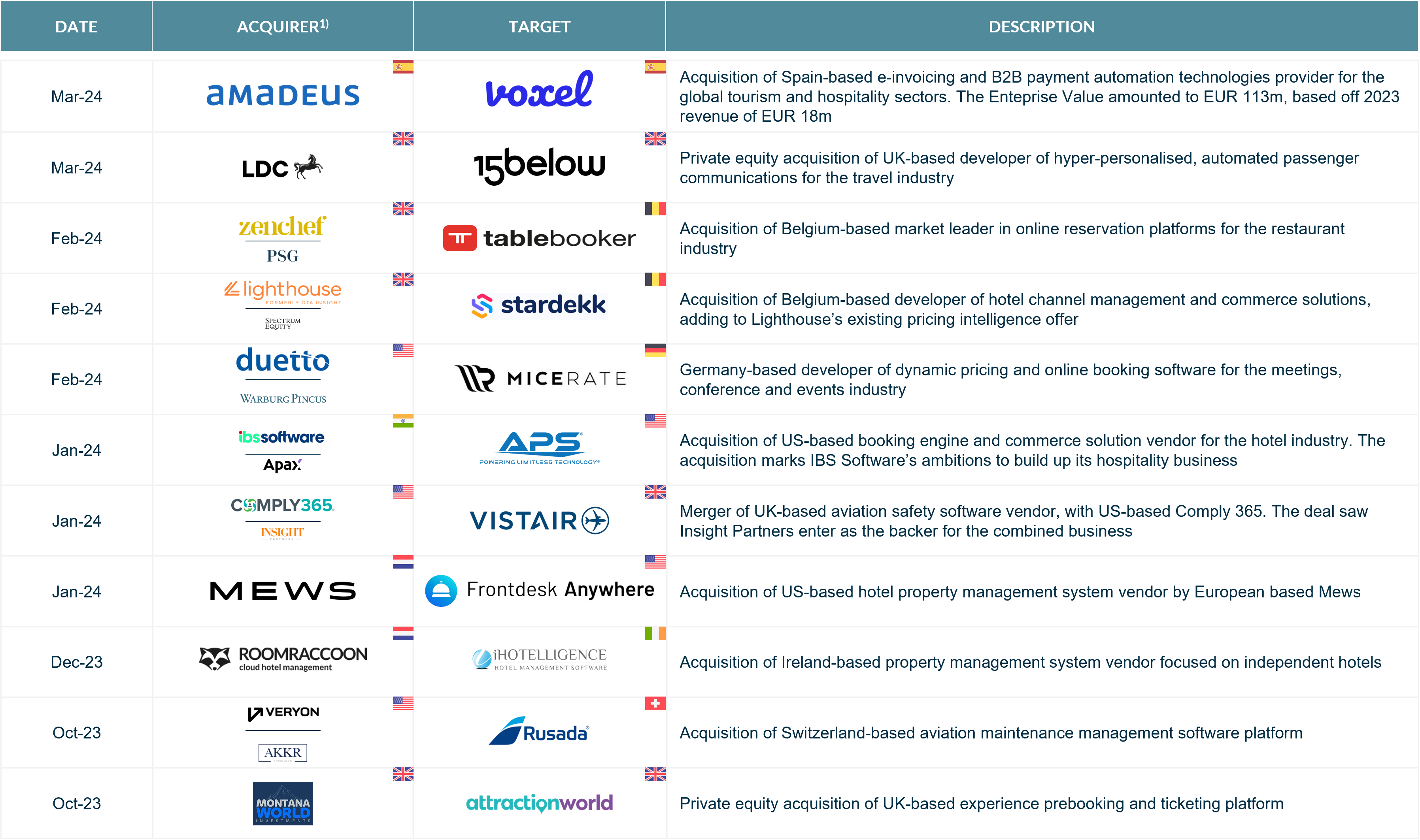

Selected transactions in travel and hospitality software

M&A cadence during 2023 & 2024 set by private equity-backed strategic consolidators and larger corporate players adding incremental tech.

