SOFTWARE VALUATIONS INSIGHTS | Q4 2024

Our quarterly Software Valuations Insights Report is a vital resource for SaaS founders, CEOs, and investors, offering comprehensive analysis and insights into the valuation of public software companies.

The report is divided into ten benchmark segments, providing a detailed examination of the performance and outlook across various software verticals. It delivers essential data and trends, enabling informed decision-making in the rapidly evolving software industry.

Key takeaways from the Q4 update include:

Record software valuations

Record software valuations amid the AI boom as AI-driven innovation—particularly around GenAI—pushes valuations to unprecedented heights, with investors seeing strong AI roadmaps as catalysts for revenue and margin expansion.

The surge in AI adoption across sectors has amplified demand for software vendors embedding advanced AI capabilities, driving valuation growth and intensifying M&A interest from strategic and financial acquirers.

Accelerating enterprise GenAI

Accelerating enterprise GenAI adoption as companies rapidly move from pilot programs to full-scale GenAI implementations, streamlining workflows, enhancing customer experiences, and unlocking new revenue streams.

This underscores the mission-critical nature of AI-first strategies, driving investments in AI talent, infrastructure, and partnerships—creating an environment ripe for M&A opportunities as companies strive to stay ahead.

Record levels of GenAI fundraising

Record levels of GenAI fundraising, with multiple ten-figure rounds. The GenAI funding landscape is surging as investors back next-gen language models and AI-driven applications.

Competition for high-potential AI startups is pushing valuations higher, even at early stages, and will continue through 2025, especially in specialized verticals—fueling deal flow for acquirers seeking a foothold in the AI-driven future.

No longer a buzzword

GenAI has evolved from a buzzword to a strategic imperative, transforming the enterprise landscape. Rapid adoption across multiple use cases—coupled with record-breaking funding—indicates that AI-powered solutions will drive software innovation and valuation well into 2025.

In this update, we explore how GenAI is reshaping product roadmaps, creating new revenue opportunities, and prompting investors to double down on AI-first companies—ultimately setting the stage for the next wave of software disruption.

Q4 2024 Public Software Valuations

Public market software valuations continue to surge amid AI euphoria

Propelled by the ongoing adoption and innovation of AI-driven solutions, public software valuations have reached unprecedented heights. Investors, captivated by AI’s potential to enhance productivity and unlock new revenue streams, are rewarding strong AI capabilities with soaring valuations, underscoring the market’s sustained confidence in AI’s transformative power.