Note: 1) Private equity backer of strategic acquirer highlighted where relevant; sources: Mergermarket, Pitchbook, Press releases.

Travel and Hospitality software public valuation metrics

Source: S&P Capital IQ as of 12-Mar-24

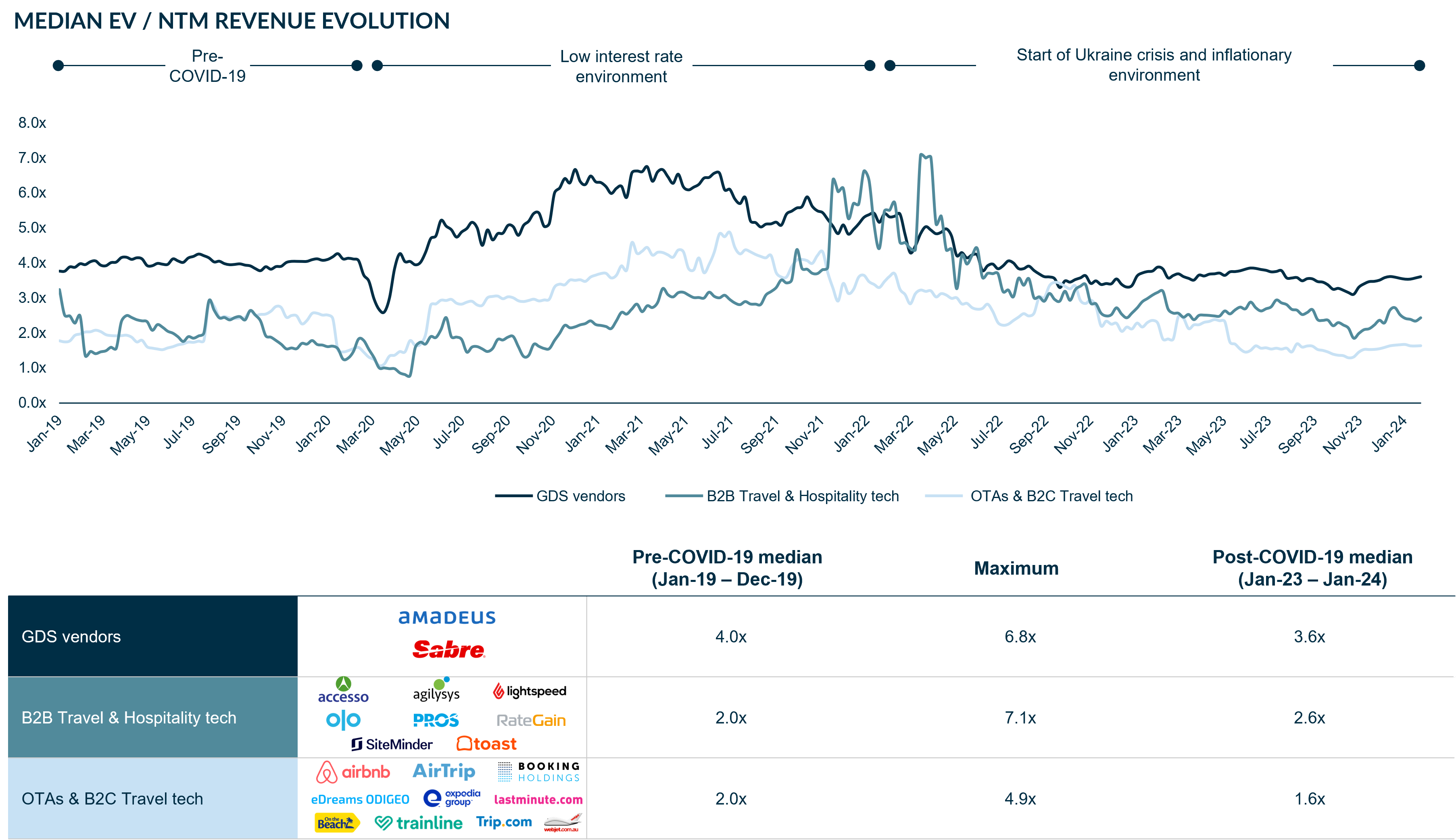

The evolution of valuation multiples across travel and hospitality

Re-rating across Travel and Hospitality technology sector following the COVID-19 pandemic