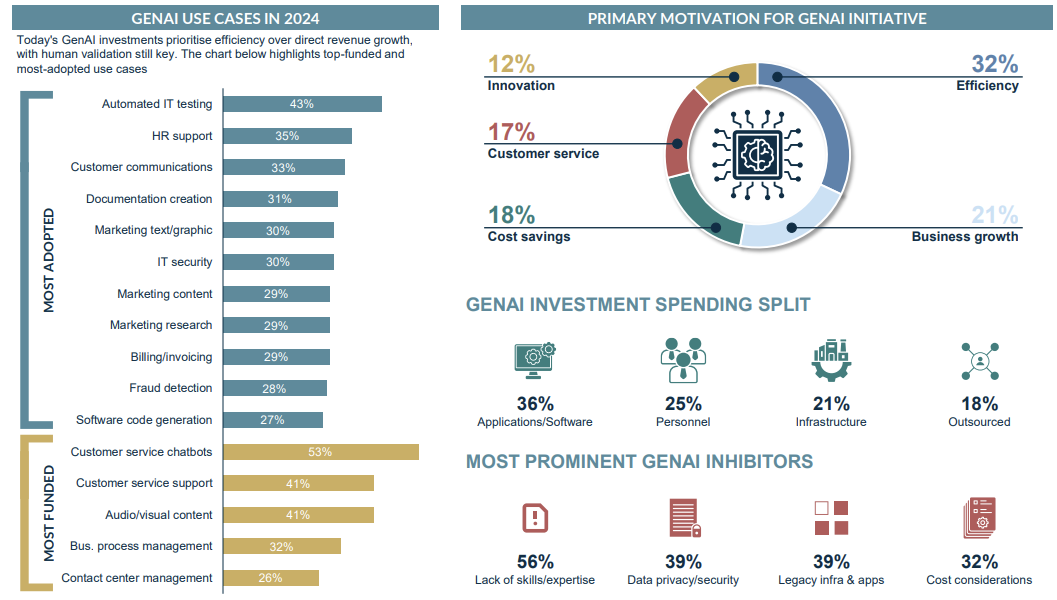

Enterprise GenAI adoption accelerates across critical use cases

GenAI adoption at the enterprise level has surged, doubling year on year in 2024. Organizations are integrating GenAI into critical areas such as automated IT testing, customer communications, and marketing content creation. This momentum highlights the technology’s transformative potential to enhance efficiency and drive innovation.

Record-breaking VC fundraising for GenAI in 2024

In 2024, venture capital investment in generative AI skyrocketed, more than doubling year on year. Major rounds included Databricks’ $10 billion, OpenAI’s $6.6 billion, and Anthropic’s $4 billion, with GenAI capturing 40% of total AI funding across the U.S., Europe, and Israel.

6.2x

Current median EV/NTM revenue estimate across all verticals (1)

65%

Of enterprises have adopted GenAI (2).

$56B

Raised in GenAI fundraising in 2024.

Notes:

- Based on 188 publicly listed software companies across all verticals as of 31/12/2024.

- Per McKinsey Global Survey.

Sources:

D.A. Davidson MCF International research; PitchBook; S&P CapIQ.

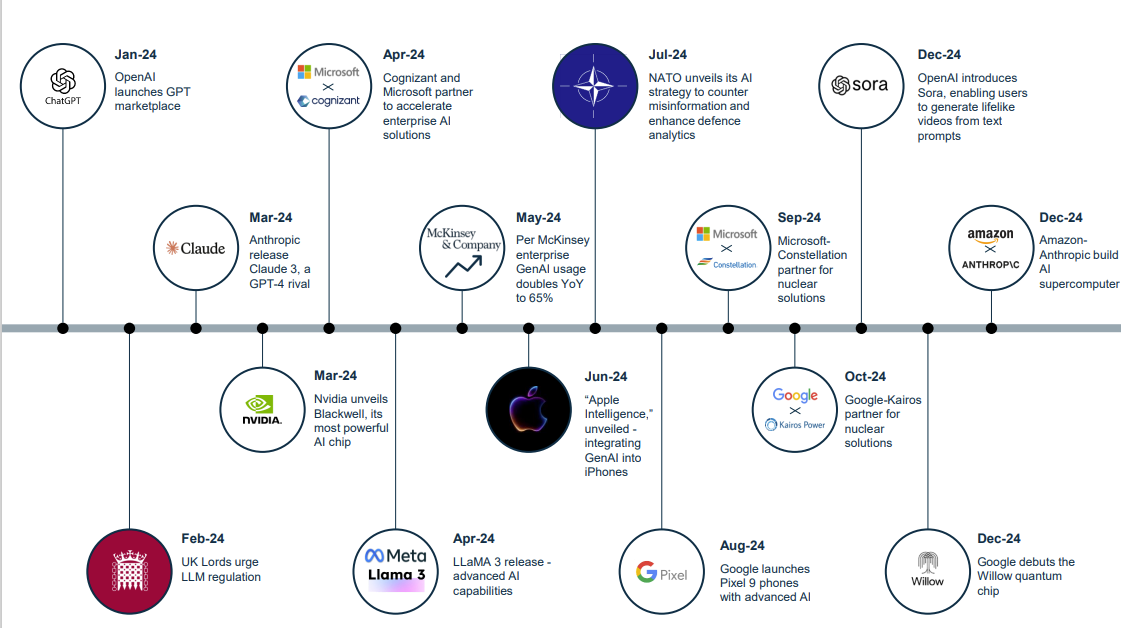

AI LANDSCAPE IN 2024

2024 AI Milestones: From Emerging Breakthroughs to Mainstream Integration

Charting the landmark breakthroughs, transformative alliances, and pivotal regulatory actions that defined AI’s evolution this year