Source: S&P Capital IQ as of 12-Mar-24

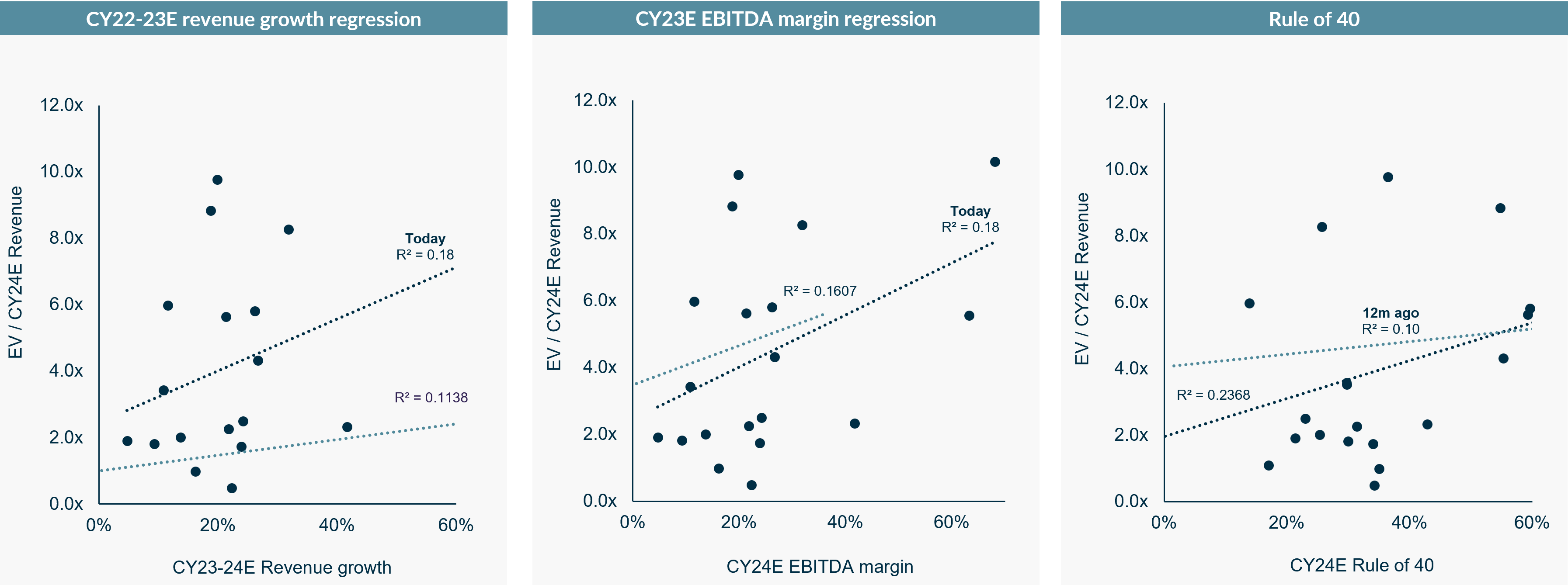

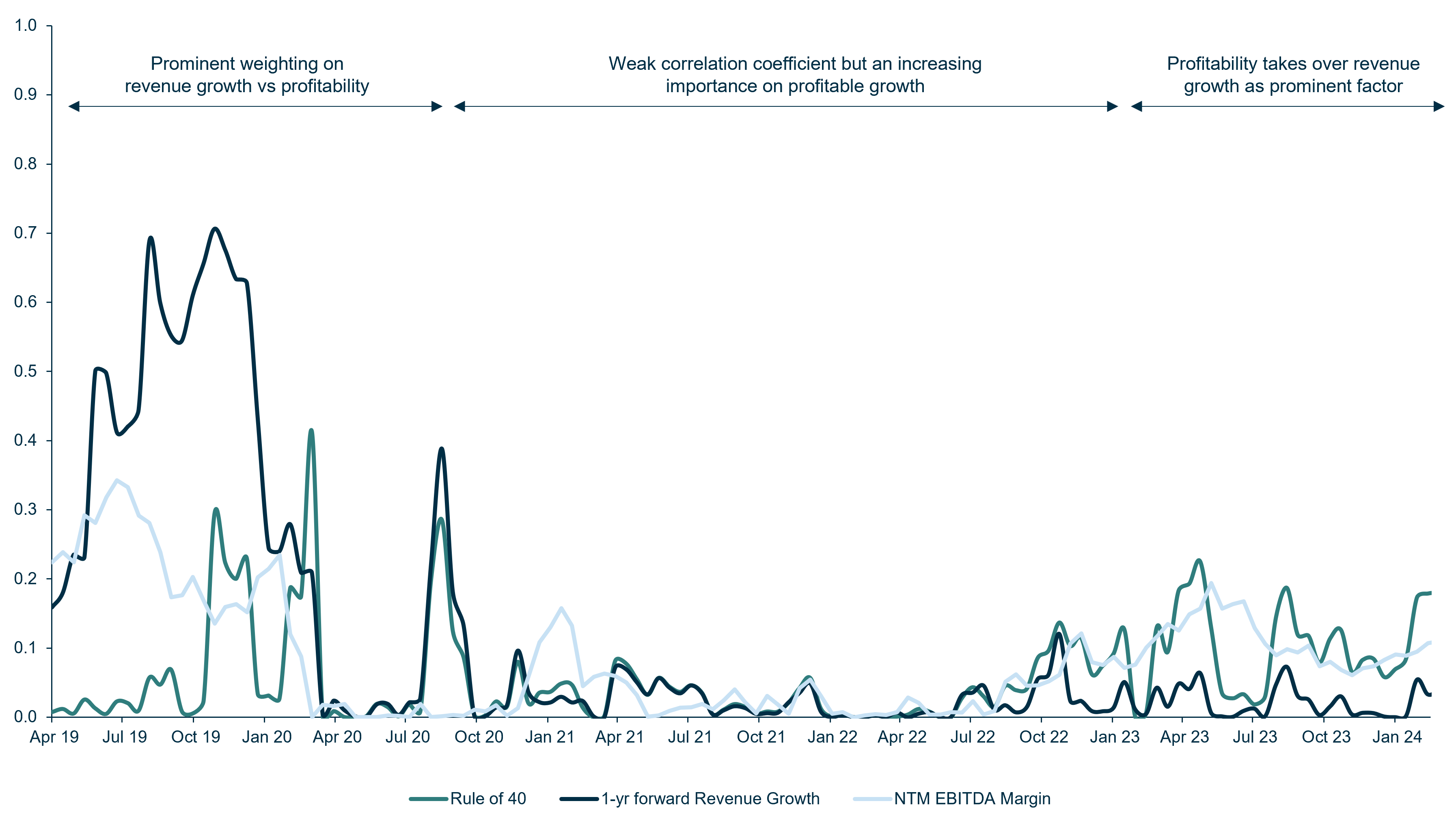

Travel and hospitality companies that adhere to the Rule of 40 today attract higher valuation multiples

- Today, investor sentiment is leaning towards a combination of growth and profitability following seismic market shocks impacting the travel & hospitality industry over the last five years.

- As such, the R2 value between Rule of 40 and EV/ Revenue multiples has increased from 0.10 12 months ago to 0.24 today, suggesting that companies that are growing profitably demand a higher valuation in today’s market environment.

With a change in factors determining valuation

Source: S&P Capital IQ as of 12-Mar-24

Get in touch

If you found the report engaging or wish to delve deeper into understanding how M&A activities can support your growth objectives, please reach out. Our team is on hand to discuss the nuances of the report or explore strategic opportunities tailored to your specific needs.

You can find additional insights and explore our Technology M&A services here.

Related Technology Insights

Software valuations report Q1 2024

European Supply Chain Software – Industry Update 2024

Technology M&A: Software Sector Update – Q1 2024

Get in touch