Sources:

D.A. Davidson MCF International research; PitchBook

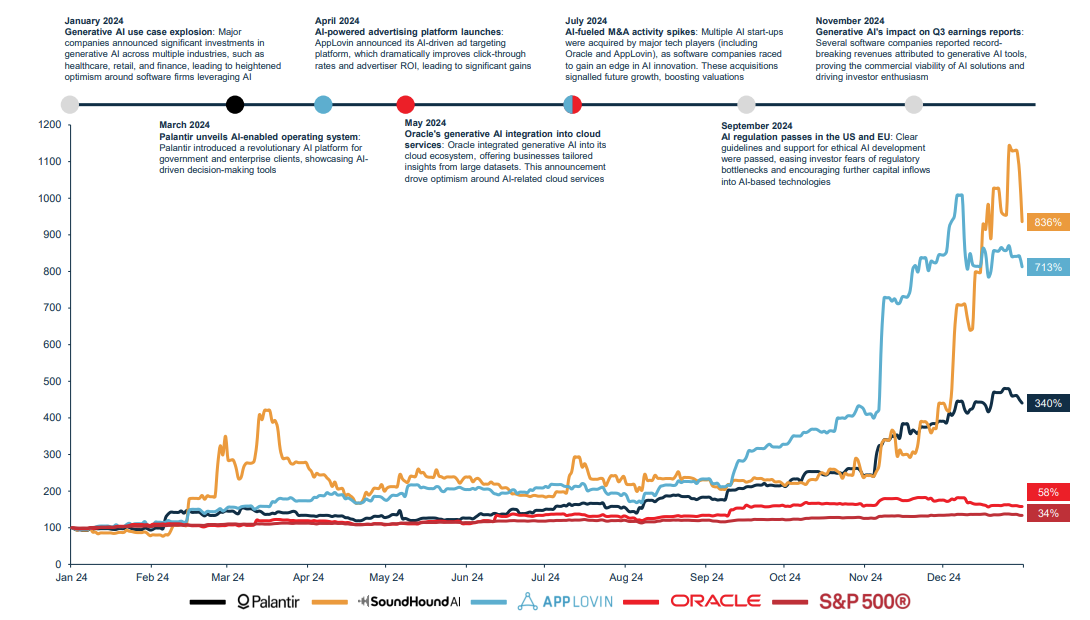

2024 WAS A BREAKOUT YEAR FOR AI-CENTRIC COMPANIES

Publicly traded AI innovators surge in valuation, outperforming broad market benchmarks and drawing heightened investor interest.

AI IN 2024: THE SHIFT FROM EXPLORATION TO ENTERPRISE ADOPTION

From foundational breakthroughs in software and infrastructure to the transformative rise of Generative AI – 2024 has set the stage for an era of AI driven innovation.

Notes: 1) Per McKinsey Global Survey

Sources: IDC2, , Pitchbook3, Mergermarket

INSIDE THE RAPID RISE OF ENTERPRISE GENAI

Top use cases, motivations, and barriers shaping adoption in 2024 as capital investment focuses more on efficiency and profitability use cases.

Sources: D.A Davidson MCF International research, ISG state of GenAI market report

The Full Report

For more information including why 2024 was a record-breaking year for GenAI fundraising and quarterly insights on public valuations companies please access the full report available at the top of this page.

Contact us

If you have any questions about the report, software market or how AI is an opportunity for M&A, please contact one of our team. You can find more information about our tech capabilities here.

Previous Software Reports

Software Valuation Insights | Q3 2024

Software Valuation Insights | Q2 2024

Software Valuations Insights – Q1 2024

Contact us